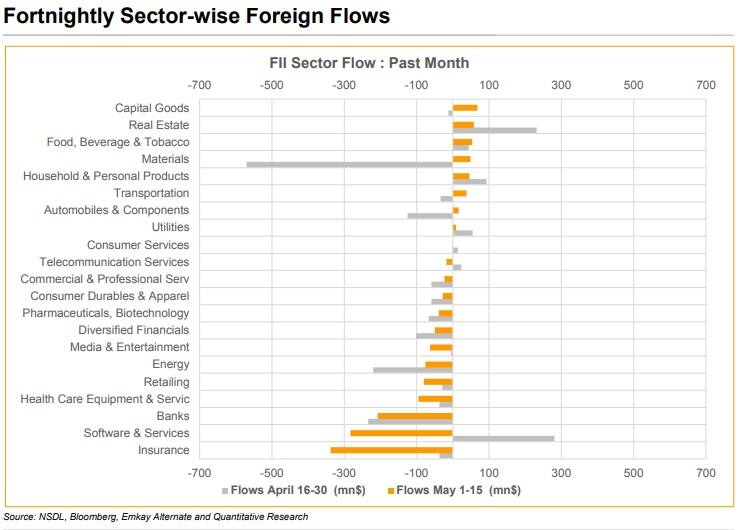

Software and services, and insurance and banking sectors seem to be unfavourable at the foreign institutional investors' (FIIs) desk in the first half of May 2021 as they have turned sellers in these sectors.

Sectoral indices data also indicated that there was selling pressure in these sectors. In case of banking, there could be fear of non-performing assets (NPAs) returning to the books due to lockdowns and restrictions in several states, while in case of software and services, the selling could have happened, post March quarter earnings, which are largely in line with analysts' estimates.

For insurance, the reason could be the increase in claims related to COVID patients as India reported more than 4 lakh cases a day, the highest in the world, which later fell below 3 lakh cases a day.

“So far, we have seen increased death claims due to COVID-19. However, the impact is not significant on the overall claim experience of the company. We typically see 2-3 months’ lag in claims reporting. So, the full impact of the second wave is yet to be seen. Nonetheless, we are monitoring the trends to understand the impact this wave will have on our overall claim experience," said Subhrajit Mukhopadhyay, executive director at Edelweiss Tokio Life Insurance.

"FIIs turned sellers in the software and services sector during the first half of May after being buyers in the second half of April. FIIs continued selling in the insurance and banking sectors in the first half of May," said Emkay Global.

All three sectors mentioned above saw outflows in excess of $200 million, the brokerage added.

In fact, selling was also visible in these indices as the BSE IT index was down 0.66 percent, and BSE Bankex and BSE Finance indices were down 1.89 percent and 0.77 percent, respectively, during the first half of May 2021.

Generally, these sectors have high weightage to the BSE Sensex. The finance sector's weightage to the Sensex stood at 42.74 percent and IT’s at 17.70 percent, as per the index data available on the NSE.

Overall, FIIs also net sold shares worth Rs 8,713.25 crore in the same period.

"FIIs continued buying in real estate, and turned buyers in capital goods and food, beverage and tobacco sectors with each of these sectors seeing inflows in excess of $50 million in the first half of May," said Emkay Global.

In the same period, the BSE Capital Goods index was up 5.34 percent, and the FMCG index was up 3.85 percent, but the realty index declined 3.21 percent.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.