The market fell for the first time in the last five consecutive sessions with the Nifty50 falling below 14,900 levels, due to selling pressure in private banks, IT, metals and pharma stocks on May 11.

The BSE Sensex declined 340.60 points to close at 49,161.81, while the Nifty50 slipped 91.60 points to 14,850.80 but formed a bullish candle on the daily charts as the closing was higher than opening levels.

"A reasonable positive candle was formed at the lows with minor upper shadow. Technically, this pattern indicates an attempt of bulls to come back after early part weakness. This signals that the market is not willing to give up the upper range of 14,900 levels," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"The upper range of 14,900-15,000 levels have finally proved a difficult task for the market to break out on the higher side and the current weakness from the highs could be considered as another failed upside breakout attempt of the broader high low range," he said.

He further said, "There is a possibility of this weakness getting over in the next 1-2 sessions and one may expect a formation of higher bottom around 14,700-14,750 levels. This market action signal increasing strength of upside momentum and that could eventually result in Nifty retesting the hurdle and the upper range around 15,000-15,100 levels."

Though the Nifty declined on Tuesday, the overall market breadth was positive and the broad market indices like Nifty Midcap 100 and Nifty Smallcap 100 indices have closed higher by 0.79 percent and 0.82 percent respectively. This is a positive indication, Shetti says.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,781.47, followed by 14,712.13. If the index moves up, the key resistance levels to watch out for are 14,910.07 and 14,969.33.

Nifty Bank

The Nifty Bank corrected 270.20 points to close at 32,872.20 on May 11. The important pivot level, which will act as crucial support for the index, is placed at 32,604.5, followed by 32,336.8. On the upside, key resistance levels are placed at 33,147.11 and 33,422.0 levels.

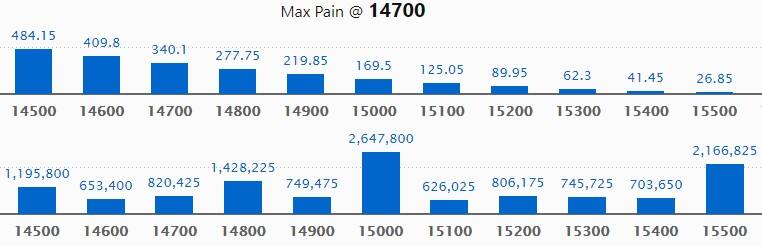

Call option data

Maximum Call open interest of 26.47 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the May series.

This is followed by 15,500 strike, which holds 21.66 lakh contracts, and 14,800 strike, which has accumulated 14.28 lakh contracts.

Call writing was seen at 14,800 strike, which added 4.39 lakh contracts, followed by 14,900 strike which added 1.43 lakh contracts and 15,300 strike which added 1.36 lakh contracts.

Call unwinding was seen at 15,700 strike, which shed 3.29 lakh contracts, followed by 15,600 strike which shed 1.67 lakh contracts and 14,500 strike which shed 65,700 contracts.

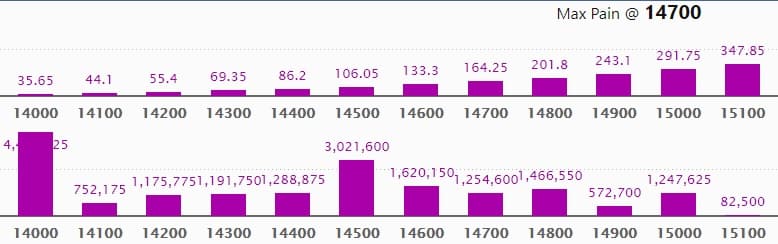

Put option data

Maximum Put open interest of 44.84 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the May series.

This is followed by 14,500 strike, which holds 30.21 lakh contracts, and 14,600 strike, which has accumulated 16.20 lakh contracts.

Put writing was seen at 14,800 strike, which added 5.33 lakh contracts, followed by 14,400 strike which added 3.16 lakh contracts and 14,500 strike which added 2.64 lakh contracts.

Put unwinding was seen at 15,000 strike which shed 36,225 contracts, followed by 15,200 strike, which shed 17,775 contracts.

