The benchmark indices, after sharp weakness in the previous session, shifted into consolidation mode and closed on a flat note on May 14, but the broader markets witnessed sharp selling pressure with the Nifty Midcap 100 and Smallcap 100 indices falling 1.64 percent and 1.48 percent, respectively.

The BSE Sensex rose 41.75 points to 48,732.55, while the Nifty50 fell 18.70 points to 14,677.80 and formed a bearish candle which resembles a Hammer-kind of pattern on the daily charts. The index during the week declined a percent and formed a bearish candle on the weekly scale.

"A small negative candle was formed on the daily chart with lower shadow on Friday. This pattern was formed beside the long bear candle of Wednesday. This consolidation movement indicates a lack of selling enthusiasm in the market after a short weakness of a few sessions. This pattern could eventually result in bulls making comeback from the lower levels," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"The short term trend of Nifty is choppy with weak bias. The present market action signals chances of an upside bounce in the coming sessions," he said.

"The confirmation of higher bottom at 14,591 (Friday's low) is expected to pull the market on the upside. The next upper levels could be watched around 14,900-15,000 in the next one week. Immediate support is placed at 14,590," he added.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,596.57, followed by 14,515.33. If the index moves up, the key resistance levels to watch out for are 14,754.37 and 14,830.9.

Nifty Bank

The Nifty Bank underperformed the benchmark indices, falling 282.75 points to close at 32,169.55 on May 14. The important pivot level, which will act as crucial support for the index, is placed at 31,982.5, followed by 31,795.4. On the upside, key resistance levels are placed at 32,489.7 and 32,809.8 levels.

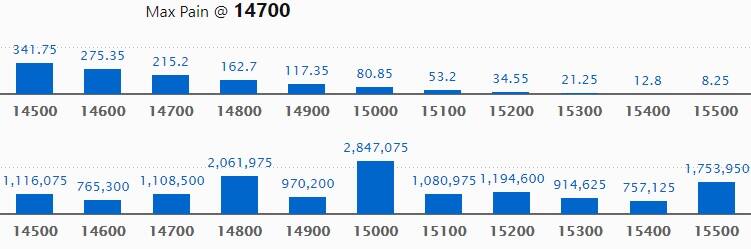

Call option data

Maximum Call open interest of 28.47 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the May series.

This is followed by 14,800 strike, which holds 20.61 lakh contracts, and 15,500 strike, which has accumulated 17.53 lakh contracts.

Call writing was seen at 15,100 strike, which added 3.79 lakh contracts, followed by 15,300 strike which added 1.58 lakh contracts and 14,700 strike which added 1.04 lakh contracts.

Call unwinding was seen at 15,400 strike, which shed 1.15 lakh contracts, followed by 14,800 strike which shed 98,325 contracts.

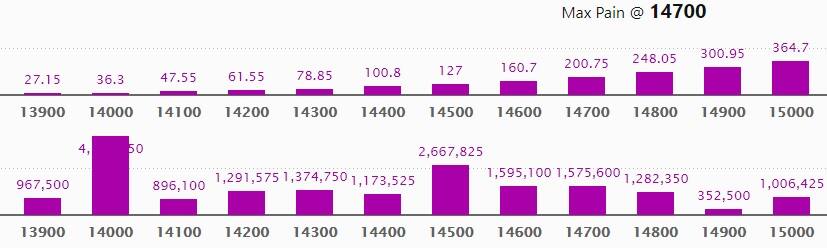

Put option data

Maximum Put open interest of 41.85 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the May series.

This is followed by 14,500 strike, which holds 26.67 lakh contracts, and 14,600 strike, which has accumulated 15.95 lakh contracts.

Put writing was seen at 14,500 strike, which added 1.93 lakh contracts, followed by 14,700 strike which added 84,375 contracts and 14,100 strike which added 51,600 contracts.

Put unwinding was seen at 14,800 strike which shed 2.01 lakh contracts, followed by 14,900 strike, which shed 1.4 lakh contracts, and 14,000 strike which shed 76,350 contracts.

