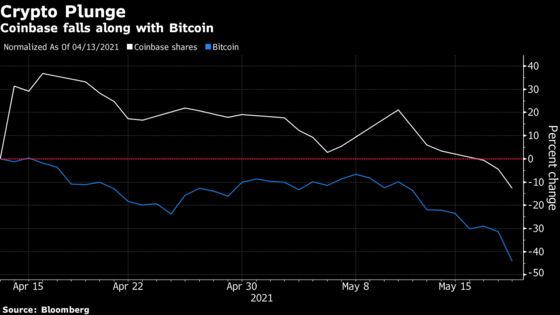

Coinbase Plunges With Other Crypto Stocks Amid Bitcoin Rout

(Bloomberg) -- Coinbase Global Inc. posted its biggest decline on record Wednesday, joining a rout in global crypto stocks after Bitcoin and Ether prices collapsed.

The largest U.S. cryptocurrency exchange fell as much as 13% to a record low of $208 amid a broader rout in cryptocurrencies. Coinbase also said it was investigating “intermittent downtime” on its platform, while Binance, the world’s biggest cryptocurrency exchange, temporarily disabled Ethereum withdrawals citing network congestion.

Bitcoin plunged as much as 31% and approached $30,000 before rebounding to about $36,000 at 9:55 a.m. in New York. The cryptocurrency has now erased all the gains it made following Tesla Inc.’s Feb. 8 announcement that it would add the asset to its balance sheet. A statement from the People’s Bank of China Tuesday reiterating that digital tokens can’t be used as a form of payment added to the selloff. Ethereum lost more than 40%, while Dogecoin declined 45%.

The broader U.S. stock market also slumped with the S&P 500 Index and Nasdaq 100 Index each falling 1.3% as concern over a pickup in inflation weighed on global stocks.

MicroStrategy Inc. lost as much as 16% and has now erased two-thirds of its value from its February high. On Tuesday, the enterprise-software company known for its bullish bets on cryptocurrencies disclosed that it bought another 229 Bitcoin, bringing its total to over 92,000.

Amid other crypto-connected stocks, Galaxy Digital Holdings Ltd. lost 14%, Marathon Digital Holdings Inc. fell 13%, Riot Blockchain Inc. slid 13% and Bit Digital Inc. was down 11%.

©2021 Bloomberg L.P.