Cisco Analysts Look Past Guidance and Raise Price Targets

Cisco Systems (CSCO) - Get Report analysts on Thursday looked past the network-equipment company's disappointing fourth-quarter guidance and raised their price targets on the stock.

Shares of the San Jose, Calif., company at last check were down 3.4% at $50.60.

Bitcoin, Ford F-150 Lightning, Applied Materials - 5 Things You Must Know

After the bell on Wednesday Cisco topped fiscal-third-quarter estimates but offered weaker-than-expected guidance for the current quarter.

Cisco forecast non-GAAP earnings of 81 to 83 cents a share for its fiscal fourth quarter with revenue up 6% to 8%. Analysts surveyed by FactSet had been expecting the company to make 86 cents a share in the current period.

Despite the forecast, Oppenheimer analyst Ittai Kidron raised his price target on Cisco to $55 from $50 while affirming an outperform rating on the shares.

The analyst said in a research note that Cisco's demand backdrop was improving as customers resumed projects they had postponed and pulled forward planned projects into this calendar year.

Order trends improved significantly across every region and customer segment, reflecting subsiding COVID-19 headwinds, he added.

"That said, supply-chain constraints continue to impact margins, and headwinds are expected to persist through year end," Kidron said.

Jefferies analyst George Notter has a buy rating on the shares. He raised his price target to $56 a share from $52.

"Despite current supply-chain challenges," Notter said, "Cisco’s April quarter results and July guidance offered a view into the continued post-COVID recovery process at the company. We continue to view the risk/reward favorably."

JMP analyst Erik Suppiger maintained his market-perform rating. He noted that total orders were up 10% from a year earlier, "a significant acceleration from last quarter’s 1% year over year, marking the best growth rate showcased in our model since 2011. "

The analyst said the results suggested "a broad-based recovery from the pandemic across all geographies and customer segments." The most notable improvement stemmed from Asia-Pacific, Japan and China, he said.

"We note APJC was the most impacted geography from the pandemic initially, so the growth does benefit from a tailwind related to an easier year-over-year comparison," he said.

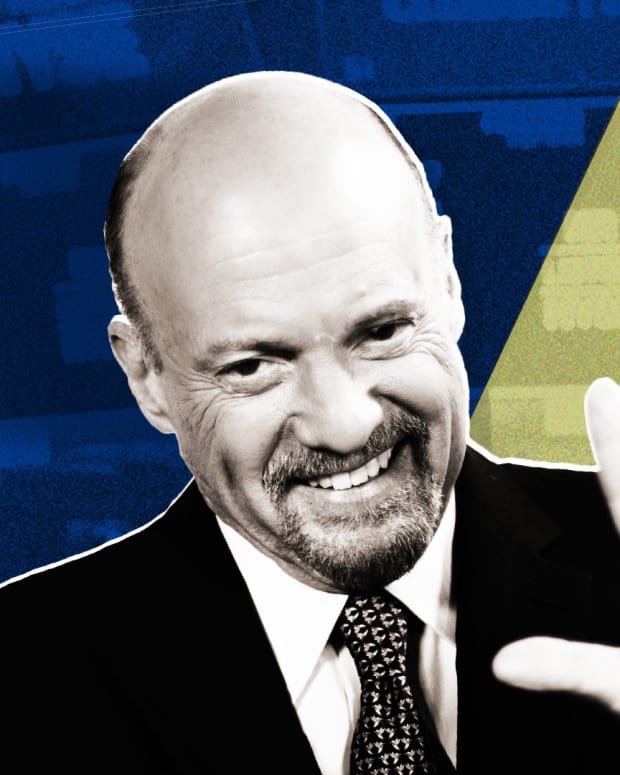

TheStreet.com Founder Jim Cramer on Wednesday interviewed Chuck Robbins, Cisco's chairman and CEO, on the Executive Decision segment of "Mad Money."

Robbins said that both revenue growth and earnings per share were up in the quarter, with order growth of 10%. This was the highest level of growth the company has seen in a decade.

Asked about demand, Robbins explained that companies are investing now as they prepare both for a return to the office and a hybrid work environment for many workers.

Customers are also responding to Cisco's many new products, including those that run off their custom-designed silicon.

Last month, Cisco stock was the subject of a number of analyst upgrades, including from Wolfe Research, which upgraded the company to outperform from peer perform.