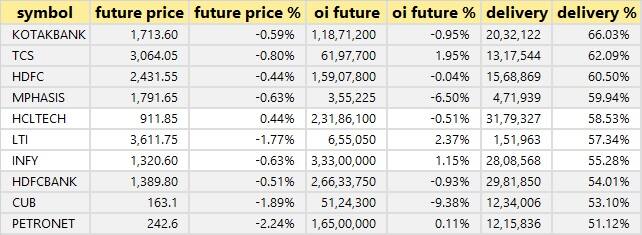

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

12 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

67 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

57 stocks saw short build-up

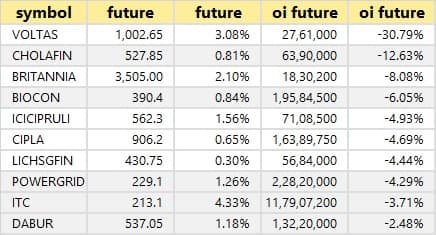

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

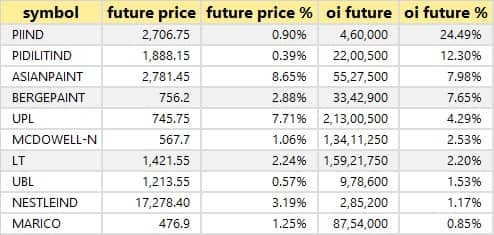

23 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

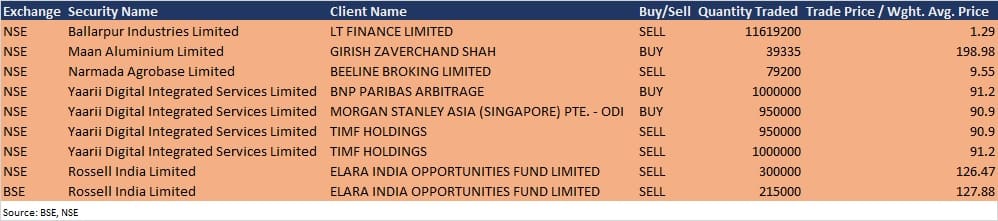

Bulk deals

(For more bulk deals, click here)

Results on May 17

Bharti Airtel, Federal Bank, Colgate Palmolive, Gland Pharma, Sun Pharma Advanced Research Company, Orient Cement, 3i Infotech, Asit C Mehta Financial Services, ATV Projects India, Butterfly Gandhimathi Appliances, Gujarat Narmada Valley Fertilizers, Gokul Agro Resources, Garden Reach Shipbuilders & Engineers, Indo Count Industries, Mangalore Refinery & Petrochemicals, Nalin Lease Finance, Nutricircle, Prakash Pipes, Rane Brake Lining, SBEC Systems, Shakti Pumps (India), Subex, Suraj, and Wabco India will release quarterly scorecard on May 17.

Stocks in News

Larsen & Toubro: The company reported higher consolidated profit at Rs 3,293 crore in Q4FY21 against Rs 3,197 crore in Q4FY20; revenue jumped to Rs 48,087.9 crore from Rs 44,245.3 crore YoY.

Cipla: The company reported sharply higher consolidated profit at Rs 411.5 crore in Q4FY21 against Rs 239 crore in Q4FY20; revenue rose to Rs 4,606.4 crore from Rs 4,376 crore YoY.

Route Mobile: Subsidiary Route Mobile (UK) appointed John Owen as its Chief Executive Officer of Europe and Americas, based in the UK (London) office, with immediate effect.

Jayant Agro-Organics: The company reported higher consolidated profit at Rs 24.3 crore in Q4FY21 against Rs 7.11 crore in Q4FY20. Revenue rose to Rs 484.2 crore from Rs 430.7 crore YoY.

Quick Heal Technologies: The company reported consolidated profit at Rs 39.73 crore in Q4FY21 against Rs 7.99 crore in Q4FY20. Revenue jumped to Rs 105.3 crore from Rs 64.25 crore YoY.

Geojit Financial Services: The company reported higher consolidated profit at Rs 37.16 crore in Q4FY21 against Rs 19.7 crore. Revenue jumped to Rs 121.38 crore from Rs 82.3 crore YoY.

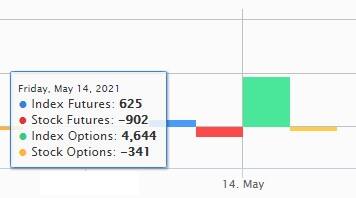

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 2,607.85 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 613.26 crore in the Indian equity market on May 14, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Six stocks - BHEL, Cadila Healthcare, Canara Bank, Punjab National Bank, SAIL and Sun TV Network - are under the F&O ban for May 17. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.