FEATURED FUNDS

ICICI Prudential Midcap Direct Plan-Growth

5Y Return

16.64 %

Invest Now

FEATURED FUNDS

ICICI Prudential Credit Risk Fund Direct Plan-Gr..

5Y Return

9.22 %

Invest Now

FEATURED FUNDS

ICICI Prudential Multicap Fund Direct Plan-Growt..

5Y Return

14.88 %

Invest Now

FEATURED FUNDS

ICICI Prudential Smallcap Fund Direct Plan-Growt..

5Y Return

16.86 %

Invest Now

FEATURED FUNDS

ICICI Prudential Asset Allocator Fund (FOF) Dire..

5Y Return

14.05 %

Invest Now

Tick-tac-toe

Want this newsletter delievered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Unwrapped

We'll soon meet in your inbox.

/ Unwrapped / Unwrapped |

Good morning,

Hi, it’s Shephali. Four months ago, we exposed the black market where blue ticks for social media profiles are bought and sold. Pardon the clickbait, but you won’t believe what happened next.

ETtech Follow-up: Fantastic blue ticks and where to buy them

On Thursday, Twitter announced that it is resuming its verification process -- which it paused in 2017 -- to award users (who are authentic, notable and active) with a blue tick.

My immediate reaction to the news was, “Oh dear lord!”

Why so dramatic, you ask?

Let me explain: On January 30, we published an article exposing the black market where blue ticks or verified badges are bought and sold at private marketplaces.

We explained the modus operandi of individuals and agencies that offer social media verification services for a fee — from Rs 30,000 to Rs 1 lakh in India, and many times higher for users in countries like the US and the UK.

During our investigation, we found several verified accounts that looked suspicious. When we flagged those to Facebook/Instagram as part of our queries, the tech company was quick to take the blue ticks off some of them. We also noticed that a few accounts made distinct changes to their bios and feeds shortly after we sent them a media query.

There are obvious dangers of users manipulating social media platforms’ guidelines to obtain verified badges, especially in the age of misinformation, we pointed out.

Experts mentioned how the issue will likely balloon once Twitter opens up its verification gates again.

Now, you might think the anticipation of said ballooning is what evoked a dramatic reaction.

But that's not it.

The news just reminded me of everything that followed after the story was published. Everything that proved just how rampant this was; my own “investigation” felt like it had barely scratched the surface.

Little else explains this screenshot I received minutes after sharing the piece online. Here, a user is expressing his frustration at members of a private Facebook group for allegedly bringing the “market rate” for verified badges down from Rs 1-2 lakh to an abysmal Rs 50,000 these days. “There are just so many people offering and getting blue ticks these days... How does one command higher prices anymore,” he rues.

It didn’t stop there. Multiple users reached out via Twitter and Instagram DMs to flag more suspiciously verified accounts. “This guy is the linchpin,” a user pointed out.

“I tried reporting this person for these activities but he found out and threatened me,” said another.

Over the next few days, I received dozens of tips from users which I forwarded to the communications team at Instagram. Around 90% of those accounts don’t have a blue tick anymore. Another 5% stand deactivated as of today.

“We know that bad actors constantly try to game our systems and we routinely disable accounts that break our rules,” a Facebook spokesperson said when I asked what prompted it to remove blue ticks from the accounts we had been flagging for weeks after the story was out.

“Additionally, we constantly work on new ways to keep our community safe and away from scams and fraudulent activity. An example of this is the in-app communication we’ve placed to make sure users know that Instagram will never contact them through DM, and that any account doing so and asking for personal information is a scam. Finally, any user can report an entire account for pretending to be someone else,” the spokesperson added.

Meanwhile, I was left wondering why I spent days doing what should have been Facebook’s job.

And it was far from over.

