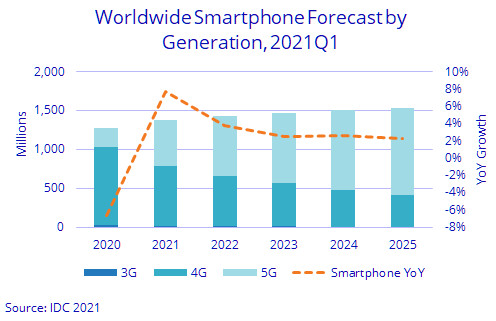

In a statement, the company said the trend of growth would continue until 2022 when year-on-year growth would be 3.8% with shipments totalling 1.43 billion. Low single digit growth was expected to continue through to 2025, with a five-year compound annual growth rate of 3.7%.

The forecast said countries where 5G networks were being deployed would continue to see increases in the use of devices suited for this technology. But in emerging markets, there was still demand for mid-range and low-end 4G phones after the slowdown caused by the pandemic.

"Smartphones are seeing competition for consumer spending from adjacent markets like PCs, tablets, TVs, and smart home devices, yet that hasn't slowed the market's path to recovery," said Ryan Reith, program vice-president with IDC's Worldwide Mobile Device Trackers.

"There continues to be a strong supply-side push toward 5G, and price points continue to drop as a result. IDC expects average selling prices for 5G Android devices to drop 12% year-over-year in 2021 to US$456 (A$589.30) and then below US$400 in 2022. Apple will continue to feel price pressure."

"There continues to be a strong supply-side push toward 5G, and price points continue to drop as a result. IDC expects average selling prices for 5G Android devices to drop 12% year-over-year in 2021 to US$456 (A$589.30) and then below US$400 in 2022. Apple will continue to feel price pressure."

IDC said 5G shipments were expected to grow by nearly 130% this year and all regions outside China would see triple-digit growth by the end of the year. As far as market share was concerned, China would account for nearly half the shipments while the US would have about 16%.

Markets like Western Europe and the Asia-Pacific, excluding China and Japan, would combine to take about 23.1% share by the end of 2021.

"Although the 7.7% growth will feel like an impressive market turnaround, we must keep in mind that we are rebounding from one of the most challenging years on record," said Anthony Scarsella, research manager with IDC's Worldwide Mobile Device Trackers.

"[The year] 2021 will represent the largest year-over-year growth the market has witnessed since 2015, as the shift towards 5G across all price tiers continues to accelerate.

"The 5G shift will also deliver peak smartphone ASPs in 2021 (US$376, up 9.7% year-over-year) when compared to the remainder of the forecast period, as costly 5G devices continue to replace LTE devices, which are also starting to drop in price, down 27% in 2021."