The market snapped two-week rally and fell one percent amid fear of higher US inflation and interest rate hike in the US due to increasing commodity prices, in the holiday shortened week ended May 14. But early signs of peaking in COVID-19 cases limited downside.

The BSE Sensex corrected 473.92 points to close at 48,732.55, and the Nifty50 declined 145.35 points to 14,677.80 after rising around 3 percent in previous two consecutive weeks, dragged by banking & financials, IT and metals stocks.

The broader markets slightly outpaced frontliners as the BSE Midcap index declined 0.49 percent and BSE Smallcap index was down 0.08 percent.

Experts expect the stock-specific action to continue given the quarterly earnings season, and feel the market will closely watch COVID-related updates, progress of the vaccine drive, global cues and movement in commodities.

"In the coming week, the market is expected to have a stock-specific rally based on the forthcoming results. The effectiveness of vaccination in curbing COVID spread will be a key in determining the long-term trend in the market," said Vinod Nair, Head of Research at Geojit Financial Services said.

Ajit Mishra, VP Research at Religare Broking believes global indices would remain volatile in the near term and movement in key commodities would be actively tracked. He advised maintaining extra caution in selection of stocks and managing overnight risk management.

Here are 10 key factors that will keep traders busy next week:

We will enter into sixth week of March quarter earnings season and more than 170 companies will release their quarterly scorecard. Given the March quarter and year-end results, this earning season is generally last till May-end.

Bharti Airtel, Tata Motors, Hindalco Industries, State Bank of India, Shree Cement, Indian Oil Corporation, HPCL, Bosch, Colgate Palmolive, Federal Bank, Aarti Industries, Canara Bank, GSK Pharma, Jindal Stainless (Hisar), Minda Corporation, Route Mobile, Ujjivan Small Finance Bank, Indiabulls Housing Finance, JK Tyre, Havells India, JK Lakshmi Cement, Torrent Power, Zee Entertainment Enterprises, Container Corporation of India, JSW Steel, South Indian Bank, United Spirits, Amara Raja Batteries, and Amber Enterprises India are among key companies that will declare quarterly earnings next week.

State Bank of India

The stock to watch out for in the coming week would be State Bank of India. The country's largest lender on May 21 is expected to report strong earnings growth for the March 2021 quarter on the back of decline in provisions, and strong net interest income & pre-provision operating profit. The low base partly on account of high provisions in the year-ago period could also support earnings growth.

Brokerages largely expect more than double profit growth in Q4FY21, with double digit increase in net interest income and pre-provision operating profit YoY, while non-interest income (other income) could see a decline YoY as the base quarter was aided by sale of shares in SBI Card.

"We expect a healthy operating profit growth of 15 percent YoY led by 11 percent YoY revenue growth. Solid NII growth will be partly aided by a lower base. Loan growth to be subdued at around 5 percent YoY and NIM (core) unchanged QoQ at around 3.1 percent," said Kotak Institutional Equities which sees 113 percent YoY growth in profit, 27 percent in net interest income, and 17 percent in pre-provision operating profit for the quarter.

Kotak expects slippages at 2 percent of loans (adjusted for previous slippages while reported would be higher) led by the retail and SME portfolio, and also expects a solid positive commentary on the bank's loan book from an asset quality perspective.

The fall in COVID-19 cases in the last few days to near 3.26 lakh, from the crucial 4 lakh mark, seems to be playing supportive role for the market and as a result the market seems to have got a support at 14,500 levels on the Nifty50. Given the market is forward looking, experts feel the market could gradually be getting a sense that cases may be peaking out soon and with the expected big vaccination drive could control the virus spread as well as death rate in coming months.

"For the last many days, the number of states reporting the daily cases were higher than the previous day. But, lately, it seems to be consistently going down. E.g., Mumbai's daily COVID positive numbers have dwindled quite significantly in the last 10 days or so. The data also suggests the second wave of COVID is going to start receding much sooner-than-expected," said Sachin Shah of Emkay Investment Managers, adding the other very relevant point is that the economic activity in this second wave as not been affected as much when compared to the national lockdown of the last year 2020 and it is also reflected in the unemployment data.

The total COVID-19 cases in the country increased by 3.26 lakh on Friday, much lower compared to over 4.01 lakh cases reported on previous Friday and 3.43 lakh cases in previous day (May 13). The active cases also declined by 31,091, taking total active cases now to 36.74 lakh.

The recovery rate also improved further to 83.83 percent, from 83.50 percent in previous day, and 81.90 percent on previous Friday.

Total recoveries, so far, stood at 2.04 crore, while the total confirmed cases increased to 2.44 crore with 2.67 lakh deaths, while the mortality rate remained at 1.09 percent for more than a week now.

On the other side, a total of 18.05 crore doses of COVID vaccines have been administered so far in the country, which experts feel could increase considerably in coming months.

Commodity-led Inflationary Pressure

The commodity prices, especially metals, increased significantly in last few days when the world economies are still struggling with pandemic crisis. The Nifty Metal index itself shot up around 250 percent since March 2020 lows, outshining all leading sectors.

The US President Joe Biden's big infrastructure push could be one of factors pushing metals (especially steel) prices higher. Experts feel with resilient demand and expected supply-side constraints could keep pushing prices higher but now are worried about inflationary pressure that could raise chances of interest rate hikes earlier than later, though the Federal Reserve chair Jerome Powell promised to keep the interest rates at zero levels and continuing bond purchases plan till the recovery in economy.

