The market on May 26 extended gains for fourth consecutive session amid hope for new stimulus package and ahead of expiry of May derivative contracts. Technology, financial services, auto, and select pharma stocks supported the market.

The BSE Sensex climbed 379.99 points to 51,017.52, while the Nifty50 jumped 93 points to 15,301.50, the highest closing level since February 16, and formed bullish candle which resembles Hanging Man kind of formation on the daily charts.

"Nifty is now placed at the resistance zone of around 15,350-15,450 levels (previous swing highs of February-March 2021) and previously, the market has witnessed sharp profit booking from the highs in the past. Nifty not showing any sharp reversal from the highs so far could be a positive indication. As long as this strength of uptrend continues for the next 1-2 sessions, one may expect a decisive upside breakout of the hurdle at 15,450 levels," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"If Nifty sustains around this highs (15,350-15,450) for the next couple of sessions, then that could open doors for an upper target of 15,800 levels. Any profit booking from the hurdles could be a buy on dips opportunity for short term. Immediate support is placed at 15,200-15,150 levels," he said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,224.37, followed by 15,147.23. If the index moves up, the key resistance levels to watch out for are 15,349.27 and 15,397.03.

Nifty Bank

The Nifty Bank underperformed benchmark indices, rising 22.20 points to 34,684.20 on May 26. The important pivot level, which will act as crucial support for the index, is placed at 34,465.16, followed by 34,246.13. On the upside, key resistance levels are placed at 34,900.56 and 35,116.93 levels.

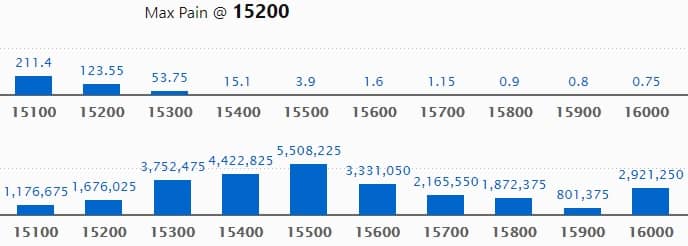

Call option data

Maximum Call open interest of 55.08 lakh contracts was seen at 15,500 strike, which will act as a crucial resistance level in the May series.

This is followed by 15,400 strike, which holds 44.22 lakh contracts, and 15,300 strike, which has accumulated 37.52 lakh contracts.

Call writing was seen at 15,400 strike, which added 8.16 lakh contracts, followed by 15,600 strike which added 5.37 lakh contracts and 15,500 strike which added 2.26 lakh contracts.

Call unwinding was seen at 15,200 strike, which shed 14.76 lakh contracts, followed by 15,800 strike which shed 12.77 lakh contracts, and 15,300 strike which shed 9.09 lakh contracts.

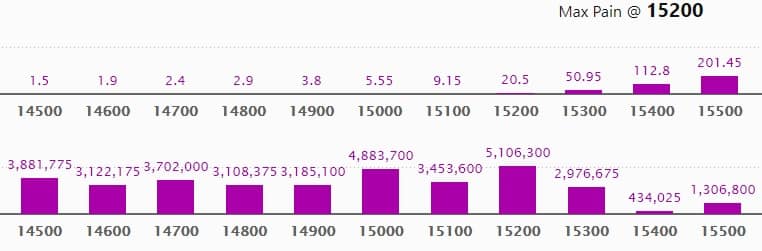

Put option data

Maximum Put open interest of 51.06 lakh contracts was seen at 15,200 strike, which will act as a crucial support level in the May series.

This is followed by 15,000 strike, which holds 48.83 lakh contracts, and 14,500 strike, which has accumulated 38.81 lakh contracts.

Put writing was seen at 15,300 strike, which added 20.01 lakh contracts, followed by 15,200 strike which added 18.23 lakh contracts and 14,700 strike which added 11.08 lakh contracts.

Put unwinding was seen at 16,000 strike which shed 63,675 contracts, followed by 14,500 strike, which shed 11,250 contracts.