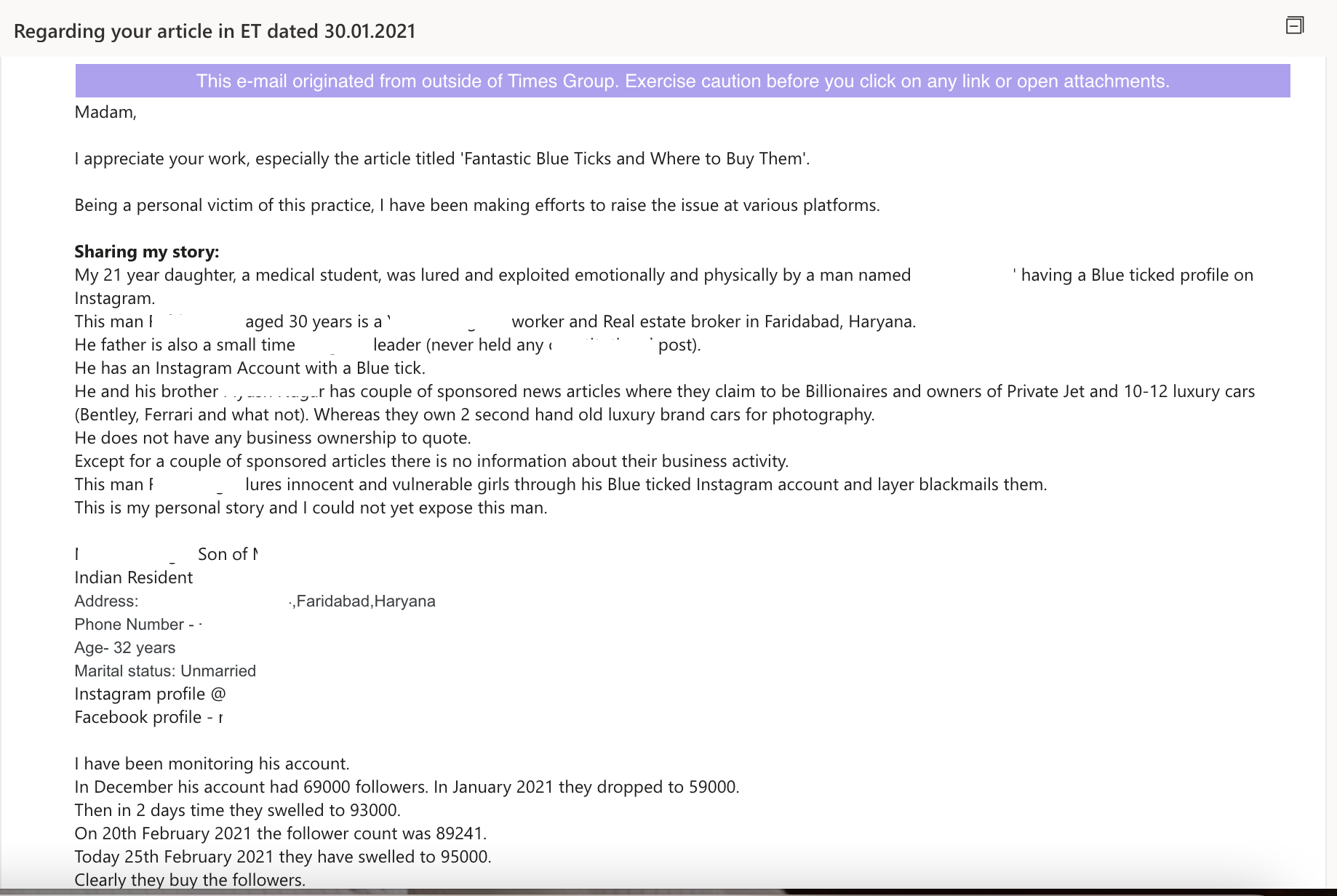

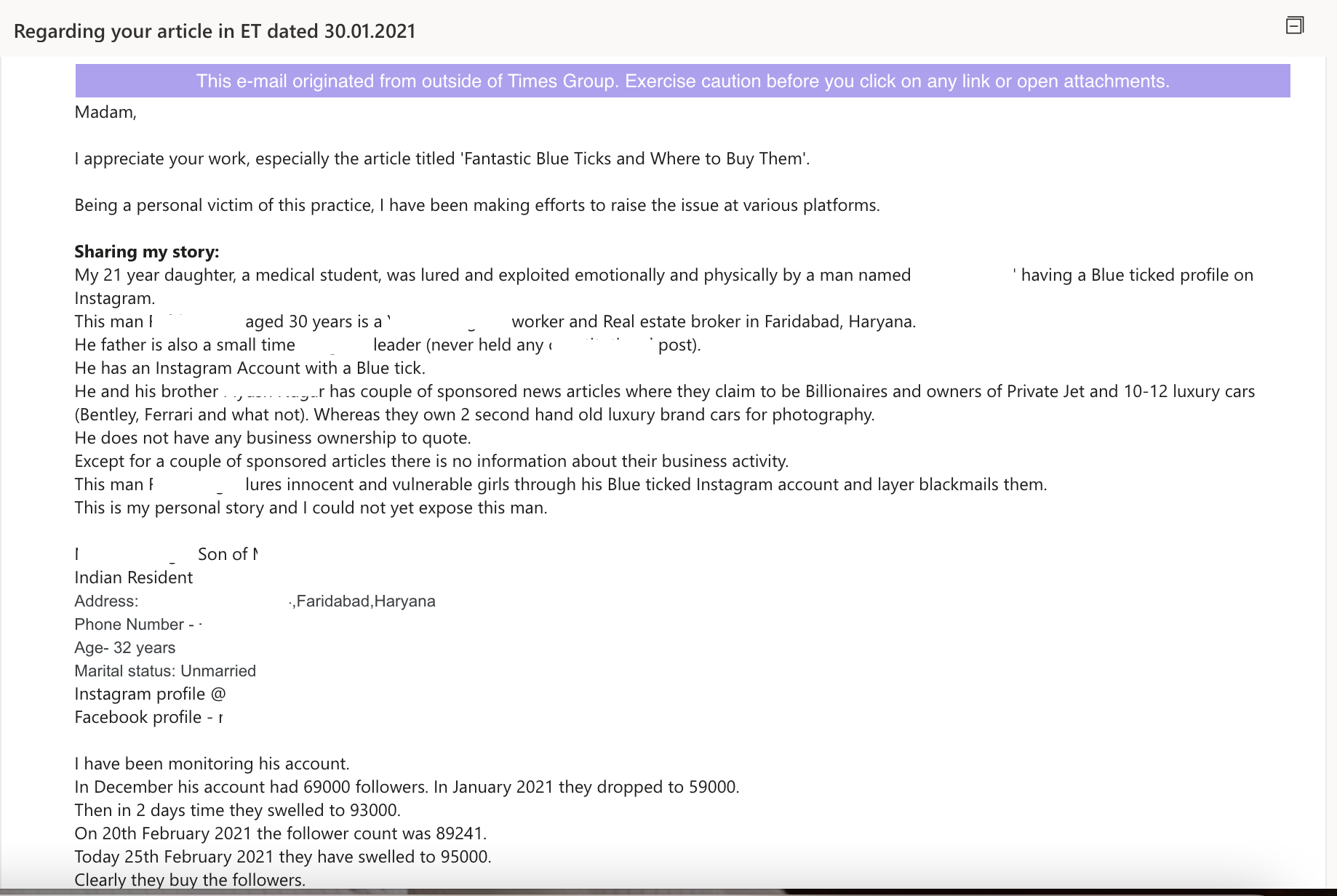

A month after the story was published, I received a deeply disturbing email.

A reader wrote to me sharing how his daughter was allegedly exploited by a verified user who may have obtained the blue tick fraudulently. The reader pointed out the sudden and massive rise and fall in the verified user’s follower count indicated they may have been bought.

Our story had only hinted at the possibility of the dangers of this practice. Now it had become real. The said user’s account continues to hold a verified badge on Instagram.

There’s more.

A few weeks ago, a user alerted me that an agency mentioned in our article, which boasts of offering “technical support” to users to get verified badges, now had a blue-tick account on Facebook.

When I asked Facebook about this, a spokesperson said, “The verification was an error and the page has now been unverified.”

“An error”? Are you kidding me?

In the middle of a full-blown misinformation crisis, a social media behemoth is erroneously giving away authenticity badges. What could possibly go wrong?

Over to my colleague Vikas SN to take you through the week’s most important stories.

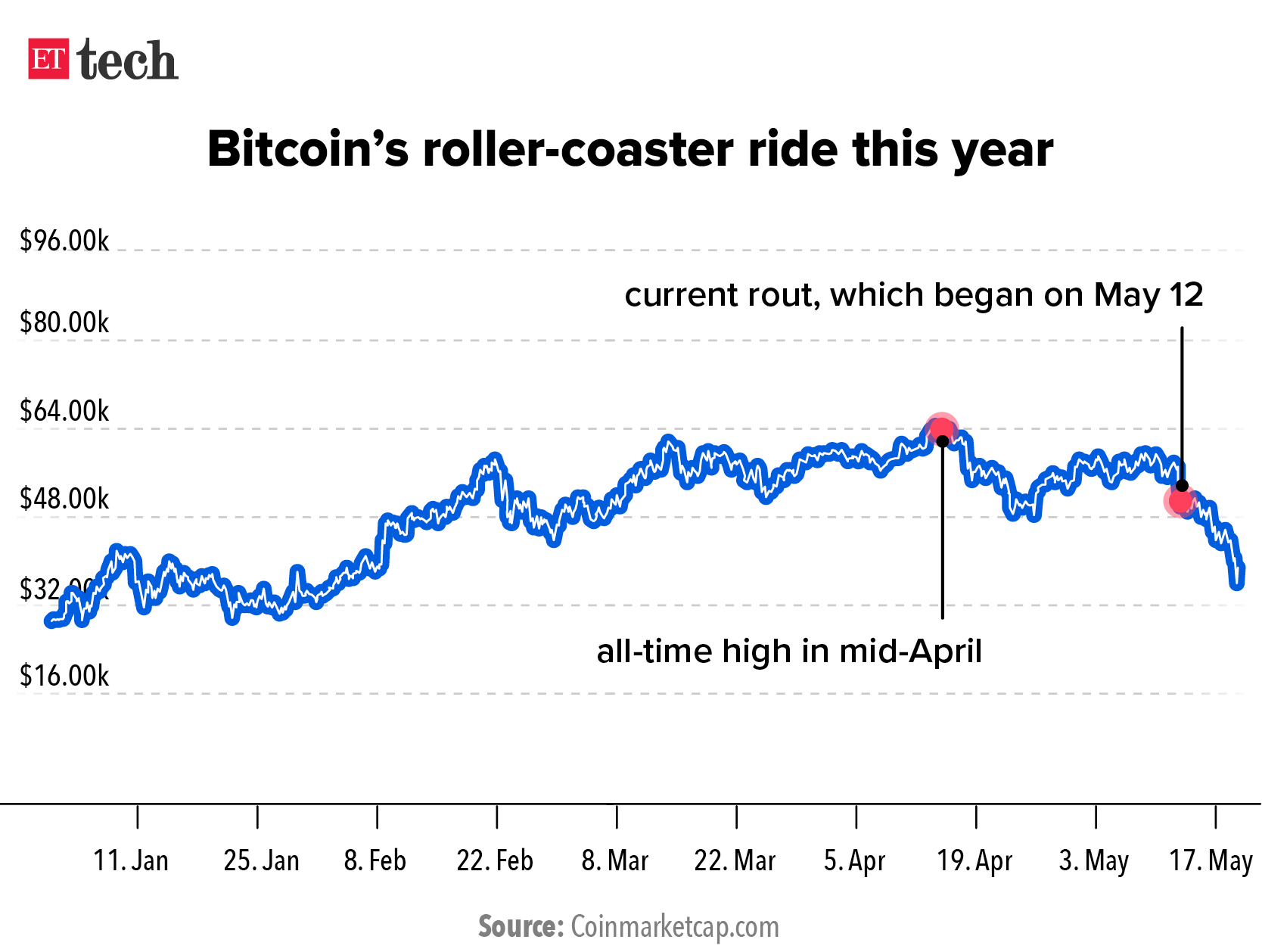

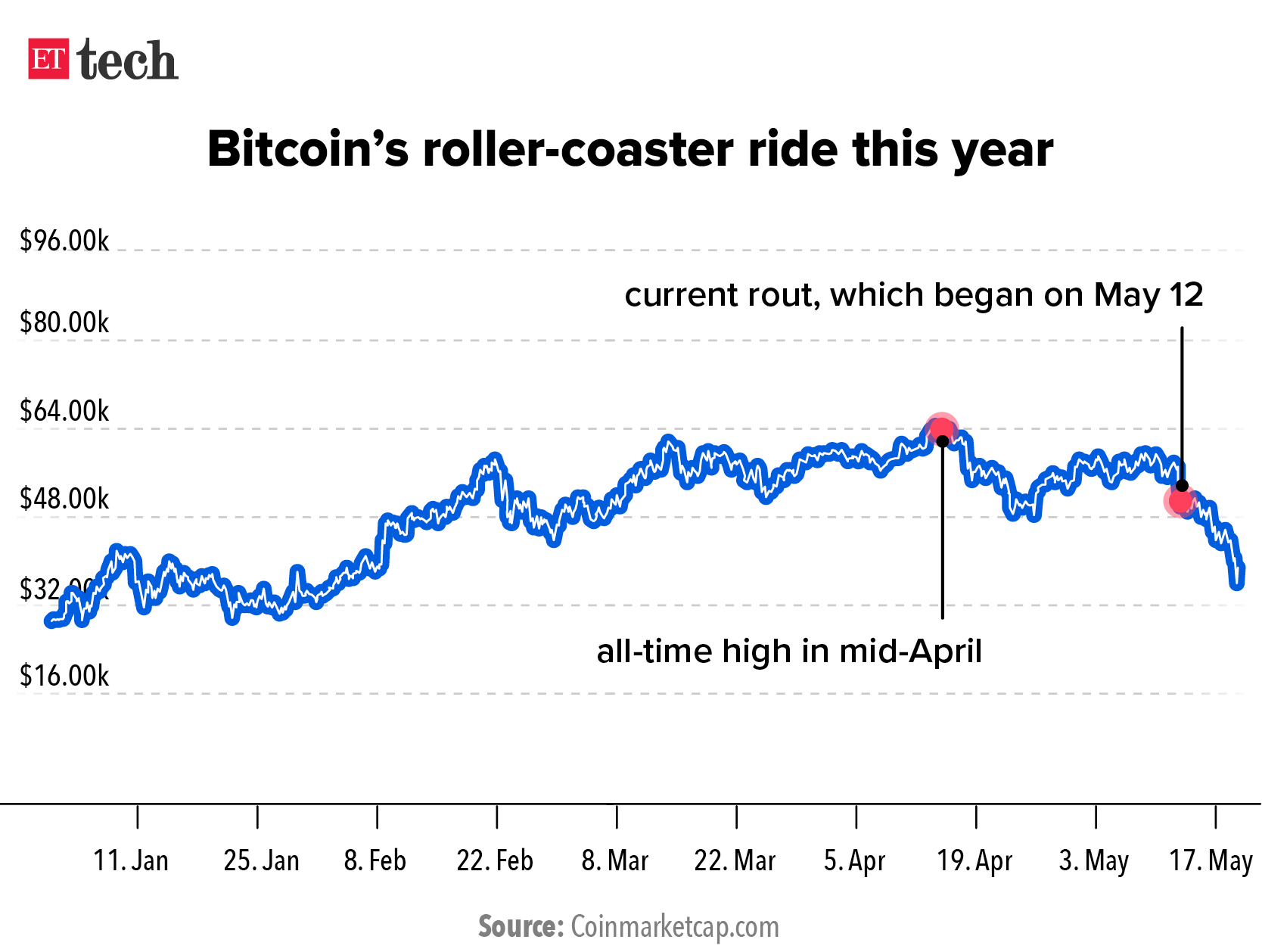

THE AFTERMATH OF THECRYPTO BLOODBATH

It's been a tumultuous week for Crypto investors after Bitcoin posted its biggest single-day fall in nearly a year. According to Coingecko.com, nearly 50% of the entire crypto sector's market capitalisation has been wiped off between May 13 and May 20.

Fear, uncertainty and doubt (FUD) took hold of Indian investors, several of whom are new and have never experienced such major volatility in crypto assets.

According to crypto industry insiders, a correction had long been overdue, and a few international institutions had liquidated their Bitcoin positions in recent weeks as prices reached unrealistic levels.

That said, several crypto exchanges, including WazirX and CoinDCX, went into a "downtime" unable to handle trading volumes. Earlier in the week, we looked into why Indian exchanges have a meltdown every time crypto prices go crazy.

Binance-owned crypto exchange WazirX said it will implement measures to minimise volatile pricing of newly listed cryptocurrency tokens as was seen with the unusual spike in prices of ‘meme-coin’ Shiba Inu (SHIB) on its platform last week. It also announced an Airdrop programme of new WazirX tokens to partially compensate users who suffered losses on account of the SHIB pricing glitch.

Meanwhile, financial advisors and wealth managers are in a bit of a tangle: They have been peppered with questions about Bitcoin and other cryptos over the past few days, but are not sure whether rendering advice about cryptocurrency trading is permitted under existing regulations of the Securities and Exchange Board of India (Sebi). The capital markets regulator's unusual silence on cryptocurrency means that various advisory firms and lawyers have been interpreting the existing rules in different ways.

This also comes amid looming regulatory uncertainty over cryptocurrency in the country as major banks and payment gateways have recently distanced themselves from crypto exchanges. Paytm Payments Bank stopped users to buy and sell crypto assets through its platform from Friday evening, when it will stop dealing with cryptocurrency exchanges, sources told us.

This has led to cryptocurrency exchanges devising alternative methods to keep their businesses running amid an unprecedented surge in sign-ups. Among the measures include creating specialised wallets, onboarding payment processing companies, using banks outside India and even setting up 'offline' payment systems to let investors access crypto assets.

