Benchmark indices continue to breach records driven by a subsiding second COVID wave, expectations of opening up of the economy, robust March quarter earnings, and positive global cues including a stable dollar index and rising commodity prices.

At 2:00 PM, the Nifty50 was trading at 15,562.70, down 0.13 percent from Monday’s close. In the last seven sessions, both Nifty 50 and BSE 30 gained at least 4 percent each. Overall in May, gains topped 6.6 percent. The Nifty Midcap 100 and Smallcap 100 indices too gained 6 and 8 percent respectively during the month. Metals, banking & financials, IT, auto, infrastructure stocks and Reliance Industries were the drivers behind this rally.

Experts expect the momentum to continue in coming sessions.

"Economic growth may appear weak in the short term, but it is likely to stabilise and recover quickly once we are in business-as-usual mode. The optimism in global economic growth and its outlook is reflected in the prices of commodities, including base metals and oil," Vaibhav Sanghavi, Co-CEO at Avendus Capital Public Markets Alternate Strategies LLP told Moneycontrol.

"The robust recovery in prices may lead to inflation and the risk of sooner than expected rate hikes. However, we do think that some part of this inflation spike is transitory, and as the supply-side gets better, we may see inflation numbers getting steady," he said.

"From an investor perspective, what it all means is that the coming few years can post a robust growth environment including corporate earnings, which is likely to have a positive effect on the markets and share prices," he added.

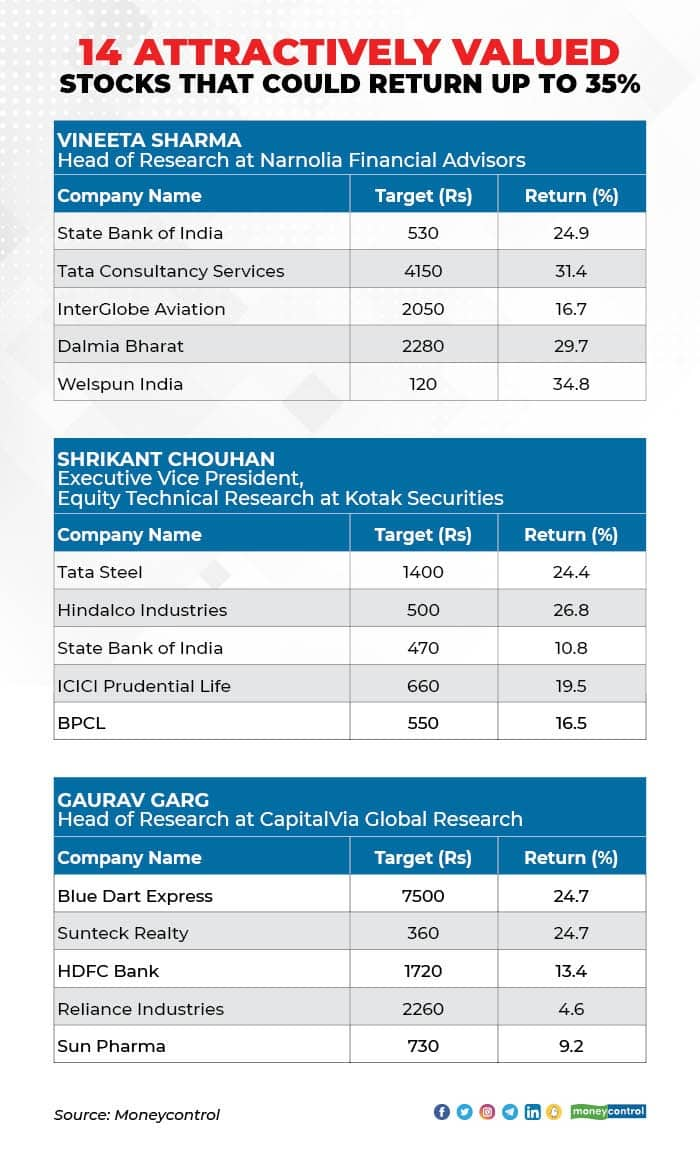

Given the expected strong momentum, experts advise top 14 stock picks that are available at attractive valuations now:

Expert: Vineeta Sharma, Head of Research at Narnolia Financial Advisors

State Bank of India: Buy | Target: Rs 530 | Return: 24.9 percent

SBI held market share of 22.6 percent and 23.6 percent in advances and deposits respectively in FY20. SBI is the only PSU bank which has been able to sustain its deposit market share of around 24 percent after the consolidation.

