In an effort to capture the next generation of investors, Fidelity Investments (US) has launched a commission-free brokerage account for 13 to 17-year-olds that lets them trade stocks on a mobile app, as well as save and spend using a debit card.

It won't be long before this trend hits India. Here's how you can approach it...

The youth accounts, the first ever as per the company, are available to teens whose parents or guardians, who can monitor the accounts, are Fidelity customers.

Teens can access Fidelity's educational tools and can buy and sell domestic stocks, including through fractional shares, as well as most exchange-traded funds, through the accounts.

When the investor turns 18, the account transitions to a standard brokerage account that comes with more choice and flexibility.

--- Advertisement ---

This Stock Could Potentially be the Next Bajaj Finance

It's a small NBFC player.

This company is backed by one of the most experienced and competent people in the sector.

It already derives good business from corporate lending.

But now the company is making a transition from being a corporate lender to a retail lender.

A transition which turned around the fortunes of Bajaj Finance, another NBFC player.

That's why Richa is confident that this small NBFC player which she has uncovered could potentially be the next Bajaj Finance.

Richa calls this small NBFC player the dark horse of the stock market.

At our Smallcap Revival Summit, Richa revealed the details of this stock.

Plus, she also revealed the details of two more dark horse stocks like this.

You had signed-up for Richa's summit, but missed it for some reason.

You still have the chance to get the details of these 3 little-known stocks which could potentially hand you multi-digit gains over the long term.

Just click on the link below to watch the special replay of Richa's summit.

Watch the Replay

------------------------------

Fidelity says that the account is positioned as a way for parents to have conversations around money with their children but it's only the latest step in a broad push by the industry to draw more first-time investors into the market.

Young investors have flooded into the market in the US since October 2019 when large brokers such as Fidelity and Charles Schwab dropped their trading commissions and start-ups such as Robinhood courted young adult traders.

While Robinhood offers a trading experience with social interaction seeped into its DNA, an entertainment ecosystem has risen up alongside Robinhood.

TikTok videos under #robinhoodstocks have millions of views while communities of at-home investors use online forums such as Reddit's WallStreetBets to join forces on stock-buying campaigns.

Younger investors in their 20s have also been taking the market by storm, with trading volumes rising across brokerages.

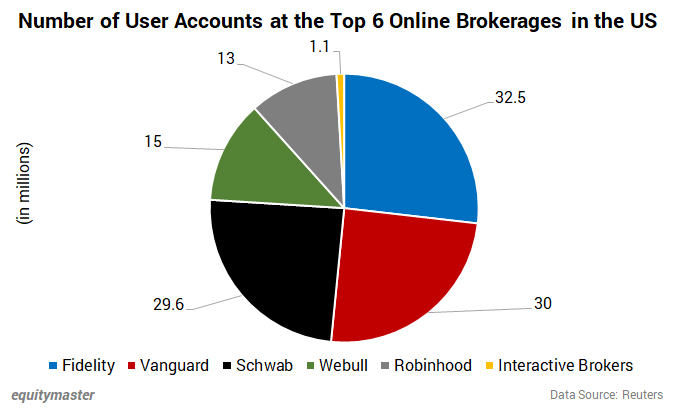

As per an article in Reuters, the top six online brokerages accounted for over 100 m accounts, according to the most recent data.

Apex Clearing, which helps facilitate trades for brokerages, told Reuters around 1 m of the new accounts it opened last year belonged to Gen Z investors, with an average age of 19.

Factors such as digitization and growing awareness about equities have also pushed investors in India to shift their savings from traditional instruments such as gold, real estate and bank deposits to alternatives like stocks.

Watch Now: Get Details of Richa's 3 Dark Horse Stocks

Younger investors as well as investors from Tier-2 and Tier-3 cities have adapted to the digital journey.

Additionally, as markets made a robust rally in FY21 after the crash following the lockdown in March last year, appetite for stock trading has grown.

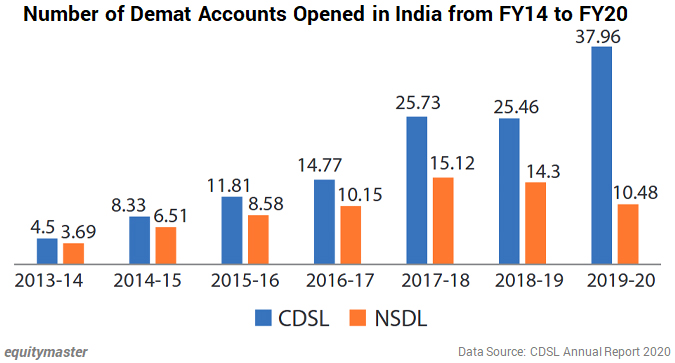

Indian investors opened a record 14.2 m new demat accounts in FY21, as the global pandemic and business disruptions opened up new investment opportunities.

In contrast, 4.9 m demat accounts were opened in FY20, with a three-year average of 4.3 m in the three fiscal years starting FY18, data from National Securities Depository (NSDL) and Central Depository Services (CDSL) showed.

They can. Contrary to what one may assume, there is no minimum age to invest in the Indian stock market. Hence, both adults and minors can have demat accounts that enable stock market trading.

If one is under 18 years of age, the demat account can be opened by the parents/appointed guardian once all important documents are submitted.

Sure. From a financial literary perspective, investing early through apps like these bring a new dimension to learning especially understanding the magic of compound interest and the advantages of riding out volatile markets.

However, there are investment dangers inherent in stock trading apps. The instant gratification of stock trading smartphone apps can be downright addictive, triggering risky behaviour in teenagers and driving compulsive trades.

On the other hand, trading can be tricky even for experienced and sophisticated investors, but it can be downright devastating for newcomers to the market.

Especially, markets they don't fully understand.

Moreover, academic research has shown that self-guided investors do worse the more actively they trade but most of these studies were done before zero brokerage commissions.

Markets have also gotten faster and more competitive, meaning anyone trading from a phone app without any expertise is trying to outwit increasingly sophisticated pros on the other side of the bet.

It is. With low-interest rates and rising inflation, the more traditional means of saving are effectively defunct which makes investing in the market more obvious.

Besides, with the help of technology, most of the barriers to stock market investments have been minimized, or totally eliminated by the online world.

However, with trading commissions now at zero for many brokerage firms and trading apps, the desire to constantly buy and sell can be overwhelming.

Whether you're a teenager, a brand-new investor or an experienced builder of wealth, the new generation of trading apps come with a world of opportunity and no small amount of risk.

If you're thinking of opening an account for your child with one of these platforms, it's important that your kid educates herself, and does her homework before logging on. And even then you need to be there to provide the calming influence.

Ayesha Shetty is a financial writer with the StockSelect team at Equitymaster. An engineer by qualification, she uses her analytical skills to decode the latest developments in financial markets. This reflects in her well-researched and insightful articles. When she is not busy separating financial fact from fiction, she can be found reading about new trends in technology and international politics.

So far in 2021, IPOs in India have raised nearly US$ 3 bn, the best start to the year since 2018.

Here's the rundown on the company's latest quarterly results.

PersonalFN analyses the features of Aditya Birla Sun Life Nifty 50 Equal Weight Index Fund and explains the potential this fund has to offer to its investors.

I'm cautious on the stock market. In this video, I'll show you why with four charts.

Are we on the cusp of another commodity bull run?

More Views on NewsA look at the various types of primary and secondary markets and the key differences between them.

I will recommended my favourite trade soon. I'm waiting for the right entry point to maximise profits.

Do you think you have what it takes to be an intraday trader? Find out in this video.

Select small-cap stocks can help you navigate these uncertain times in stock market.

May 17, 2021The tailwinds of India's revival will act as a huge catalyst for this business for decades to come.

More

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!