That said, the government may set up a panel of experts to study the possibility of regulating cryptocurrency in India. three sources privy of the discussions told ET. This comes amid the prevailing view that the recommendations by a committee headed by former finance secretary Subhash Garg in 2019 for a blanket ban on these assets had become outdated.

Picture: Polygon co-founder Sandeep Nailwal

Picture: Polygon co-founder Sandeep Nailwal

On a positive note, a crypto coin created by three Indians Polygon (MATIC) crossed $10 billion in market capitalisation last week and is currently among the top 20 crypto tokens across the world.

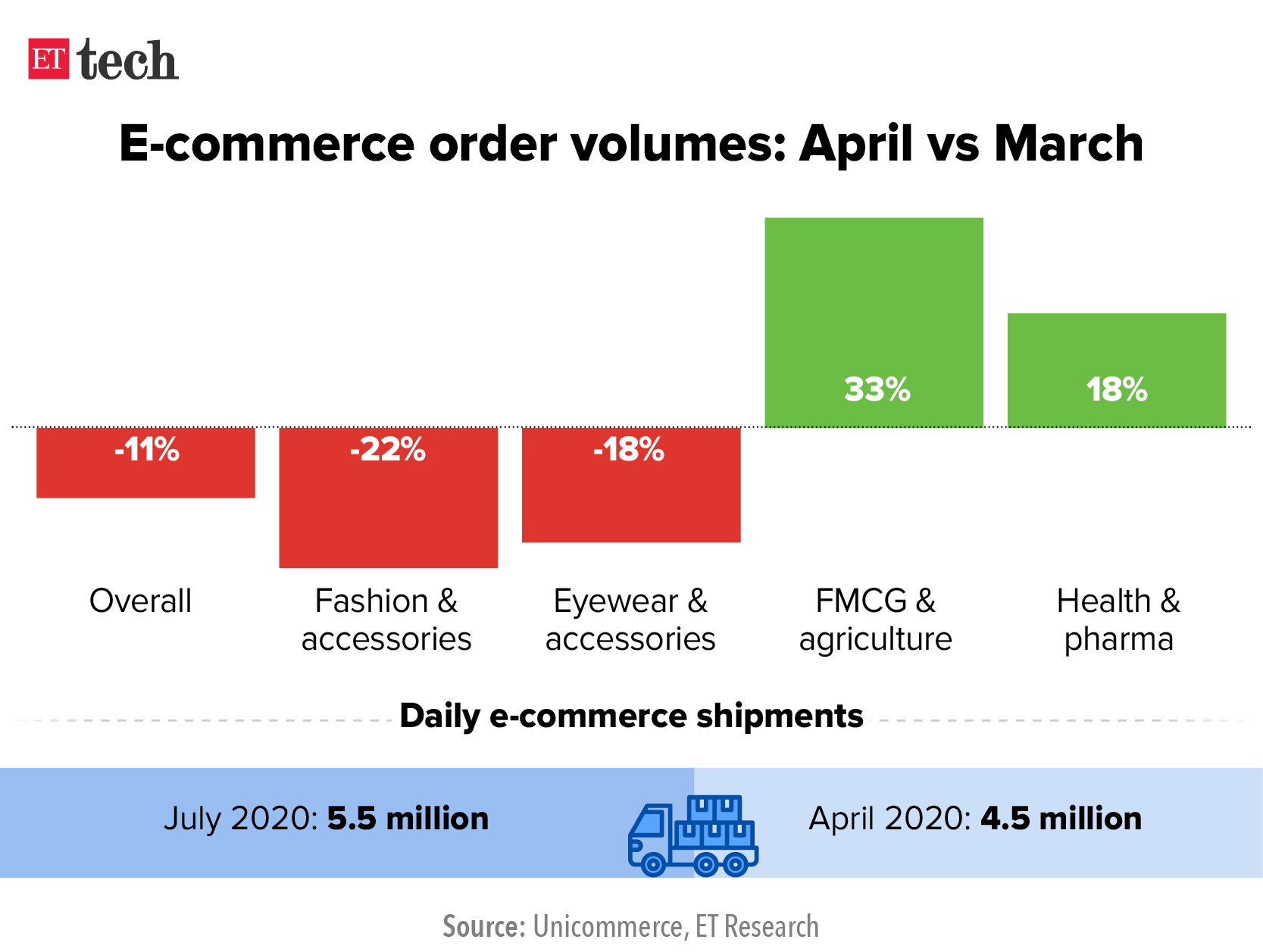

E-COMMERCE AMID THE SECOND COVID WAVE

Online grocery startupBigBasket clocked gross sales of $1.1 billion in the financial year 2021, reflecting the massive growth that online grocery platforms have seen since the start of the pandemic.

The e-tailer, now majority-owned by Tata Group, is only the second vertical e-commerce player in India to do so after online fashion retailer Myntra.