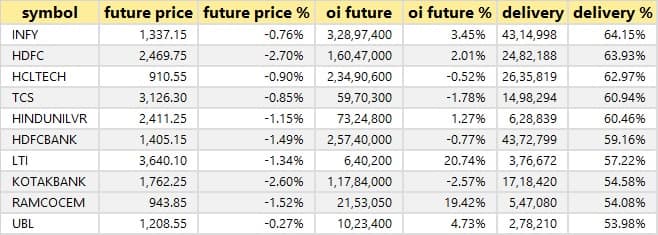

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

42 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

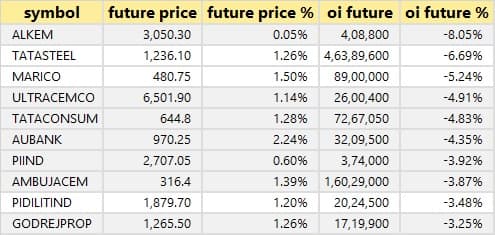

30 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

50 stocks saw short build-up

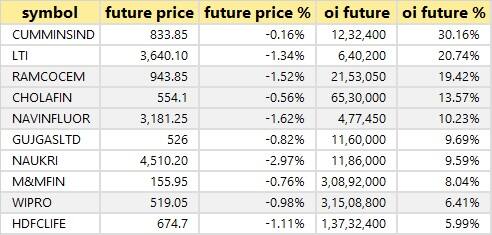

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

36 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

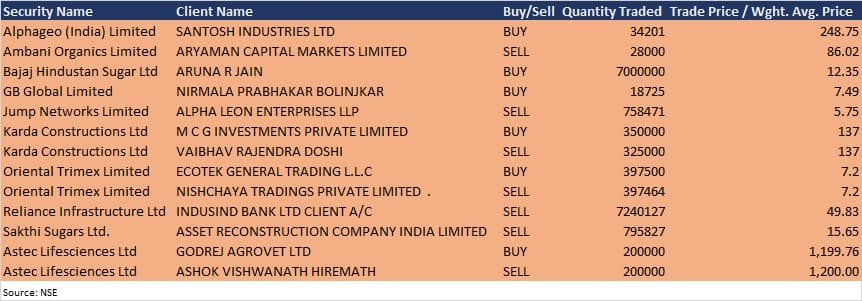

Bulk deals

(For more bulk deals, click here)

Results on May 12

Asian Paints, Lupin, UPL, Apollo Tyres, Tata Power, Avadh Sugar & Energy, Birla Corporation, Borosil Renewables, Dwarikesh Sugar Industries, GRM Overseas, Happiest Minds Technologies, HG Infra Engineering, Jindal Steel & Power, JSW Ispat Special Products, Kaycee Industries, Kennametal India, Khaitan Chemicals & Fertilizers, Mahindra Lifespace Developers, Mid East Portfolio Management, Orient Electric, Palash Securities, Pidilite Industries, Prince Pipes and Fittings, PTL Enterprises, Sagar Cements, Saregama India, SIL Investments, Sonata Software, Swiss Military Consumer Goods, Thambbi Modern Spinning Mills, Trigyn Technologies, UPL, Vaibhav Global, Vardhman Concrete, Vikas WSP, Voltas and Yasho Industries will release quarterly earnings on May 12.

Stocks in News

Pennar Industries: SAIF India IV FII Holdings sold 31,81,239 equity shares (2.24 percent shareholding) via an open market transaction on May 7, reducing stake to 6.30 percent from 8.54 percent earlier.

Linde India: The company reported higher consolidated profit at Rs 303.2 crore in Q4FY21 against Rs 39 crore in Q4FY20; revenue rose to Rs 441.4 crore from Rs 377.2 crore YoY.

Kalpataru Power Transmission: The company reported sharply higher consolidated profit at Rs 174 crore in Q4FY21 against Rs 31 crore in Q4FY20; revenue jumped to Rs 4,086 crore from Rs 3,527 crore YoY.

Infosys: The company announced a strategic collaboration with Britvic to accelerate its digital strategy.

Siemens: The company reported sharply higher consolidated profit at Rs 334.4 crore in Q2FY21 against Rs 175.7 crore in Q2FY20; revenue increased to Rs 3,483.7 crore from Rs 2,640.2 crore YoY.

Godrej Consumer Products: The company reported sharply higher consolidated profit at Rs 365.84 crore in Q4FY21 against Rs 229.9 crore in Q4FY20; revenue rose to Rs 2,730.74 crore from Rs 2,153.80 crore YoY.

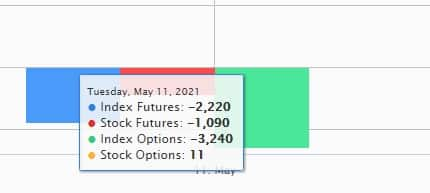

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 336 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 676.67 crore in the Indian equity market on May 11, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Four stocks - Canara Bank, NALCO, Punjab National Bank and Sun TV Network - are under the F&O ban for May 12. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.