Electrical equipment major, Siemens on Tuesday posted an over 90% rise in its consolidated net profit at Rs 3.3 bn for the March quarter, mainly on the back of higher revenues.

The profit stood at Rs 1.8 bn in the year ago quarter, the company said in a BSE filing.

Total income rose to Rs 35.4 bn in the March quarter from Rs 27.2 bn in the same period a year ago.

For the quarter under review, operating profits were up 151.6%. Operating profit growth came as a result of a lower spike in raw material costs compared to the growth in sales.

Earnings before interest, tax, depreciation, and amortization (EBITDA) was reported at Rs 4.6 bn versus Rs 2.2 bn. This was led by decline in employee cost and other expenses.

--- Advertisement ---

Revealing...The Great Indian Wealth Project

After every economic crisis in the last few decades, India has emerged stronger and better.

For instance, after the 1991 economic crisis, India bounced back stronger than ever.

In the years of recovery and growth that followed, many companies generated 4-digit and 5-digit gains for investors, turning a Rs 1 lakh stake into crores of rupees.

And today, we stand on the threshold of a similar wealth generating opportunity.

As India recovers from the Covid-19 crisis... another... potentially much bigger... opportunity to create wealth is emerging.

And we are sharing full details with our readers at a special event on 17th May.

We will be revealing:

- Details on a powerful mega trend that is playing out in India right now

- Our #1 stock pick to ride this mega trend

- And how you could become a potential dollar millionaire in the long run Since there are limited seats available, we would recommend registering for this FREE event at the earliest.

Click here to register.

------------------------------

The company follows the October to September financial year. Here's a table comparing Siemens' quarterly performance on key parameters.

| (Rs m) | Q4FY21 | Q4FY20 | Q3FY21 | YoY (%) | QoQ (%) |

|---|---|---|---|---|---|

| Revenue | 34,837 | 26,402 | 29,252 | 31.9% | 19.1% |

| Total expenses | 30,973 | 24,953 | 26,230 | 24.1% | 18.1% |

| Profit before tax | 4,427 | 2,268 | 3,603 | 95.2% | 22.9% |

| Tax | 1,208 | 585 | 926 | 106.5% | 30.5% |

| Profit after tax | 3,219 | 1,683 | 2,677 | 91.3% | 20.2% |

The company's managing director and CEO Sunil Mathur said the company's order growth has been robust across all its businesses.

There has been increased demand in the company's power transmission, digital grid and distribution systems businesses.

Digital industries segment also saw growth in the machine tool and process automation businesses.

The company registered new orders from continuing operations of Rs 33.1 bn during the quarter, registering a 16.9% increase over the same period last year.

The strongest growth in the quarter came from the smart infrastructure vertical, with sales growing 48% at Rs 11.5 bn.

The other verticals that showed positive growth in the quarter were energy, mobility, and digital revenue verticals.

At the end of the March quarter, its order book stood at Rs 127 bn.

New Research: Our #1 Stock Pick Right Now

Stating that the second surge of the coronavirus pandemic has impacted human lives in an unprecedented manner, Mathur said a cross-functional Siemens India Task Force Team has been working since March 2020 to coordinate the implementation of concrete measures to support employees at this difficult time.

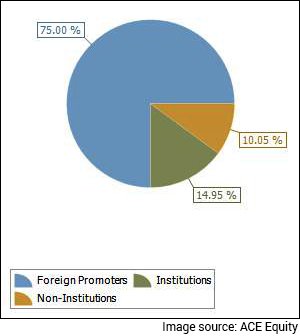

As of 31 March 2021, FII and mutual funds ownership in Siemens stood at 4.37% and 1.64%, respectively.

Here's what Aditya Vora, Research Analyst at Equitymaster, wrote about the capital goods sector in one of the editions of Profit Hunter:

--- Advertisement ---

How to Earn a Fortune in Gold, the Smart Way

Gold is on 'the verge of a decadal run' says Vijay Bhambwani, India's #1 Trader and Editor of Fast Profits Daily at Equitymaster.

