FEATURED FUNDS

ICICI Prudential Credit Risk Fund Direct Plan-Gr..

5Y Return

9.18 %

Invest Now

FEATURED FUNDS

ICICI Prudential Balanced Advantage Direct-Growt..

5Y Return

12.36 %

Invest Now

FEATURED FUNDS

ICICI Prudential Asset Allocator Fund (FOF) Dire..

5Y Return

13.73 %

Invest Now

FEATURED FUNDS

ICICI Prudential Smallcap Fund Direct Plan-Growt..

5Y Return

15.88 %

Invest Now

FEATURED FUNDS

ICICI Prudential Multicap Fund Direct Plan-Growt..

5Y Return

13.99 %

Invest Now

Crypto boomers

Want this newsletter delievered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.

/ Morning Dispatch / Morning Dispatch |

Good morning,

Indians over 45 are signing up to invest incryptocurrencies in large numbers. We looked into why, and found many did so after being educated about the new asset class by their children and grandchildren.

Also in this letter:

While the crypto industry may be treading water with India’s regulators, new investors of all ages continue to join the community in huge numbers.

Cryptocurrencies, a staple of many millennial and Gen Z investors, are increasingly attracting attention from people over 45, per data shared by various Indian crypto exchanges.

Example: WazirX, India's largest crypto exchange, saw a 337% increase in sign-ups by users over 45 between February and April compared to the previous three months.

But why? Apart from the obvious reasons such as increased awareness about cryptocurrencies and increased institutional acceptance, young investors -- armed with knowledge from YouTube, Discord and Twitter -- are educating their parents and even their grandparents about the new asset class.

FOMO in action: At least half a dozen people under 20 that we spoke to had convinced their parents and others to invest, and become their portfolio managers.

Seniors too: CoinSwitch Kuber brought on board the highest number of users over 65 in April. Ashish Singhal, CEO and founder, said Bitcoin, Ethereum, and Ripple’s XRP are popular cryptocurrencies among the over-65s.

Game changers: Teens such as Dheeraj Mehra are driving this change. Mehra recently launched a community through which he and his friends got eight people to invest in crypto, including his 80-year-old uncle. They now manage the portfolios of their eight clients based on three investment ‘commandments’.

Click here to know what they are.

Belgian investment fund Sofina is at an advanced stage of negotiations to lead a new funding round in personal care brand Mamaearth, two sources told us.

Bump: The fresh infusion of capital will likely value the direct-to-consumer brand at about $700 million, up from around $200 million last year. D2C brands have gained amid the Covid-19 pandemic as shopping increasingly shifts online.

Sofina is believed to have already picked up a stake in Mamaearth through a secondary share sale.

SoftBank Group has transferred its 40% shareholding in mobile ad services platform InMobi -- its first investment in India -- to Softbank Vision Fund (SVF) 2, people aware of the development told us.

Great expectations: The Japanese conglomerate is expecting a bumper windfall once the Bengaluru-based startup makes its public market debut. InMobi, the country’s first technology firm to hit a billion-dollar valuation, has kickstarted its US listing process by appointing three investment banks -- including JP Morgan and Goldman Sachs – as advisors to help raise $500 million to $1 billion, the people said.

In January, we reported that InMobi will start experimenting with various advertising and monetisation models this year as it expands the platform globally. Its lockscreen content platform Glance had raised $145 million in funding from Google and Mithril Capital last year.

Fintech company Paytm is set to get a stake of around 7% in PayPay, a QR code-based payments business in Japan that is a joint venture between SoftBank and Yahoo Japan, according to filings made by SoftBank.

What’s the deal? While the JV was formed two years ago with Paytm as a technology partner, the Noida-based company was given a call option to convert its holding into shares.

In related news, SoftBank has posted the highest-ever quarterly and annual profits by a Japanese firm, driven by investment gains at Vision Fund.

Winning bets: The $100 billion first Vision Fund racked up a $24.5 billion investment gain from the public market debut of South Korean e-commerce firm Coupang Inc. and a $6.3 billion gain from US food delivery platform DoorDash.

Recent India bets: SoftBank Vision Fund 2 led a $300 million investment in social commerce startup Meesho, catapulting the company's valuation to $2.1 billion. The fund is finalising a $450-million investment in food delivery app Swiggy, its first bet on India's food delivery sector, after more than three years of flirting with both Swiggy and IPO-bound Zomato. Read our explainer on it here. SoftBank Vision Fund is also in talks to lead a $100-million funding round in SaaS startup Whatfix, which could value the company at $500 million, up from $150 million when it raised funds a year ago.

