Top Searches

- News

- Business News

- India Business News

- Carlyle ups PNB Hsg Fin stake, brings in Aditya Puri

Carlyle ups PNB Hsg Fin stake, brings in Aditya Puri

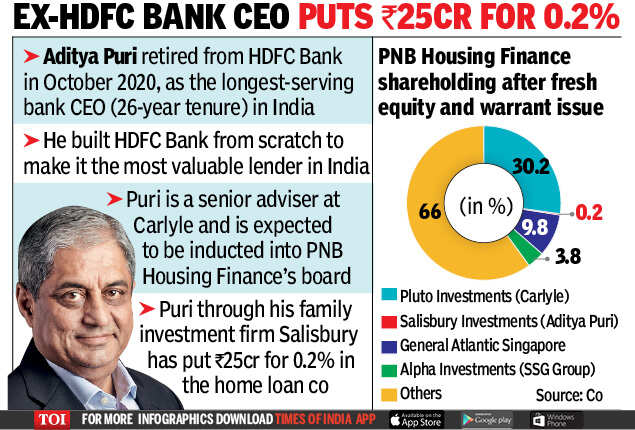

MUMBAI: In a move that will trigger an open offer under Sebi’s takeover laws, US-based Carlyle has consolidated its investment in PNB Housing Finance and has brought in Aditya Puri as a minority investor who is expected to be nominated to the board by the private equity firm.

PNB Housing Finance on Monday said that it has approved issuing equity of up to Rs 4,000 crore to investors including entities affiliated to the Carlyle Group, General Atlantic, SSG Group and Salisbury Investments — the family investment vehicle of Aditya Puri, former CEO & MD of HDFC Bank.

Pluto Investments, an affiliated entity of Carlyle Asia, has agreed to invest up to Rs 3,185 crore through a preferential allotment of equity shares and warrants, for Rs 390 per share. The proposed transaction will trigger a mandatory open offer by Pluto Investments for the purchase of up to 26% equity shares of PNB Housing Finance from public shareholders.

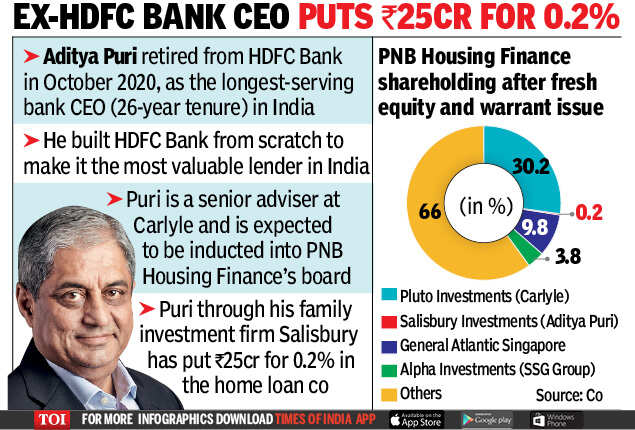

The issue comprises a combination of equity shares and warrants. Carlyle Group will hold 30.2% in the company after allotment of equity and warrants. Another 9.8% will be held by General Atlantic and 3.8% by Alpha Investments (a fund managed by the SSG Group). Puri’s Salisbury investments will be putting in Rs 25 crore, which will give him a 0.2% stake.

PNB Housing Finance is the fourth-largest housing finance company in India with loan assets of Rs 62,255 crore as on March 31, 2021, and the second-largest in deposits (Rs 17,129 crore as on the same date). Before the issue, PNB held a 32% stake in the company.

“The current fundraise and planned strengthening of the board and management team will enable us to accelerate our strategic priorities, including further expanding our footprint, driving the company’s digitalisation, improving our operating model and customer engagement,” said PNB Housing Finance MD & CEO Hardayal Prasad.

Carlyle had first invested in PNB Housing Finance six years ago. “This substantial additional investment reflects Carlyle’s strong commitment to India as a core market. We look forward to continuing our partnership with a leading bank like PNB to support the company as it embarks on a new growth journey,” said Carlyle Asia MD Sunil Kaul.

Carlyle had invested more than $1.7 billion of equity in a total of eight financial services companies as on March 31, 2021, and $3.2 billion in India overall. Among other investors, General Atlantic is a global growth equity firm providing capital and strategic support for growth companies, while Ares SSG is one of the largest alternative asset managers in Asia-Pacific, managing $7-billion assets.

PNB Housing Finance on Monday said that it has approved issuing equity of up to Rs 4,000 crore to investors including entities affiliated to the Carlyle Group, General Atlantic, SSG Group and Salisbury Investments — the family investment vehicle of Aditya Puri, former CEO & MD of HDFC Bank.

Pluto Investments, an affiliated entity of Carlyle Asia, has agreed to invest up to Rs 3,185 crore through a preferential allotment of equity shares and warrants, for Rs 390 per share. The proposed transaction will trigger a mandatory open offer by Pluto Investments for the purchase of up to 26% equity shares of PNB Housing Finance from public shareholders.

The issue comprises a combination of equity shares and warrants. Carlyle Group will hold 30.2% in the company after allotment of equity and warrants. Another 9.8% will be held by General Atlantic and 3.8% by Alpha Investments (a fund managed by the SSG Group). Puri’s Salisbury investments will be putting in Rs 25 crore, which will give him a 0.2% stake.

PNB Housing Finance is the fourth-largest housing finance company in India with loan assets of Rs 62,255 crore as on March 31, 2021, and the second-largest in deposits (Rs 17,129 crore as on the same date). Before the issue, PNB held a 32% stake in the company.

“The current fundraise and planned strengthening of the board and management team will enable us to accelerate our strategic priorities, including further expanding our footprint, driving the company’s digitalisation, improving our operating model and customer engagement,” said PNB Housing Finance MD & CEO Hardayal Prasad.

Carlyle had first invested in PNB Housing Finance six years ago. “This substantial additional investment reflects Carlyle’s strong commitment to India as a core market. We look forward to continuing our partnership with a leading bank like PNB to support the company as it embarks on a new growth journey,” said Carlyle Asia MD Sunil Kaul.

Carlyle had invested more than $1.7 billion of equity in a total of eight financial services companies as on March 31, 2021, and $3.2 billion in India overall. Among other investors, General Atlantic is a global growth equity firm providing capital and strategic support for growth companies, while Ares SSG is one of the largest alternative asset managers in Asia-Pacific, managing $7-billion assets.

FacebookTwitterLinkedinEMail

Start a Conversation

end of article

Quick Links

ELSS Mutual Funds BenefitsIncome Tax Refund statusITR Filing Last DateHome Loan EMI TipsHome Loan Repayment TipsPradhan Mantri Awas YojanaTop UP Loan FeaturesIncrease Home Loan EligibilityHome Loan on PFTax Saving Fixed DepositLink Aadhaar with ITRAtal Pension YojanaAadhaar CardSBIReliance CommunicationsMukesh AmbaniIndian Bank Ifsc codeIDBI Ifsc codeIndusind ifsc codeYes Bank Ifsc CodeVijay Bank Ifsc codeSyndicate bank Ifsc CodePNB Ifsc codeOBC Ifsc codeKarur vysya bank ifscIOB Ifsc codeICICI Ifsc codeHDFC Bank ifsc codeCanara Bank Ifsc codeBank of baroda ifscBank of America IFSC CodeBOM IFSC CodeAndhra Bank IFSC CodeAxis Bank Ifsc CodeSBI IFSC CodeGST