SBI has the opportunity to cash on the corporate lending story as the GDP picks up. Most of the private lenders have shifted their focus towards retail lending.

The high provision cycle will end soon. SBI has provisioned on an average 82 percent of its PPP (pre-provision profit) during FY15-20. Majority of stressed assets has been provided and the provisions to PPP is likely to fall around 30 percent in FY23 giving major boost the bottomline.

Tata Consultancy Services: Buy | Target: Rs 4,150 | Return: 31.4 percent

TCS' deal wins are at record high in FY21 which will result in double digit growth momentum in FY22. The management said large deals have started coming in. Moreover, smaller deal volumes have become larger.

TCS commands a higher EBITDA (earnings before interest, tax, depreciation and amortisation) margin of 29.3 percent (Q4FY21) while Infosys 27.6 percent (Q4FY21). Also, the ROE (return on equity) of TCS is 45 percent (FY22 estimates) while the ROE of Infosys is 28 percent (FY22 estimates). TCS trades at 21.3 times EV (enterprise value)/EBITDA while Infosys at 19.3 times EV/EBITDA based on FY22 estimates. Higher margin and return ratios of TCS justify a higher valuation premium over Infosys.

The company has multiple levers to drive margin like automation and utilization.

InterGlobe Aviation: Buy | Target: Rs 2,050 | Return: 16.7 percent

Post pandemic, major consolidation is happening in the airline industry. InterGlobe with free cash balances of Rs 7,445 crore will absorb the second wave impact of cash burn.

The management plans to replace 100 planes of CEO (current engine option) with NEO (new engine option) till December 2022. The NEOs have a new engine which has been delivering a reduction of up to 17-20 percent in fuel burn relative to the earlier CEOs, based on Airbus data. A reduction in maintenance costs of up to 5 percent provides further benefit.

In January 2021, IndiGo had announced to set up seven new regional bases (at Leh, Darbhanga, Kurnool, Agra, Bareily, Durgapur, and Rajkot). These new flights would aid better yields for the airline.

Its board has approved to raise Rs 3,000 crore through QIP.

Dalmia Bharat: Buy | Target: Rs 2,280 | Return: 29.7 percent

Its cement capacity is expected to rise by around 30 percent in 12-18 months to 37.5mt, led by 4.5mt addition in East India and commissioning of 3mt at MIL (Murli Industries).

High cash flow will help in debt reduction and improved profitability.

Welspun India: Buy | Target: Rs 120 | Return: 34.8 percent

China plus one strategy by the US and Europe market will create huge headroom for the Welspun India. Wal-Mart is expected triple its sourcing to $10 billion from India by 2027.

The company already has done investments into technological upgradation, which will help it towards higher revenue by Rs 1,200 crore from FY23 onwards.

Expert: Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities

Tata Steel: Buy | Target: Rs 1,400 | Return: 24.4 percent

Sharp deleveraging puts debt concerns behind & creates room for growth capex. Europe EBITDA of $65 per tonne increased sequentially from loss in Q3FY21. We value India at 6.5x & Europe at 4x March 2023 EBITDA (earnings before interest, tax, depreciation and amortization) & arrive at a fair value of Rs 1,400.