Software firm VMware has named India-born Raghu Raghuram as its next CEO. His stint will begin in June.

One in, one out: The development may have triggered the exit of his India-born colleague Sanjay Poonen, who said he was quitting after seven years at the Dell-owned company. Raghuram and Poonen were chief operating officers at VMware and both had been in the race for the top job, which fell vacant after former CEO Pat Gelsinger joined chip maker Intel as chief executive in January.

Raghuram joins an elite club of India-born executives, including Google's Sundar Pichai, IBM’s Arvind Krishna, Microsoft's Satya Nadella and Adobe's Shantanu Narayen, who head global technology companies.

Infosys plans to expand its employee stock options scheme to include a larger pool of employees as it looks to retain talent.

Why now? Indian IT firms are likely to face sharper attrition rates this year thanks to growing demand for talent, as they seek to fulfil large outsourcing orders and multinationals shift more work to captive units.

“We already have ESOP programmes today, which go to a lower level within the company, not at the entry level, but a couple of levels above that. And that’s something which is a huge success for the company,” Salil Parekh, chief executive officer, Infosys, had earlier told ET in an interview.

IT services companies such as Infosys, Wipro, Tata Consultancy Services, HCL Tech and others have launched schemes to retain employees as demand for tech talent continues to grow.

US delays implementing new H-1B wage levels: The United States will delay the implementation of a rule that calls for higher wages for H-1B workers to November 2022. The final rule will be published in the Federal Register on May 13.

Persistent Systems deepens ties with IBM: Persistent Systems said that it would join IBM’s ecosystem of partners using the US tech giant’s new Automation Foundation and IBM Cloud Paks for Automation to manage and modernize mission-critical workloads across hybrid cloud environments.

LTTS bets on 5G, connected vehicles: L&T Technology Services (LTTS) has identified five core areas that include 5G, digital manufacturing and medical technologies to grow its business over the next few years, Amit Chadha, who took over as its chief executive, told ET.

■ Coinbase is banning salary negotiations (Protocol)

■ Amazon wins $303 million tax case in European Union (Reuters)

■ China tech crackdown turns to food delivery giant Meituan as $38.96 billion is wiped off value (CNBC)

Today’sETtech Morning Dispatch was curated by Zaheer Merchant and Karan Dhar in Mumbai

Indians over 45 are signing up to invest in

Also in this letter:

Mamaearth may bag $60-80 million- Son rejigs

InMobi bet ahead of $1 billion IPO - Paytm to get 7% stake in Japan's PayPay

Boomers, seniors hop on crypto wagon

While the crypto industry may be treading water with India’s regulators, new investors of all ages continue to join the community in huge numbers.

Cryptocurrencies, a staple of many millennial and Gen Z investors, are increasingly attracting attention from people over 45, per data shared by various Indian crypto exchanges.

Example: WazirX, India's largest crypto exchange, saw a 337% increase in sign-ups by users over 45 between February and April compared to the previous three months.

But why? Apart from the obvious reasons such as increased awareness about cryptocurrencies and increased institutional acceptance, young investors -- armed with knowledge from YouTube, Discord and Twitter -- are educating their parents and even their grandparents about the new asset class.

FOMO in action: At least half a dozen people under 20 that we spoke to had convinced their parents and others to invest, and become their portfolio managers.

- Daksh Miglani, a 19-year-old from Delhi who used information from various websites to teach his parents about crypto, said their concerns finally tapered after finance minister Nirmala Sitharaman proposed a “calibrated approach” to crypto in March.

Seniors too: CoinSwitch Kuber brought on board the highest number of users over 65 in April. Ashish Singhal, CEO and founder, said Bitcoin, Ethereum, and Ripple’s XRP are popular cryptocurrencies among the over-65s.

Game changers: Teens such as Dheeraj Mehra are driving this change. Mehra recently launched a community through which he and his friends got eight people to invest in crypto, including his 80-year-old uncle. They now manage the portfolios of their eight clients based on three investment ‘commandments’.

Click here to know what they are.

