The market rebounded sharply after two-day consolidation, and ended at a record closing high on June 3, ahead of the big event - the RBI monetary policy scheduled to be held on June 4.

The BSE Sensex rallied 382.95 points to 52,232.43, driven by banking & financials, FMCG, and infra stocks. The Nifty50 climbed 114.20 points to 15,690.40 and formed a bullish candle on the daily charts.

"A small positive candle was formed on the daily chart with lower shadow. The Nifty registered another new all-time high of 15,705 and closed near the highs. Technically, this pattern signal uptrend continuation, after a small intraday dip of the previous session," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"The short term trend of the Nifty continues to be positive and one may expect further upside in the coming session. Though the Nifty placed at all-time highs, there is no indication of any reversal pattern unfolding at the swing highs. The next upside levels to be watched around 15,800-15,900 levels in the next few sessions. Immediate support is placed at 15,575," he said.

The broader markets extended gains further with the Nifty Midcap 100 index rising 0.94 percent and Smallcap 100 index gaining 1.21 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,632.5, followed by 15,574.7. If the index moves up, the key resistance levels to watch out for are 15,726.6 and 15,762.9.

Nifty Bank

The Nifty Bank rallied 275.20 points to 35,649 on June 3. The important pivot level, which will act as crucial support for the index, is placed at 35,466.77, followed by 35,284.54. On the upside, key resistance levels are placed at 35,777.47 and 35,905.93 levels.

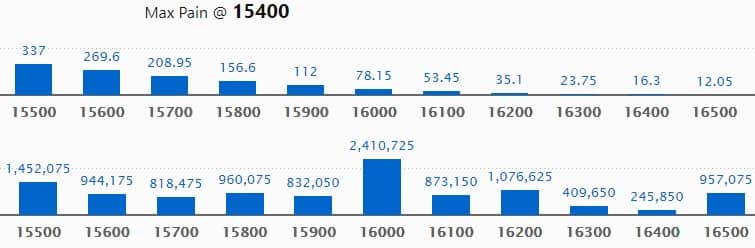

Call option data

Maximum Call open interest of 24.10 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the June series.

This is followed by 15,500 strike, which holds 14.52 lakh contracts, and 16,200 strike, which has accumulated 10.76 lakh contracts.

Call writing was seen at 15,700 strike, which added 1.56 lakh contracts, followed by 15,900 strike which added 1.53 lakh contracts, and 16,200 strike which added 1.29 lakh contracts.

Call unwinding was seen at 15,500 strike, which shed 91,125 contracts, followed by 15,000 strike which shed 75,975 contracts, and 15,400 strike which shed 54,675 contracts.

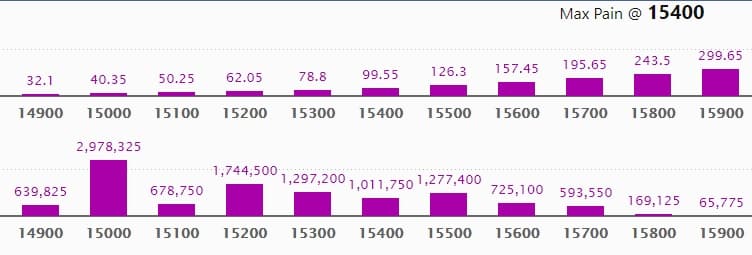

Put option data

Maximum Put open interest of 29.78 lakh contracts was seen at 15,000 strike, which will act as a crucial support level in the June series.

This is followed by 15,200 strike, which holds 17.44 lakh contracts, and 15,300 strike, which has accumulated 12.97 lakh contracts.

Put writing was seen at 15,200 strike, which added 4.22 lakh contracts, followed by 15,700 strike which added 4.2 lakh contracts, and 15,300 strike which added 2.22 lakh contracts.

Put unwinding was seen at 15,100 strike which shed 26,025 contracts, followed by 16,500 strike, which shed 16,650 contracts.