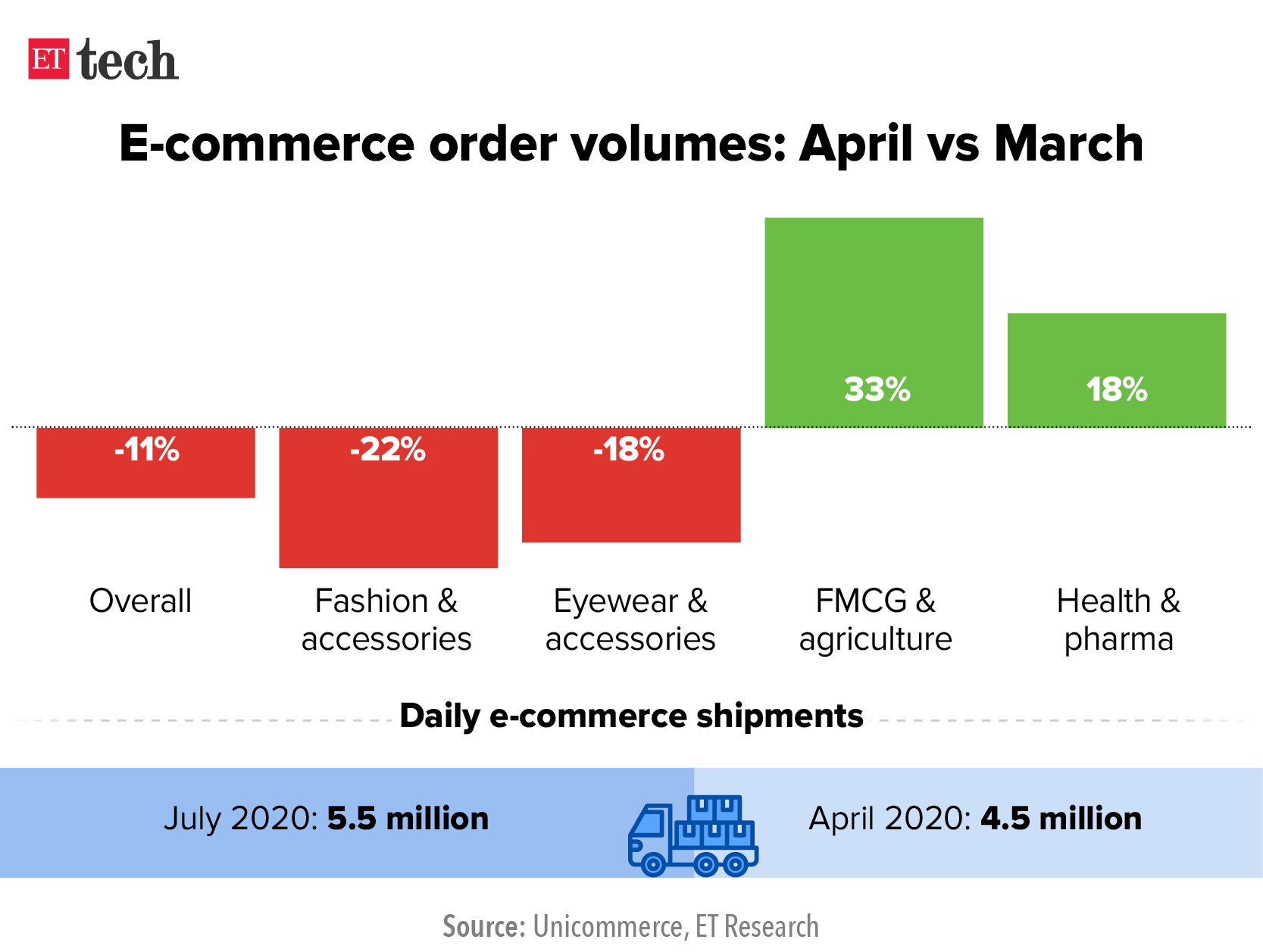

That said, the overall online shopping volumes dipped 11% in April from the month ago, according to data from Unicommerce an e-commerce solutions provider. This indicates that the Indian e-commerce sector hasn't been able to escape the impact of the ongoing second wave of the Covid-19 pandemic, unlike last year.

What happens in the rest of the current quarter will be critical as consumers and ecommerce companies are hoping on states easing norms on deliveries and some form of normalcy to return.

GOVERNMENT VS SOCIAL MEDIA

The Indian government has directed WhatsApp to withdraw its contentious privacy policy, giving the Facebook-owned messaging app seven days to respond to the latest notice that was issued on Tuesday. In a letter to the world's largest messaging app, the Ministry of Electronics and Information Technology (MeitY) termed WhatsApp’s move to introduce changes to its privacy policy, effective from May 15, as harmful to the “interests of Indian citizens,”.

The government has also asked Twitter to remove a contentious 'manipulated media' label that it is using to tag so-called 'toolkit' tweets by some Indian politicians on the social media platform, official sources told ET. MeitY said Twitter has "unilaterally drawn a conclusion" even before the investigation probe is complete.

DEALS IN THE WORKS

OTHER BIG STORIES BY OUR REPORTERS

Falcon Edge co-founders: Navroz Udwadia (left) and Rick Gerson

Falcon Edge co-founders: Navroz Udwadia (left) and Rick Gerson

A deep dive into how Falcon Edge became one of the most active investors in the buzzy technology investing space. It has ploughed $1.3 billion along with co-investors across six deals this year in India so far, as compared to $400 million spread across 14 companies for all of last year.

As Covid-19 healthcare workers grapple with the loss of life on an hourly basis, mental health professionals across the country are dealing with the impact of those deaths, one session at a time. Now, it has started to take a toll on them.

The CoWin platform has come under heavy criticism in the past few weeks, with citizens complaining that it is leading to a vaccine divide in the country as only the literate and tech-savvy are able to book slots on the platform.

Snap Inc unveiled its first augmented reality-based Spectacles, ahead of rivals Facebook and Apple. It has also seen over 100% year-over-year growth in daily active users (DAUs) in India in each of the last five quarters.

Covid-19 volunteers on Facebook, Twitter and WhatsApp say requests and pleas for assistance are still coming in but were now moving from the metros to small cities and towns.

That's about it from us this week. Stay safe and get vaccinated when you get the opportunity.

Hi, it’s Shephali. Four months ago, we exposed the black market where blue ticks for social media profiles are bought and sold. Pardon the clickbait, but you won’t believe what happened next.

ETtech Follow-up: Fantastic blue ticks and where to buy them

On Thursday, Twitter announced that it is resuming its verification process -- which it paused in 2017 -- to award users (who are authentic, notable and active) with a blue tick.

My immediate reaction to the news was, “Oh dear lord!”

Why so dramatic, you ask?

Let me explain: On January 30, we published an article exposing the black market where blue ticks or verified badges are bought and sold at private marketplaces.

We explained the modus operandi of individuals and agencies that offer social media verification services for a fee — from Rs 30,000 to Rs 1 lakh in India, and many times higher for users in countries like the US and the UK.

During our investigation, we found several verified accounts that looked suspicious. When we flagged those to Facebook/Instagram as part of our queries, the tech company was quick to take the blue ticks off some of them. We also noticed that a few accounts made distinct changes to their bios and feeds shortly after we sent them a media query.

There are obvious dangers of users manipulating social media platforms’ guidelines to obtain verified badges, especially in the age of misinformation, we pointed out.

Experts mentioned how the issue will likely balloon once Twitter opens up its verification gates again.

Now, you might think the anticipation of said ballooning is what evoked a dramatic reaction.

But that's not it.

The news just reminded me of everything that followed after the story was published. Everything that proved just how rampant this was; my own “investigation” felt like it had barely scratched the surface.

Little else explains this screenshot I received minutes after sharing the piece online. Here, a user is expressing his frustration at members of a private Facebook group for allegedly bringing the “market rate” for verified badges down from Rs 1-2 lakh to an abysmal Rs 50,000 these days. “There are just so many people offering and getting blue ticks these days... How does one command higher prices anymore,” he rues.

It didn’t stop there. Multiple users reached out via Twitter and Instagram DMs to flag more suspiciously verified accounts. “This guy is the linchpin,” a user pointed out.

“I tried reporting this person for these activities but he found out and threatened me,” said another.

Over the next few days, I received dozens of tips from users which I forwarded to the communications team at Instagram. Around 90% of those accounts don’t have a blue tick anymore. Another 5% stand deactivated as of today.

“We know that bad actors constantly try to game our systems and we routinely disable accounts that break our rules,” a Facebook spokesperson said when I asked what prompted it to remove blue ticks from the accounts we had been flagging for weeks after the story was out.

“Additionally, we constantly work on new ways to keep our community safe and away from scams and fraudulent activity. An example of this is the in-app communication we’ve placed to make sure users know that Instagram will never contact them through DM, and that any account doing so and asking for personal information is a scam. Finally, any user can report an entire account for pretending to be someone else,” the spokesperson added.

Meanwhile, I was left wondering why I spent days doing what should have been Facebook’s job.

And it was far from over.

A month after the story was published, I received a deeply disturbing email.

A reader wrote to me sharing how his daughter was allegedly exploited by a verified user who may have obtained the blue tick fraudulently. The reader pointed out the sudden and massive rise and fall in the verified user’s follower count indicated they may have been bought.

Our story had only hinted at the possibility of the dangers of this practice. Now it had become real. The said user’s account continues to hold a verified badge on Instagram.

There’s more.

A few weeks ago, a user alerted me that an agency mentioned in our article, which boasts of offering “technical support” to users to get verified badges, now had a blue-tick account on Facebook.

When I asked Facebook about this, a spokesperson said, “The verification was an error and the page has now been unverified.”

“An error”? Are you kidding me?

In the middle of a full-blown misinformation crisis, a social media behemoth is erroneously giving away authenticity badges. What could possibly go wrong?

Over to my colleague Vikas SN to take you through the week’s most important stories.