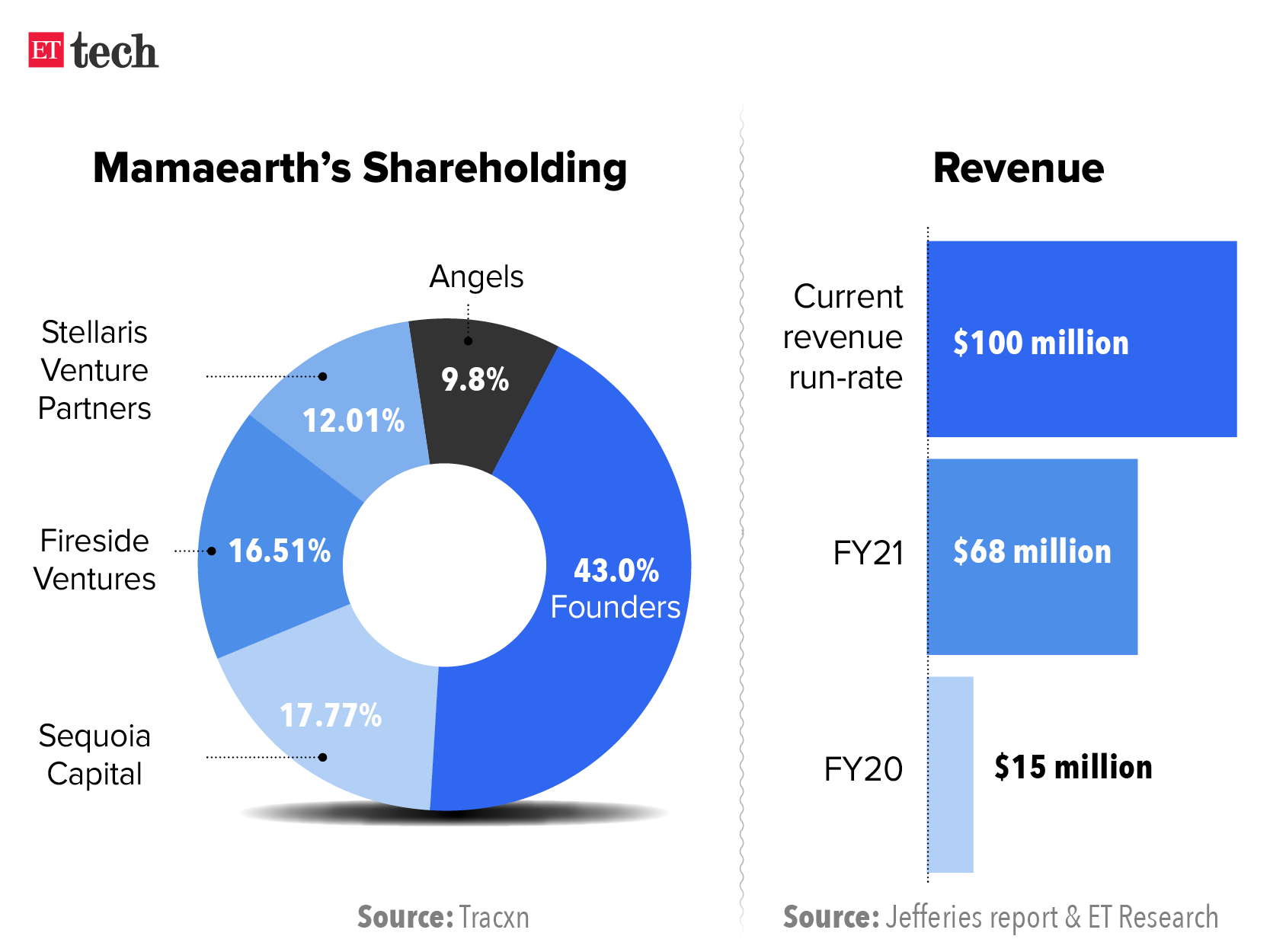

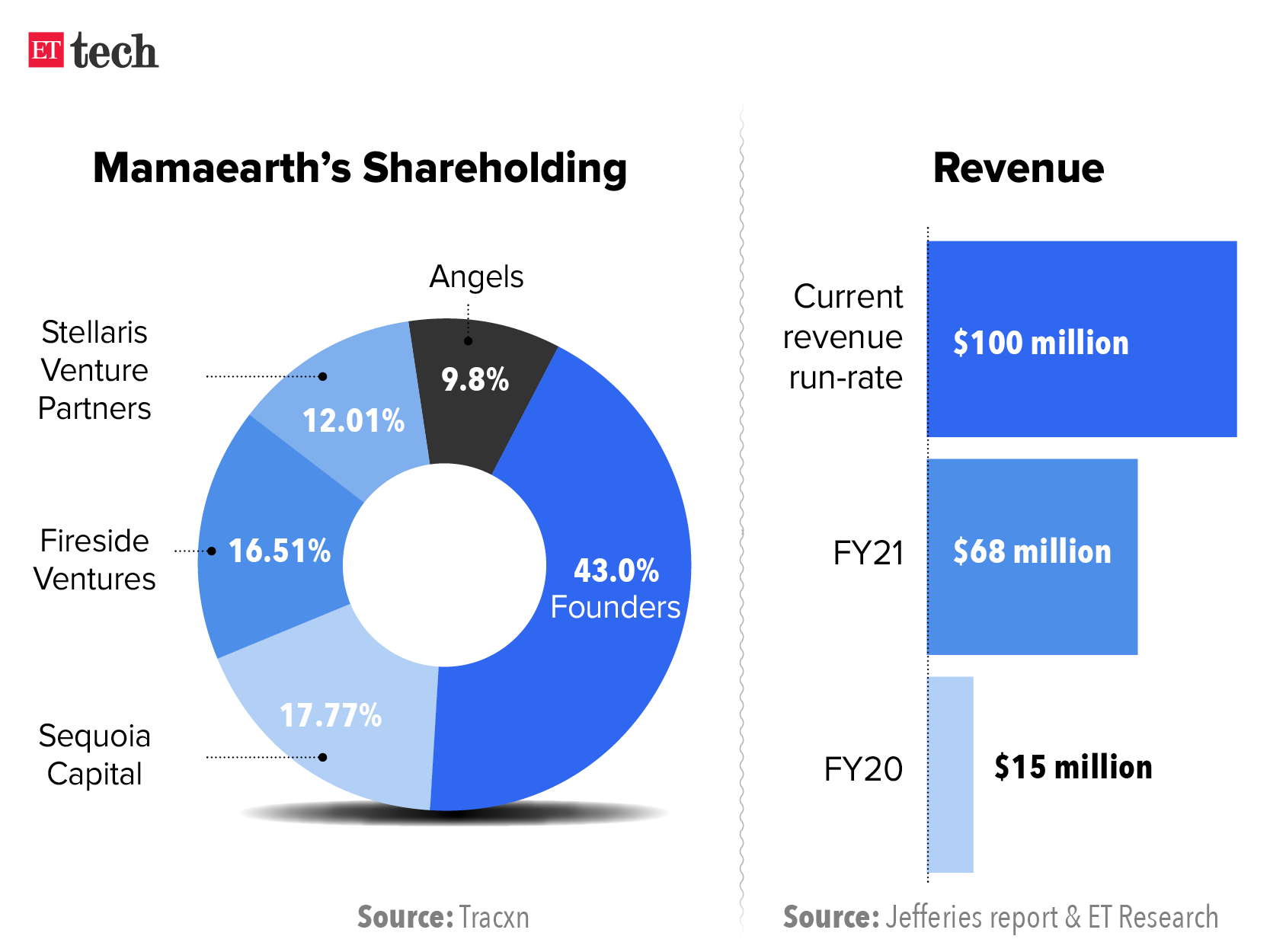

Mamaearth may raise $60-80 million

Belgian investment fund Sofina is at an advanced stage of negotiations to lead a new funding round in personal care brand Mamaearth, two sources told us.

- The financing is expected to be in the range of $60-$80 million, with a primary component of around $50 million.

Bump: The fresh infusion of capital will likely value the direct-to-consumer brand at about $700 million, up from around $200 million last year. D2C brands have gained amid the Covid-19 pandemic as shopping increasingly shifts online.

Sofina is believed to have already picked up a stake in Mamaearth through a secondary share sale.

Tweet of the day

SoftBank rejigs InMobi stake ahead of IPO

SoftBank Group has transferred its 40% shareholding in mobile ad services platform InMobi -- its first investment in India -- to Softbank Vision Fund (SVF) 2, people aware of the development told us.