He says gold has the potential to generate staggering gains in the coming years...And those who are betting on gold right now will hit the jackpot.

But wait.

While gold is an attractive investment destination, there's a very specific way to play this opportunity...

A way that ensures you rake in maximum profit and perhaps hit the jackpot...while minimizing potential pitfalls. Thankfully, Vijay - India's #1 Trader - can guide you step-by-step in the upcoming gold rush and help hit the jackpot just at the right time.

Sure, you don't want to be an average trader. That's not how you make a fortune.

Here's how you can get Vijay's guidance...

------------------------------

The recent Hidden Treasure recommendation is a fundamentally strong business in the capital goods space that is 'essential' to the infrastructure revival.

You can read the report here. (requires subscription)

If you're not a subscriber, here's where you can sign up.

Siemens share price is presently trading at Rs 2,052 on the BSE, up 5%.

Shares of the company touched a fresh 52-week high of Rs 2,143 today, up over 8%. They had hit a 52-week low of Rs 990.30 on 18 May 2020.

Earlier in the day, the stock saw a gap down opening.

The stock commands a market cap of Rs 730,740 m and is part of the Capital Goods - Diversified industry.

Over the past one year, stock of the company has outperformed the benchmark BSE Sensex. Siemens is up 89% in the past one year in comparison with 56% gains in Sensex.

At its current price, it is trading at a P/E ratio of 96 and a P/BV ratio of 7.7.

Siemens focuses on the areas of electrification automation and digitalization. It is one of the leading producers of technologies for combined cycle turbines for power generation; power transmission, and distribution solutions; infrastructure solutions for smart cities and transportation; automation and software solutions for industry and is also supplier of healthcare equipment.

Siemens has 21 factories located across India and a nation-wide sales and service network.

Siemens in which Siemens AG Germany holds 75% of the capital is the flagship listed company of Siemens AG in India.

The company was incorporated in the year 1957 as Siemens Engineering and Manufacturing Company of India Pvt Ltd.

For more details about the company, you can have a look at Siemens fact sheet and Siemens quarterly results on our website.

For a sector overview, you can read our engineering sector report.

You can also compare Siemens with its peers on our website.

To know what's moving the Indian stock markets today, check out the most recent share market updates here.

VA TECH WABAG share price is trading up by 6% and its current market price is Rs 288. The BSE CAPITAL GOODS is up by 1.2%. The top gainers in the BSE CAPITAL GOODS Index are VA TECH WABAG (up 5.7%) and SIEMENS (up 7.0%). The top losers are LAKSHMI MACHINE (down 0.2%) and SCHAEFFLER INDIA (down 0.5%).

SIEMENS share price has hit an all time high at Rs 2,143 (up 6.1%). The BSE CAPITAL GOODS Index is up by 1.1%. Among the top gainers in the BSE CAPITAL GOODS Index today are SIEMENS (up 6.1%) and HONEYWELL AUTOMATION (up 3.2%). The top losers include SCHAEFFLER INDIA (down 0.7%) and HAVELLS INDIA (down 0.7%).

GRINDWELL NORTON share price is trading up by 5% and its current market price is Rs 1,304. The BSE CAPITAL GOODS is up by 0.7%. The top gainers in the BSE CAPITAL GOODS Index are GRINDWELL NORTON (up 5.1%) and SIEMENS (up 7.5%). The top losers are CARBORUNDUM UNIVERSAL (down 0.1%) and SCHAEFFLER INDIA (down 0.4%).

The revenue of its e-mobility business grew 155% YoY to an all time high of Rs 680 m. Can it go higher?

Should you bet on this public sector defence shipbuilder?

More Views on NewsMidcaps can literally have the best of both worlds...quality and potential. However, buying the best midcap stocks does NOT m...

Price is the only due diligence one might require to buy this business.

In this video, I'll show you why I favour smallcaps over the Nifty.

Why are markets discounting the economic impact of Covid?

I've used this trading technique for many years with great success. I'm sharing it with you today.

More

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!