THE AFTERMATH OF THE

It's been a tumultuous week for Crypto investors after Bitcoin posted its biggest single-day fall in nearly a year. According to Coingecko.com, nearly 50% of the entire crypto sector's market capitalisation has been wiped off between May 13 and May 20.

Fear, uncertainty and doubt (FUD) took hold of Indian investors, several of whom are new and have never experienced such major volatility in crypto assets.

According to crypto industry insiders, a correction had long been overdue, and a few international institutions had liquidated their Bitcoin positions in recent weeks as prices reached unrealistic levels.

That said, several crypto exchanges, including WazirX and CoinDCX, went into a "downtime" unable to handle trading volumes. Earlier in the week, we looked into why Indian exchanges have a meltdown every time crypto prices go crazy.

Binance-owned crypto exchange WazirX said it will implement measures to minimise volatile pricing of newly listed cryptocurrency tokens as was seen with the unusual spike in prices of ‘meme-coin’ Shiba Inu (SHIB) on its platform last week. It also announced an Airdrop programme of new WazirX tokens to partially compensate users who suffered losses on account of the SHIB pricing glitch.

Meanwhile, financial advisors and wealth managers are in a bit of a tangle: They have been peppered with questions about Bitcoin and other cryptos over the past few days, but are not sure whether rendering advice about cryptocurrency trading is permitted under existing regulations of the Securities and Exchange Board of India (Sebi). The capital markets regulator's unusual silence on cryptocurrency means that various advisory firms and lawyers have been interpreting the existing rules in different ways.

This also comes amid looming regulatory uncertainty over cryptocurrency in the country as major banks and payment gateways have recently distanced themselves from crypto exchanges. Paytm Payments Bank stopped users to buy and sell crypto assets through its platform from Friday evening, when it will stop dealing with cryptocurrency exchanges, sources told us.

This has led to cryptocurrency exchanges devising alternative methods to keep their businesses running amid an unprecedented surge in sign-ups. Among the measures include creating specialised wallets, onboarding payment processing companies, using banks outside India and even setting up 'offline' payment systems to let investors access crypto assets.

That said, the government may set up a panel of experts to study the possibility of regulating cryptocurrency in India. three sources privy of the discussions told ET. This comes amid the prevailing view that the recommendations by a committee headed by former finance secretary Subhash Garg in 2019 for a blanket ban on these assets had become outdated.

On a positive note, a crypto coin created by three Indians Polygon (MATIC) crossed $10 billion in market capitalisation last week and is currently among the top 20 crypto tokens across the world.

Online grocery startup

The e-tailer, now majority-owned by Tata Group, is only the second vertical e-commerce player in India to do so after online fashion retailer Myntra.

That said, the overall online shopping volumes dipped 11% in April from the month ago, according to data from Unicommerce an e-commerce solutions provider. This indicates that the Indian e-commerce sector hasn't been able to escape the impact of the ongoing second wave of the Covid-19 pandemic, unlike last year.

What happens in the rest of the current quarter will be critical as consumers and ecommerce companies are hoping on states easing norms on deliveries and some form of normalcy to return.

GOVERNMENT VS SOCIAL MEDIA

The Indian government has directed WhatsApp to withdraw its contentious privacy policy, giving the Facebook-owned messaging app seven days to respond to the latest notice that was issued on Tuesday. In a letter to the world's largest messaging app, the Ministry of Electronics and Information Technology (MeitY) termed WhatsApp’s move to introduce changes to its privacy policy, effective from May 15, as harmful to the “interests of Indian citizens,”.

The government has also asked Twitter to remove a contentious 'manipulated media' label that it is using to tag so-called 'toolkit' tweets by some Indian politicians on the social media platform, official sources told ET. MeitY said Twitter has "unilaterally drawn a conclusion" even before the investigation probe is complete.

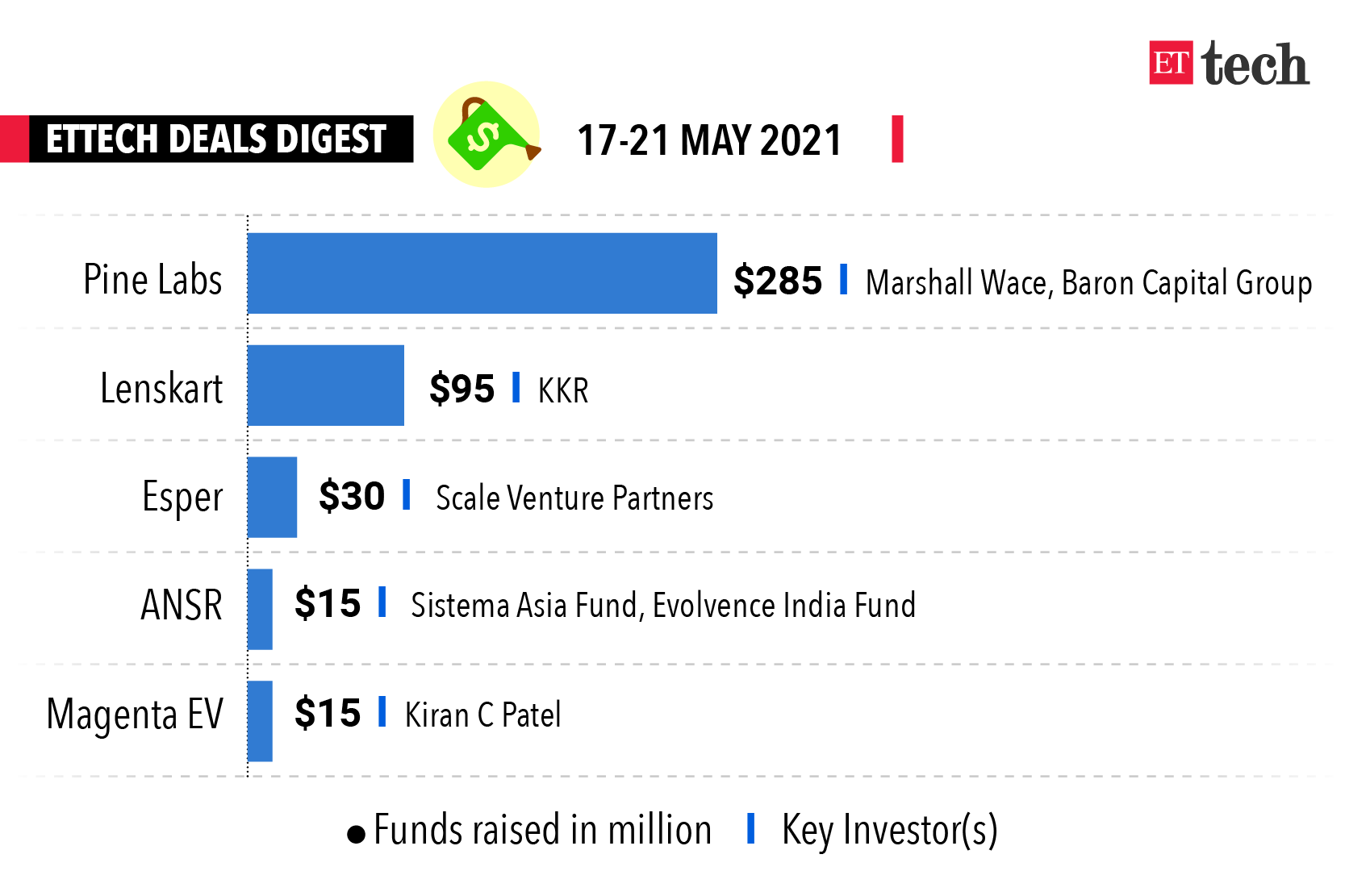

DEALS IN THE WORKS

- India’s sovereign wealth fund National Investment and Infrastructure Fund has held talks to invest in SoftBank-backed vertical e-commerce player FirstCry, three sources aware of the discussions told ET. The financing is expected to value the startup at a little over $2 billion, same as in March when TPG, ChrysCapital and Premji Invest invested around $315 million in the firm.

