Broadcom Earnings Preview: What the Charts Say Now

Broadcom (AVGO) - Get Report has performed quite well over the past year, up about 55% in that span. However, the stock has been relatively stagnant so far in 2021, up just 6%.

Will earnings after Thursday’s close of trading be enough to spark a rally?

From early November to mid-February, Broadcom really found its groove. Shares rallied more than 40% in that span as the chipmaker saw its stock glide higher.

While Broadcom topped out around the time that other high-growth stocks did, it didn’t suffer the same fate as those caught in the ensuing bear market.

However, like Nvidia (NVDA) - Get Report and other large-cap tech stocks investors want to know if Broadcom can break out of this consolidation pattern.

Based on prior commentary from management and the current chip shortage, the quarterly report should be good. But will it be strong enough to lift the stock?

Broadcom and Nvidia are holdings in Jim Cramer's Action Alerts PLUS member club. Want to be alerted before Jim Cramer buys or sells AVGO or NVDA? Learn more now.

Trading Broadcom

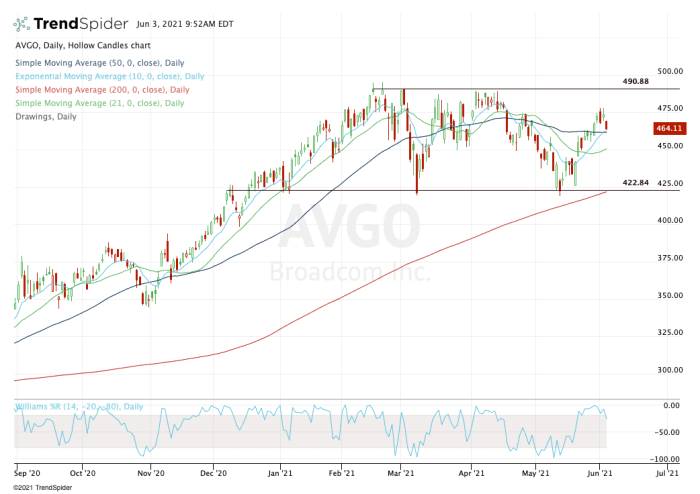

In early April, Broadcom stock ran back into resistance that was established in February, around $490. It proceeded to dip for about six weeks until shares bottomed near range support around $425.

Essentially, shares are range-bound between $425 and $490. For now, Broadcom is above all of its major moving averages, but that could change after the report.

Now declining into the 10-day and 50-day moving averages, I would love to see these measures hold as support after the report. If they don’t, the 21-day moving average near $450 is on the table.

If that measure fails to hold as support - or should Broadcom gap below these measures on a bearish post-earnings reaction - that could put the 200-day moving average and $425 range support level in play.

In that scenario, I would be looking for a potential bounce setup.

On the upside, let's see if Broadcom can rally on earnings. If that’s the case, $490 is the level to watch. If it’s resistance, be open to the idea that the stock won’t push through it and that it may remain range-bound.

If it does push through $490, $500-plus is possible and a larger breakout may take hold.