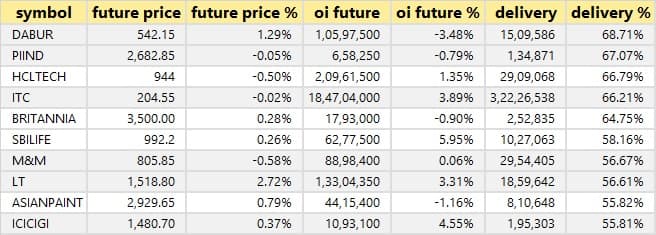

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

53 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

22 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

30 stocks saw short build-up

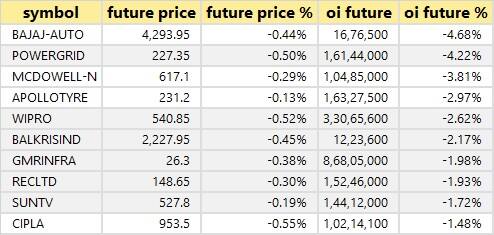

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

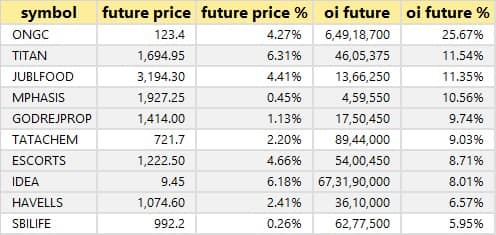

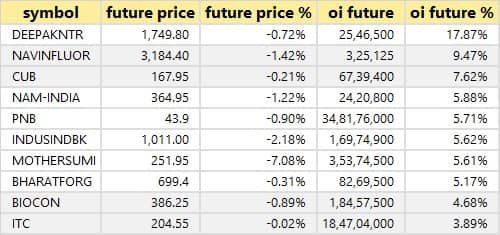

53 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

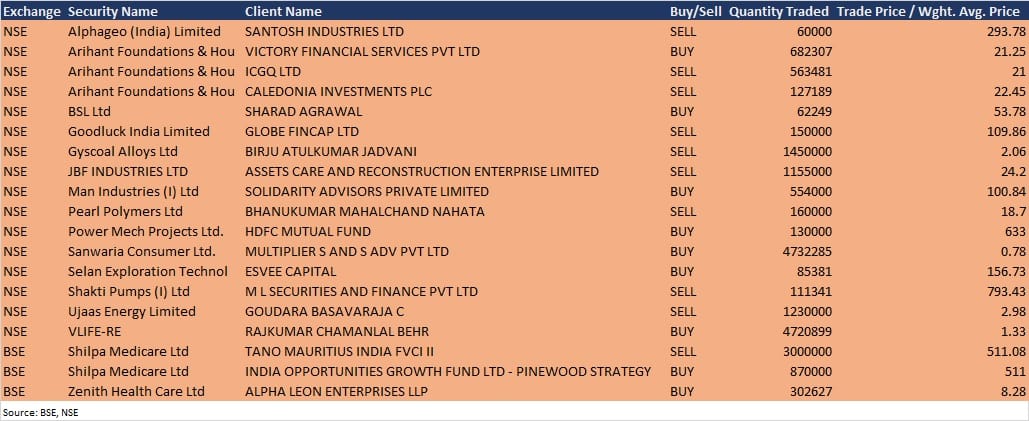

Bulk deals

Shilpa Medicare: Tano Mauritius India FVCI II sold 30 lakh equity shares in Shilpa Medicare at Rs 511.08 per share, whereas India Opportunities Growth Fund Ltd - Pinewood Strategy acquired 8.7 lakh equity shares at Rs 511 per share on the BSE, the bulk deals data showed.

Power Mech Projects: HDFC Mutual Fund bought 1.3 lakh equity shares in Power Mech at Rs 633 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Results on June 4

Punjab National Bank, Bank of India, Bharat Forge, MOIL, Ambalal Sarabhai Enterprises, Asahi Songwon Colors, Balkrishna Paper Mills, CHD Chemicals, Foods & Inns, Gufic Biosciences, Hotel Rugby, IOL Chemicals & Pharmaceuticals, Jai Corp, Jigar Cables, Jubilant Pharmova, Keltech Energies, Kranti Industries, NIIT, Paisalo Digital, Pennar Industries, Simbhaoli Sugars, and Varroc Engineering will release quarterly earnings on June 4.

Results on June 5

InterGlobe Aviation, Agri- Tech (India), Aspira Pathlab & Diagnostics, Bharat Parenterals, DHFL, IFGL Refractories, Nirmitee Robotics India, Nova Publications India, PG Electroplast, and VA Tech Wabag will release quarterly earnings on June 5.

Stocks in News

Lupin: The pharma company launched an authorised generic version of Brovana (arformoterol tartrate) Inhalation Solution 15 mcg/2 mL, unit-dose vials, of Sunovion Pharmaceuticals Inc, in the United States. The drug is used for the maintenance treatment of bronchoconstriction in patients with chronic obstructive pulmonary disease.

Som Distilleries & Breweries: The company reported consolidated profit at Rs 3.7 crore in Q4FY21 against loss of Rs 4.97 crore in Q4FY20, revenue rose to Rs 191.62 crore from Rs 161.55 crore YoY.

Cupid: The company reported profit at Rs 6.47 crore in Q4FY21 against Rs 10.43 crore in Q4FY20, revenue fell to Rs 41.69 crore from Rs 42.69 crore YoY.

Gujarat State Petronet: The company reported higher consolidated profit at Rs 577.5 crore in Q4FY21 against Rs 497.67 crore in Q4FY20, revenue rose to Rs 3,828.65 crore from Rs 3,207.41 crore YoY.

Mahindra & Mahindra: Ministry of Defence signed a contract with Mahindra Telephonics Integrated Systems for procurement of 11 airport surveillance radars with monopulse secondary surveillance radar for the Indian Navy and Indian Coast Guard. The procurement, at a cost of Rs 323.47 crore, will be made under the 'buy & make' category.

Nucleus Software Exports: The company reported consolidated profit at Rs 27.35 crore in Q4FY21 against Rs 28.14 crore in Q4FY20, revenue fell to Rs 124.18 crore from Rs 138.23 crore YoY.

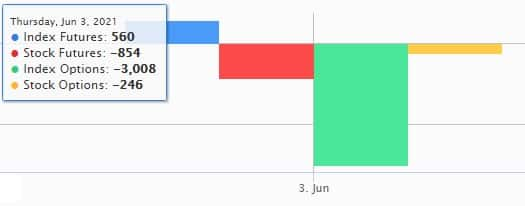

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net acquired shares worth Rs 1,079.20 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 278.97 crore in the Indian equity market on June 3, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Four stocks - Bank of Baroda, Punjab National Bank, SAIL, and Sun TV Network - are under the F&O ban for June 4. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.