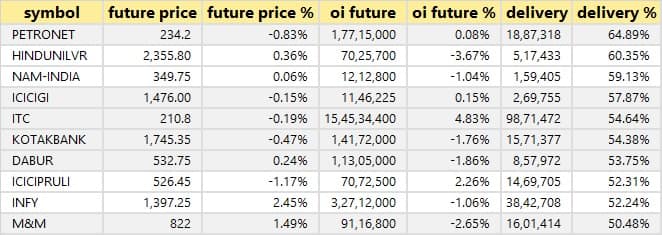

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

30 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

48 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

25 stocks saw short build-up

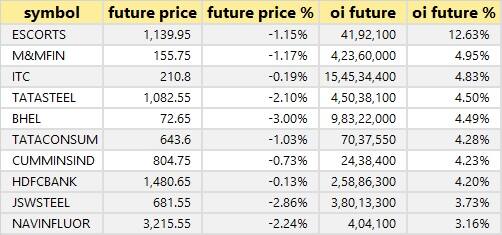

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

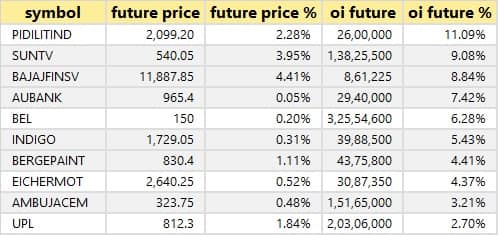

54 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

Kalpataru Power Transmission: SBI Mutual Fund acquired 28,27,724 equity shares in Kalpataru Power at Rs 425 per share, whereas Kalpataru Properties sold 28,88,800 equity shares at Rs 425.01 per share on the BSE, the bulk deal data showed.

Lux Industries: WHV-EAM International Small Cap Equity Fund acquired 1,44,080 equity shares in Lux Industries at Rs 2,537.72 per share on the NSE, the bulk deal data showed.

Pennar Industries: Saif India IV FII Holdings sold 11,13,529 equity shares in Pennar Industries at Rs 21.14 per share on the NSE, the bulk deal data showed.

(For more bulk deals, click here)

Results on May 27

Eicher Motors, Sun Pharma, Cadila Healthcare, IRB Infrastructure Developers, 63 Moons Technologies, Ador Fontech, Aegis Logistics, Alkyl Amines Chemicals, Amalgamated Electricity, Amrutanjan Health Care, Axtel Industries, Banaras Beads, Bharat Bijlee, Black Rose Industries, Blue Chip Tex Industries, Borosil, BSEL Infrastructure Realty, Capri Global Capital, John Cockerill India, Colinz Laboratories, Dixon Technologies, Elecon Engineering, Everest Industries, Fine Organic Industries, Garware Technical Fibres, Gujarat Industries Power, Golden Crest Education, Goodyear India, Gujarat Pipavav Port, GRM Overseas, Greenlam Industries, Garware Hi-Tech Films, Gujarat State Fertilizers, GTL, Hawkins Cookers, HEG, Honda India Power Products, International Data Management, India Grid Trust, Infibeam Avenues, India Infrastructure Trust, Jindal Saw, Kalyan Jewellers, KIOCL, Kopran, KREBS Biochemicals & Industries, Kunststoffe Industries, Mangalam Organics, Metropolis Healthcare, Modern Converters, Navneet Education, Nocil, Page Industries, PC Jeweller, The Phoenix Mills, Punjab Chemicals and Crop Protection, Rashtriya Chemicals & Fertilizers, Redington (India), Solar Industries, Strides Pharma Science, Suryoday Small Finance Bank, Themis Medicare, Thomas Cook, Tower Infrastructure Trust, TTK Healthcare, UCO Bank, and Wockhardt will release their quarterly earnings on May 27.

Stocks in News

Bharat Petroleum Corporation: The company reported standalone profit at Rs 11,940.13 crore in Q4FY21 against Rs 2,777.62 crore in Q3FY21, revenue rose to Rs 98,755.62 crore from Rs 86,579.95 crore in the previous quarter.

Cummins India: The company reported lower consolidated profit at Rs 168.56 crore in Q4FY21 against Rs 170.24 crore in Q4FY20, revenue rose to Rs 1,256.25 crore from Rs 1,062.46 crore YoY.

Tata Consultancy Services: TCS partnered with LACChain to develop a blockchain ecosystem in Latin America and the Caribbean.

ASM Technologies: ASM partnered with Netherlands-based EclecticIQ for new cybersecurity managed services offering.

Pricol: The company reported lower consolidated profit at Rs 1.4 crore in Q4FY21 against Rs 21.31 crore in Q4FY20, revenue rose to Rs 447.25 crore from Rs 294.16 crore YoY.

Karnataka Bank: The bank reported higher profit at Rs 31.36 crore in Q4FY21 against Rs 27.31 crore in Q4FY20, net interest income fell to Rs 459.14 crore from Rs 529.3 crore YoY.

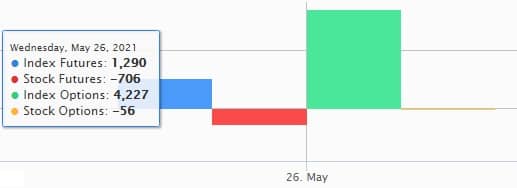

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 241.60 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 438.59 crore in the Indian equity market on May 26, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Amara Raja Batteries and Canara Bank - are under the F&O ban for May 27. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.