Great expectations: The Japanese conglomerate is expecting a bumper windfall once the Bengaluru-based startup makes its public market debut. InMobi, the country’s first technology firm to hit a billion-dollar valuation, has kickstarted its US listing process by appointing three investment banks -- including JP Morgan and Goldman Sachs – as advisors to help raise $500 million to $1 billion, the people said.

In January, we reported that InMobi will start experimenting with various advertising and monetisation models this year as it expands the platform globally. Its lockscreen content platform Glance had raised $145 million in funding from Google and Mithril Capital last year.

Paytm set to get 7% stake in Japan's PayPay

Fintech company Paytm is set to get a stake of around 7% in PayPay, a QR code-based payments business in Japan that is a joint venture between SoftBank and Yahoo Japan, according to filings made by SoftBank.

What’s the deal? While the JV was formed two years ago with Paytm as a technology partner, the Noida-based company was given a call option to convert its holding into shares.

- SoftBank Group, including its subsidiary Yahoo Japan, will own more than 90% of the payments firm. SoftBank owns around 20% of One97 Communications, which runs Paytm.

In related news, SoftBank has posted the highest-ever quarterly and annual profits by a Japanese firm, driven by investment gains at Vision Fund.

Winning bets: The $100 billion first Vision Fund racked up a $24.5 billion investment gain from the public market debut of South Korean e-commerce firm Coupang Inc. and a $6.3 billion gain from US food delivery platform DoorDash.

Recent India bets: SoftBank Vision Fund 2 led a $300 million investment in social commerce startup Meesho, catapulting the company's valuation to $2.1 billion. The fund is finalising a $450-million investment in food delivery app Swiggy, its first bet on India's food delivery sector, after more than three years of flirting with both Swiggy and IPO-bound Zomato. Read our explainer on it here. SoftBank Vision Fund is also in talks to lead a $100-million funding round in SaaS startup Whatfix, which could value the company at $500 million, up from $150 million when it raised funds a year ago.

Infographic Insight

VMware names India-born Raghu Raghuram as CEO

Software firm VMware has named India-born Raghu Raghuram as its next CEO. His stint will begin in June.

One in, one out: The development may have triggered the exit of his India-born colleague Sanjay Poonen, who said he was quitting after seven years at the Dell-owned company. Raghuram and Poonen were chief operating officers at VMware and both had been in the race for the top job, which fell vacant after former CEO Pat Gelsinger joined chip maker Intel as chief executive in January.

Raghuram joins an elite club of India-born executives, including Google's Sundar Pichai, IBM’s Arvind Krishna, Microsoft's Satya Nadella and Adobe's Shantanu Narayen, who head global technology companies.

Infosys to expand ESOP pool to retain talent

Infosys plans to expand its employee stock options scheme to include a larger pool of employees as it looks to retain talent.

Why now? Indian IT firms are likely to face sharper attrition rates this year thanks to growing demand for talent, as they seek to fulfil large outsourcing orders and multinationals shift more work to captive units.

“We already have ESOP programmes today, which go to a lower level within the company, not at the entry level, but a couple of levels above that. And that’s something which is a huge success for the company,” Salil Parekh, chief executive officer, Infosys, had earlier told ET in an interview.

IT services companies such as Infosys, Wipro, Tata Consultancy Services, HCL Tech and others have launched schemes to retain employees as demand for tech talent continues to grow.

Top Stories We Are Covering

US delays implementing new H-1B wage levels: The United States will delay the implementation of a rule that calls for higher wages for H-1B workers to November 2022. The final rule will be published in the Federal Register on May 13.

Persistent Systems deepens ties with IBM: Persistent Systems said that it would join IBM’s ecosystem of partners using the US tech giant’s new Automation Foundation and IBM Cloud Paks for Automation to manage and modernize mission-critical workloads across hybrid cloud environments.

LTTS bets on 5G, connected vehicles: L&T Technology Services (LTTS) has identified five core areas that include 5G, digital manufacturing and medical technologies to grow its business over the next few years, Amit Chadha, who took over as its chief executive, told ET.

Global Picks We Are Reading

■ Coinbase is banning salary negotiations (Protocol)

■ Amazon wins $303 million tax case in European Union (Reuters)

■ China tech crackdown turns to food delivery giant Meituan as $38.96 billion is wiped off value (CNBC)

Today’s

Want this newsletter delievered to your inbox?

I agree to receive newsletters and marketing communications via e-mail

Thank you for subscribing to Morning Dispatch

We'll soon meet in your inbox.