- Car buying portal CarTrade has filed draft documents with markets regulator Sebi for an initial public offering, seeking to raise around Rs 2,000 crore. With this, CarTrade joins a long list of tech-focused companies that are eyeing public market listings such as Zomato, Nykaa, PolicyBazaar, and Flipkart.

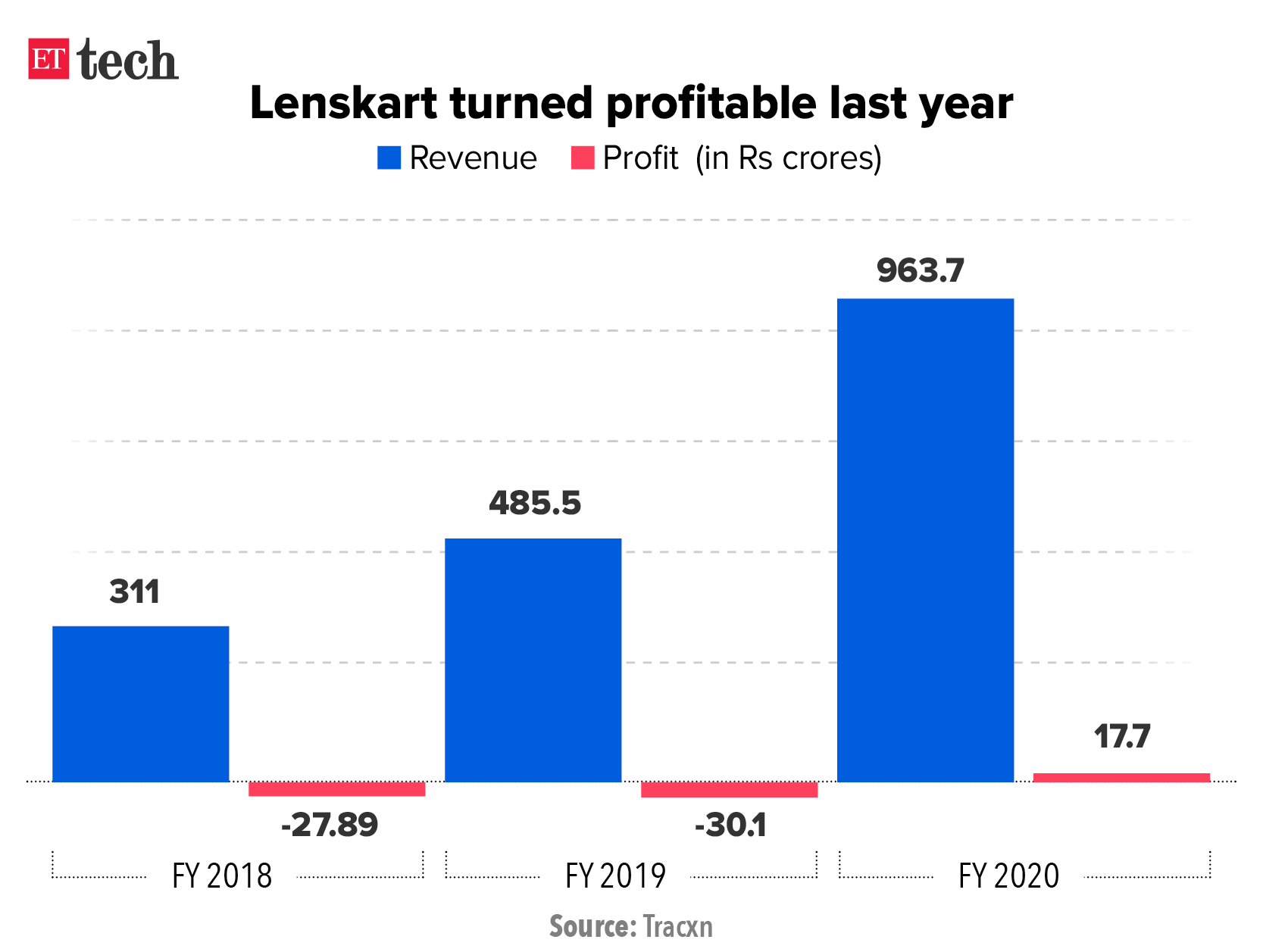

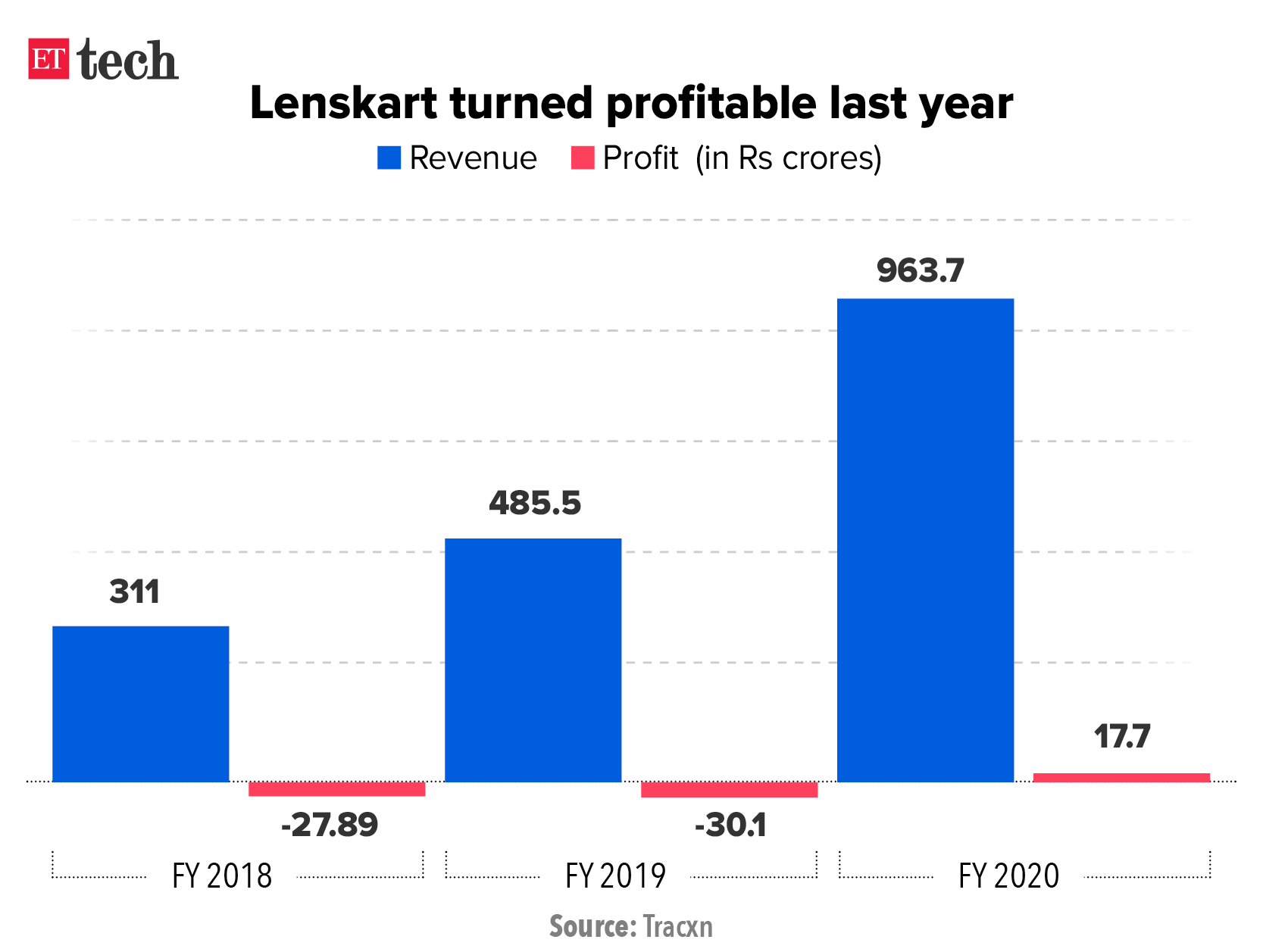

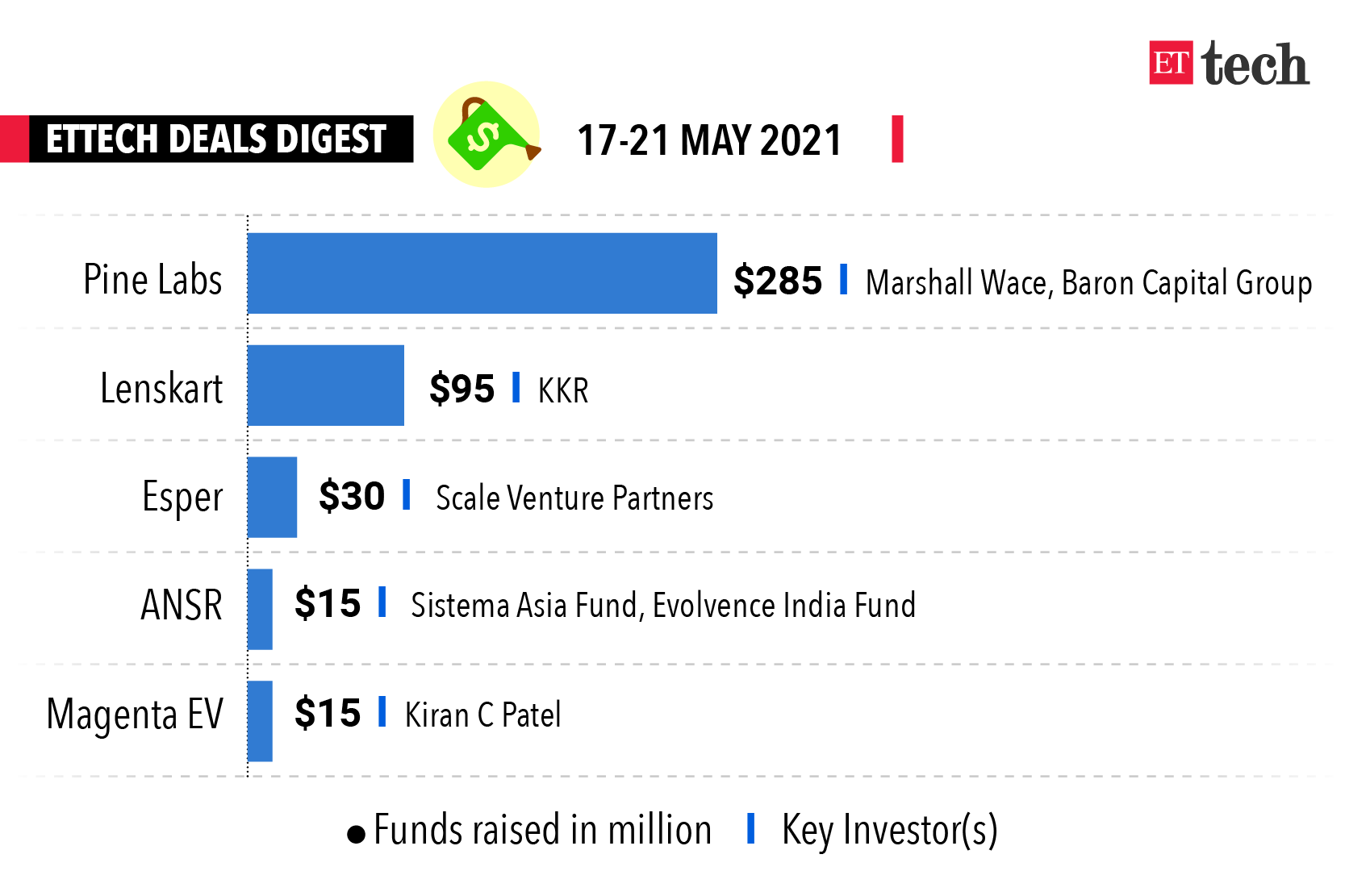

- Private equity group KKR is leading a $250-300 million fund-raising round in omni-channel eyewear retailer Lenskart. The round is expected to include a $200-220 million secondary capital at a valuation of about $2.3 billion, and $75-100 million in primary capital at a $2.5 billion valuation. During the week, KKR pumped in $95 million to Lenskart through a secondary stake acquisition.

- Digital payments major PhonePe is in talks to acquire homegrown content and app discovery platform Indus OS in a deal valued around $60 million, sources aware of the matter told ET. The deal could strengthen PhonePe's super-app ambitions by boosting its Switch platform, which hosts a range of WeChat-like mini-apps for food delivery, grocery, shopping, health and fitness, entertainment and more.

- Tiger Global is in talks to lead a $20 million funding round in veteran fashion retail executive Rishi Vasudev's new Thrasio-style venture Goat Brands Labs. Venture capital firm Mayfield Fund and Flipkart's venture fund are also expected to back the round. The startup aims to acquire lifestyle brands and help them build and grow online.

