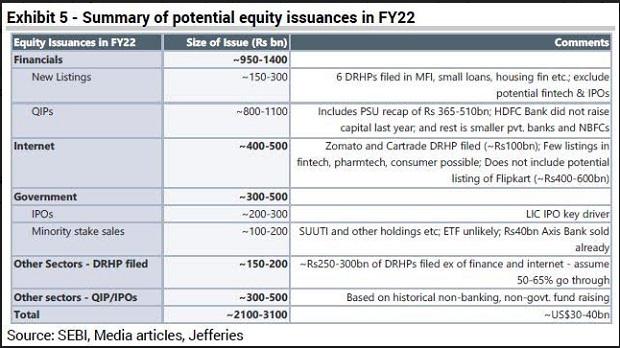

Indian equity markets that are trading near all-time high levels could see a record Rs 2 – 3 trillion ($30 – 40 billion) equity supply in fiscal 2021-22 (FY22) with 40 per cent of this being raised via initial public offers (IPOs), though the actual quantum of the corporate equity paper supply would depend on institutional flows and may bring in new investors, suggests a note from Jefferies.

“Maturing of India's internet space, government's disinvestment program and traditionally large financial issuers will likely dominate but at around 1 per cent of market-cap, the supply is within limits. Our analysis suggests that net equity supply has easily exceeded 1 per cent in strong bull markets in the past and a similar number now can imply net / gross equity issuance of $30-40 billion can be absorbed,” wrote Mahesh Nandurkar, managing director at Jefferies in a coauthored report with Abhinav Sinha.

The net (of buy-backs, adjusted for promoter contribution to rights) equity supply in FY21, according to Jefferies, was at an estimated $24 billion – a three-year high.

Over the past decade, the contribution of initial public offers (IPOs) to equity fund-raising at around 27 per cent has been muted, Jefferies said. India's maturing internet space, however, can change this trend going ahead with two pig players – Zomato and Paytm – looking to list this fiscal.

PolicyBazaar, India’s largest online insurance company, too is gearing up for an IPO and plans to raise Rs 4,000 crore via an IPO, reports suggest. Zomato has already filed its draft red herring prospectus (DRHP) with the Securities and Exchange Board of India (Sebi) and looks to raise Rs 8,250 crore, or over $1.1 billion, via the IPO route. “The company will be utilising part proceeds to fund organic and inorganic growth. The rest will be used for general corporate purposes. The IPO will be a test of Indian investors’ appetite for unicorns,” said Shobit Singhal of Anand Rathi in a recent note.

Paytm, on the other hand, aims to raise $3 billion (around Rs 22,000 crore) later this year. If successful, this could be the biggest IPO by an Indian company, breaking Coal India’s 2010 record of Rs 15,475 crore.

Financial sector

The financial sector, according to Jefferies, has been the largest equity raiser historically, contributing 47-62 per cent of the total supply over FY18-21. While there would be equity issuances in other sectors as well such as infrastructure, real estate etc., but some of these, Jefferies feels, could be subject to reopening / capex-cycle uptick getting underway.

“Financial sector fund-raising may rise to $13-20 billion with contributions from state-owned banks ($5-7 billion), large private banks ($3-4 billion) and smaller private banks / non-bank finance companies, or NBFCs ($3-4 billion) may be back in the market. New listings including some small finance banks, microfinance & insurance-related companies may raise $2-4 billion as well,” Nandurkar and Sinha said.

The next big chunk of issuances, they said, will be via the government's Rs 1.75 trillion divestment agenda this fiscal that looks to pare stakes in marquee names such as Bharat Petroleum Corporation Limited (BPCL), Air India and Life Insurance Corporation of India (LIC).

"Along with few other stake sales / minority exits (e.g. Axis Bank stake worth Rs 40 billion sold already), we expect disinvestment to contribute $4-7 billion to the equity supply," Jefferies said.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

RECOMMENDED FOR YOU