Hindalco Industries: Buy | Target: Rs 500 | Return: 26.8 percent

India aluminum EBITDA per tonne of $658 per tonne for Q4FY21 was led by 7 percent QoQ higher LME prices. Novelis, earlier, reported yet another quarter with $500 per tonne margin in Q4FY21. We value Hindalco domestic business at 5x and Novelis at 7x March 2023 EBITDA.

State Bank of India: Buy | Target: Rs 470 | Return: 10.8 percent

SBI reported 80 percent YoY earnings growth in Q4FY21. Well placed to improve return on equities (RoEs). Asset quality has held up exceptionally well. We have valued SBI at 1.1x book & 7x FY23E EPS for RoEs in the range of around 13-14 percent.

ICICI Prudential Life: Buy | Target: Rs 660 | Return: 19.5 percent

The 26 percent YoY growth in VNB (value of new business) on the back of 27 percent growth in APE (99 percent YoY growth in March 2021). Overall bouquet is currently diversified. (48 percent ULIPs, 31 percent non-linked, 5 percent group savings & 16 percent protection). At our fair value of Rs 660, the business will trade at 2.4X EV.

BPCL: Buy | Target: Rs 550 | Return: 16.5 percent

Normalized refining margins at $2.5 per barrel is at a premium to benchmark. The privatization process seems to be inching forward gradually.

BPCL declared final dividend of Rs 58 per share. Sum-of-the-parts fair value is Rs 550. Trading at a PE of 11.4x on FY23E earnings.

Expert: Gaurav Garg, Head of Research at CapitalVia Global Research

Blue Dart Express: Buy | Target: Rs 7,500 | Return: 24.7 percent

The company has posted healthy numbers year- on-year, in addition to this a new initiative is on way-The Blue Dart Med-Express Consortium. This consortium is an initiative by Bluedart, Niti Ayog, Government of Telangana, World economic Forum, Healthnet Global to deliver vaccines, medicines and essentials via drones and thereby devising alternative logistics routes to reach the remotest parts of the country.

This initiative is one of its kind in the country and the success of which may increase the reach and operational efficiency of the firm. The Ministry of Civil Aviation (MoCA) has granted the project with necessary exemptions and rights to fly drone flights on an experimental basis in Telangana. Thus the stock looks promising at the current levels.

Sunteck Realty: Buy | Target: Rs 360 | Return: 24.7 percent

The strong downtrend in this real estate company (Sunteck Realty) appears to be over since the stock price has risen substantially the last week. In the early part of May 2021, we see the emergence of a crucial bottom reversal at Rs 250, and the stock price is now indicating an upwards comeback after two weeks of consolidation.

During the pandemic, Chairman Kamal Khetan stated, "We executed three huge bargain transactions that were among the largest in the recent seven years." Last year, it bought around 9 million square feet and is in plans to buy more in 2021.

HDFC Bank: Buy | Target: Rs 1,720 | Return: 13.4 percent

The bank has been delivering consistent growth in loans and deposits. The bank's operating performance remains steady, aided by healthy revenue growth, stable margins, and controlled operating expenses.

Reliance Industries: Buy | Target: Rs 2,260 | Return: 4.6 percent

For the quarter ended 31-03-2021, the company has reported a consolidated total income of Rs 1,58,133 crore, up 23.11 percent from last quarter's total income of Rs 1,28,450 crore and up 12.65 percent from last year same quarter's total income of Rs 1,40,373 crore.

The company has reported a net profit after tax of Rs 14,981 crore in the latest quarter. The stock is also breaking out after around 2 months of consolidation and can eye a price of Rs 2,250 in coming days.

Sun Pharma: Buy | Target: Rs 730 | Return: 9.2 percent

Sun Pharma delivered a Q4FY21 performance marginally below our expectations, weighed by moderation in US and API sales. Domestic Formulation (DF) business growth has been strengthening for three consecutive quarters now. Marketing efforts are driving strong performance in Illumya, a specialty product – 51 percent YoY growth was reported for FY21. It further intends to build a Biosimilar portfolio for launch over CY28–30.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.