The gradual opening of economies with the falling COVID cases, and China's commitment to reduce production activities to move towards their goal of carbon neutrality by 2060 also lifted the momentum in metals prices. Hence the market will keep a close watch on metal price movement.

"With these production cuts in steel, copper etc., supply-side constraints will exaggerate further pushing prices higher. Therefore, the rise in commodity prices will continue to play an influential role in inflationary tendencies going ahead but the real question is how long will the rally continue," said Nirali Shah, Head of Equity Research at Samco Securities.

"Given the multiple tailwinds of resilient demand and production cuts along with P/B ratio of a couple of steel stocks which had been historically trading over 2.3x at the top of their cycle, are currently still trading around 1.8x. Keeping these things in mind, our best case scenario is the momentum can still continue for some more time with short term corrections," she added.

FII Flow

The total outflow by foreign investors increased further in the month of May, to Rs 8,700 crore given the number of COVID cases in the country, which could be a bit of concern for the market. But experts feel if the cases continue declining in coming weeks then the flow could reverse and that could take the market towards record levels again. The outflow in April was more than Rs 12,000 crore.

On the contrary, the domestic institutional investors have also not provided much support to the market as their total inflow in the market was Rs 891 crore, so far in May, against the buying of Rs 11,360 crore in previous month. And as a result, overall there has been a volatile and rangebound trade in the market for last several weeks.

Technical View

The Nifty50 recovered in last couple of hours of trade to end with moderate loss and formed bearish candle which resembles Hammer kind of pattern on the daily charts. The index fell a percent during the week and there was a bearish candle formation on the weekly scale as the closing was lower than opening levels.

Experts feel the Nifty could get crucial support around 14,300-14,400 levels, while 15,000 is expected to continue to act as the crucial resistance levels.

"Nifty on the weekly chart, formed a negative candle at the highs, which signal an inability of bulls to sustain the highs. After the upside breakout of down sloping trendline resistance in the previous week, Nifty has slipped into weakness on the weekly chart and is now placed at the previous upside breakout area of around 14,650-14,700 levels. The, market is also above another support of weekly 10 period EMA around 14,650 levels. Both of these action indicate a possibility of an upside bounce in the market from the lows in coming sessions," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He feels the short term trend of Nifty is choppy with weak bias. "The present market action signal chances of an upside bounce in the coming sessions. The confirmation of higher bottom at 14,591 (Friday's Low) is expected to pull the market on upside. The next upper levels to be watched around 14,900-15,000 in the next one week. Immediate support is placed at 14,590," he said.

F&O Cues

Maximum Call open interest was seen at 15,000 strike, followed by 15,300 and 14,900 strikes, while maximum Put open interest was seen at 14,000 strike, followed by 14,500 and 14,600 strikes.

Call writing was seen at 15,000 strike, followed by 14,900 and 15,300 strikes, while Put writing was seen at 14,600 strike, followed by 14,400 and 14,700 strikes, with Put unwinding at 15,000 strike. This option data indicated a wider trading range for the Nifty could be 14,400 to 15,000 levels for coming sessions.

"Going ahead, sustainability of 14,700 seems crucial for fresh positive bias from a trading perspective. Even from the options perspective, continued writing was experienced at ATM Call and Put strikes suggesting rangebound bias to continue with significant activities seen at OTM Call strikes," said ICICI Direct.

"Sustainability above 14,700 may trigger closure among Call writers, which may pull the Nifty towards higher band of the consolidation. On downsides, we expect levels near 14,500 to provide support to the index,' the brokerage added.

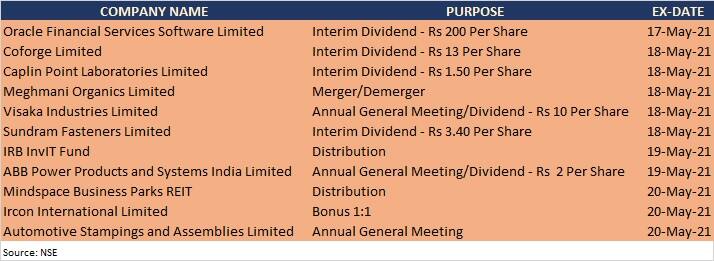

Corporate Action

Here are key corporate actions taking place in the coming week:

Economic Data Points

WPI inflation data for April will be announced on Monday, while deposit & bank loan growth for the fortnight ended May 7, and foreign exchange reserves for week ended May 14 will be released on Friday.

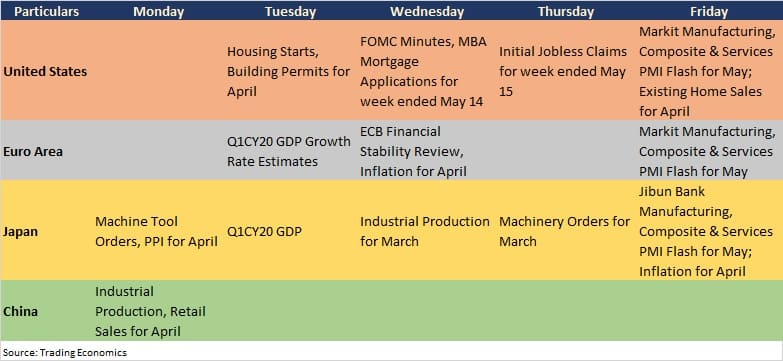

Global Cues

Here are key global data points to watch out for next week: