The largest paint maker in the country, Asian Paints on Wednesday reported an 81% year-on-year (YoY) growth in profit for the January-March quarter (Q4FY21) as demand recovery continued across urban and rural areas.

Consolidated net profit was reported at Rs 8.7 bn for the quarter, up from Rs 4.8 bn during the same period last year.

Revenue improved to Rs 66.5 bn, a 43% growth YoY even though sales were impacted for the last two weeks in March 2020 due to the Covid-19 pandemic.

EBITDA grew by 53% to Rs 13.2 bn while EBITDA margin improved by 127 basis points to 19.8%.

On a sequential basis, the company's net profit fell 31% as the preceding third quarter coincided with the festival season, which is usually a period of strong demand for paint-makers.

Here's a table comparing Asian Paints' quarterly performance on key parameters.

| (Rs m) | Q4FY21 | Q4FY20 | Q3FY21 | YoY (%) | QoQ (%) |

|---|---|---|---|---|---|

| Revenue | 66,514 | 46,356 | 67,885 | 43.50% | -2.00% |

| Total expenses | 55,764 | 39,961 | 52,149 | 39.50% | 6.90% |

| Profit before tax | 11,563 | 6,992 | 16,968 | 65.40% | -31.90% |

| Tax | 2,864 | 2,190 | 4,314 | 30.80% | -33.60% |

| Profit after tax | 8,699 | 4,802 | 12,654 | 81.20% | -31.30% |

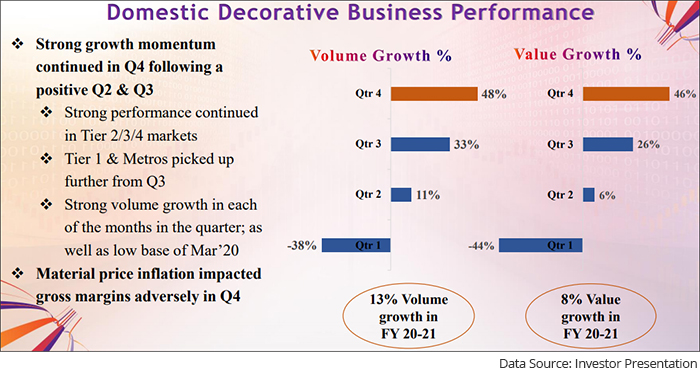

The company's domestic decorative business delivered a stellar performance registering a 48% volume growth in the quarter, led by a robust growth in the premium and luxury product range.

That was also aided by a lower base as several states had started announcing restrictions in March last year before a complete lockdown.

--- Advertisement ---

FREE Event on Equitymaster's New Project

On May 17, we are holding a FREE event to reveal Equitymaster's Great Indian Wealth Project.

At this event, we'll reveal the details of your first stock for a potential Rs 7 crore in long-term wealth.

Seats for this event are filling up fast.

Since there are limited seats, we urge you to register at the earliest.

Click here for free sign-up

------------------------------

The home improvement business also, registering record sales for the quarter aided by the foray into the home decor business.

Similarly, the industrial coatings business delivered a robust performance, particularly in protective coatings, and refinish segments supported by the uptick in the industrial activity.

The international business recorded double-digit volume growth, led by good growth in Asia and the Middle East.

Commenting on the Q4 performance, Amit Syngle, managing director and chief executive officer of Asian Paints said:

Asian Paints strong Q4 was aided by good demand across rural and urban areas at the country level.

Learn: How to Potentially Accumulate Rs 7 Crore in Wealth Over the Long-term

For the complete financial year, Asian Paints reported a consolidated profit of Rs 32.1 bn, up 15% over the preceding year.

Revenue grew marginally by 7% to Rs 217.1 bn, despite the impact of the pandemic.

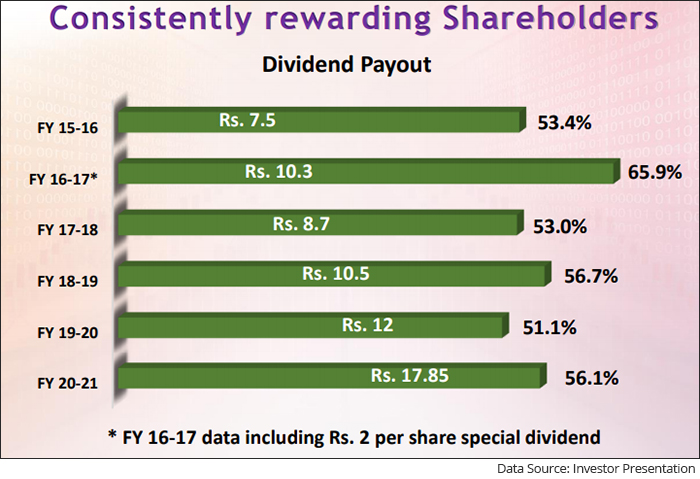

The company announced a final dividend of Rs 14.5 per share bringing the total dividend for FY21 to Rs 17.85.

Asian Paints has a consistent track record of rewarding shareholders via dividends as can be seen from the image below.

The company said that uncertainty is again on the rise with the second wave seemingly far more wide-spread in India as well as some in international markets, especially in South Asia.

The company said it might face elevated inflationary pressures on the raw material front, which is still posing a challenge.

There was a significant increases in input prices since December 2020 and the uptrend continues.

--- Advertisement ---

How to Earn a Fortune in Gold, the Smart Way

Gold is on 'the verge of a decadal run' says Vijay Bhambwani, India's #1 Trader and Editor of Fast Profits Daily at Equitymaster.

He says gold has the potential to generate staggering gains in the coming years...And those who are betting on gold right now will hit the jackpot.

But wait.

While gold is an attractive investment destination, there's a very specific way to play this opportunity...

A way that ensures you rake in maximum profit and perhaps hit the jackpot...while minimizing potential pitfalls. Thankfully, Vijay - India's #1 Trader - can guide you step-by-step in the upcoming gold rush and help hit the jackpot just at the right time.

Sure, you don't want to be an average trader. That's not how you make a fortune.

Here's how you can get Vijay's guidance...

------------------------------

Asian Paints share price ended the day on a flat note yesterday after declaring its Q4 results.

Shares of the company pared gains of as much as 1.3% to close flat at Rs 2,556 apiece compared with a 1% decline in benchmarks Sensex and Nifty.

Shares of the company have touched a 52-week high of Rs 2,873 and a 52-week low of Rs 1,483.

The stock commands a market cap of Rs 2,451,811 m.

Over the past one year, stock of the company has outperformed the benchmark BSE Sensex. Asian Paints is up 68% in the past one year in comparison with 55% gains in Sensex.

At its current price, it is trading at a P/E ratio of 88 and a P/BV ratio of 24.2.

Set up in 1942, the Asian Paints group is the largest paint manufacturer in India also engaged in the business of manufacturing of varnishes, enamels, or lacquers, surfacing preparation, organic composite solvents, and thinners.

It operates in 15 countries and has 26 paint manufacturing facilities in the world serving consumers in over 60 countries.

Besides Asian Paints, the group operates around the world through its various brands viz. Asian Paints Berger, Apco Coatings, SCIB Paints, Taubmans, Causeway Paints, and Kadisco Asian Paints.

It also manufactures metal sanitary ware such as bath, sinks, washbasins and similar articles. Recently introduced lightings, furnishings, and furniture thus adding more products in the home decor and interior design category.

For more details about the company, you can have a look at Asian Paints fact sheet and Asian Paints quarterly results on our website.

For a sector overview, you can read our paints sector report.

You can also compare Asian Paints with its peers on our website.

Asian Paints vs Kansai Nerolac

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

For the quarter ended December 2020, ASIAN PAINTS has posted a net profit of Rs 12 bn (up 63.1% YoY). Sales on the other hand came in at Rs 68 bn (up 25.2% YoY). Read on for a complete analysis of ASIAN PAINTS's quarterly results.

For the quarter ended September 2020, ASIAN PAINTS has posted a net profit of Rs 8 bn (up 1.3% YoY). Sales on the other hand came in at Rs 54 bn (up 5.9% YoY). Read on for a complete analysis of ASIAN PAINTS's quarterly results.

Here's an analysis of the annual report of ASIAN PAINTS for 2019-20. It includes a full income statement, balance sheet and cash flow analysis of ASIAN PAINTS. Also includes updates on the valuation of ASIAN PAINTS.

Here's an analysis of the annual report of ASIAN PAINTS for 2018-19. It includes a full income statement, balance sheet and cash flow analysis of ASIAN PAINTS. Also includes updates on the valuation of ASIAN PAINTS.

More Views on NewsPrice is the only due diligence one might require to buy this business.

In this video, I'll show you why I favour smallcaps over the Nifty.

Why are markets discounting the economic impact of Covid?

I've used this trading technique for many years with great success. I'm sharing it with you today.

More

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!