- SoftBank-backed Oyo is in the process of raising around Rs 4,400 crore from a bunch of international investors through a Term Loan B (TLB) issuance in a move that can be seen as a precursor to a public listing.

OTHER BIG STORIES BY OUR REPORTERS

A deep dive into how Falcon Edge became one of the most active investors in the buzzy technology investing space. It has ploughed $1.3 billion along with co-investors across six deals this year in India so far, as compared to $400 million spread across 14 companies for all of last year.

As Covid-19 healthcare workers grapple with the loss of life on an hourly basis, mental health professionals across the country are dealing with the impact of those deaths, one session at a time. Now, it has started to take a toll on them.

The CoWin platform has come under heavy criticism in the past few weeks, with citizens complaining that it is leading to a vaccine divide in the country as only the literate and tech-savvy are able to book slots on the platform.

Snap Inc unveiled its first augmented reality-based Spectacles, ahead of rivals Facebook and Apple. It has also seen over 100% year-over-year growth in daily active users (DAUs) in India in each of the last five quarters.

Covid-19 volunteers on Facebook, Twitter and WhatsApp say requests and pleas for assistance are still coming in but were now moving from the metros to small cities and towns.

That's about it from us this week. Stay safe and get vaccinated when you get the opportunity.

Want this newsletter delievered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Unwrapped

We'll soon meet in your inbox.