Emerging market (EM) equities, mainly comprising India, China, Hong Kong, Taiwan, South Korea, Brazil and Russia, started 2021 on a strong footing, having risen by almost 30.9 percent (in US Dollar terms) after the 2020 US general election. However, the markets corrected by around 10.5 percent mid-Feb, and have remained flat since, raising doubts about the long-term prospects of the basket.

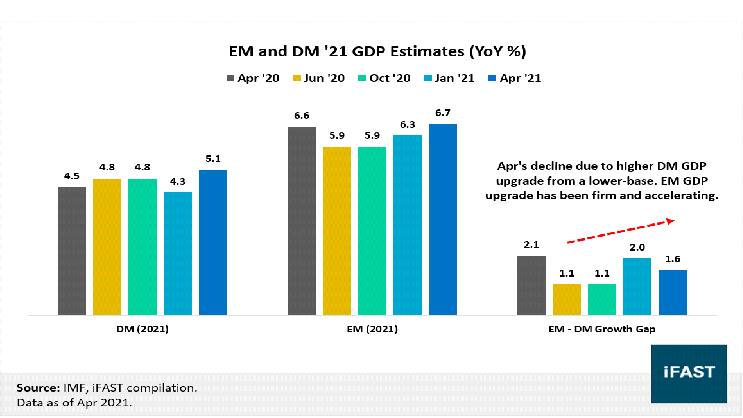

A stronger USD (US Dollar) and weakness in the Asian tech stocks, which comprise 21 percent of the entire MSCI EM index, are the main factors behind the halt in the EM rally. However, analysis confirms that EM’s recent correction is not fundamentally linked, as macro and earnings recovery are still healthy and strong. The EMs' GDP should continue to see an uptick, and the earnings growth gap between emerging and developed markets should widen in late 2021.

Interpreting risks

USD has limited upside

The strengthening of the USD has a significant impact on EM equities as well as currencies, and is the primary risk to the EMs currently. Its recent rise was supported by the following factors:

-The higher real yield attracted inflows, exerting upward pressure on the USD

-The strong US fiscal stimulus of USD 1.9 trillion led to a growth upside for the US over the rest of the world

-The USD further strengthened due to increased short covering by other countries in March

In the near term, the dollar is likely to be supported by strong growth outlook for the US. However, the factors that led to the USD’s strengthening have already been priced in by the market, and we believe it has limited potential for further rise.

Our long-term view for USD is bearish, and we see the dollar downtrend reasserting itself. On a mid to long-term basis, the dollar will be back in its regular range as the widening US twin deficits will exert pressure on the currency. The real rate differential between EUR/USD also seems to be peaking, which indicates that there will be support for a stronger EUR/USD rate.

Asia tech weakness short term in nature

Asian tech earnings saw the impact of a rising US treasury yield, triggering a sell-off of global growth names. China’s tech regulation troubles presented a more focused worry, with China’s tech stocks drastically losing valuation. However, the bad news has now been priced in. Also, tech companies are systematically important for China’s economic growth over the next five years, and we expect the policymakers to be pragmatic. The fundamentals of Chinese tech companies remain strong, with expectations of robust earnings, backed by a strong macro outlook.

Counting on EM fundamentals

The EMs’ fundamental recovery, both macro and corporate, is still intact in our view. The macro recovery is on track and the GDP estimates for 2021 have been seeing consistent upgrades. Strong China recovery, easy monetary conditions and the global manufacturing up-cycle will further boost growth for EMs.

We’re seeing minimum monetary tightening in EMs, as most economies focus on growth. A majority EMs also have a healthier balance sheet with target inflation being in line. As vaccination pervades and economies open up, we see the growth gap between emerging and developing markets widening by late 2021.

Estimating earnings & valuations

The EM earnings per share (EPS) rebound has been strong in 2021. Analyst sentiments have been positive as more companies have seen upgrades. As a result, EPS growth estimates remain robust at 37.5 percent (FY21) and 19.4 percent (FY22).

The double-digit earnings growth remains the strongest reason for EM outperformance, especially on a relative basis, where developed markets are delivering lower earnings growth in the same period.

While it is true that EMs are trading at a higher valuation (of around 10 percent) than their average fair value over the last five years, this is also true of most equity markets today. EMs have also traditionally traded at a premium due to greater insertion of growth stocks. Therefore, despite the slight valuation premium, we see two factors driving further valuation upside: the FY22 earnings growth rebound, and the EMs’ relative performance to the DMs.

Maintaining optimism

Expected cyclical recovery and the global manufacturing upcycle are the major catalysts driving the valuation re-rating and earnings recovery for EMs. Despite the recent faltering, we maintain our optimistic view over the medium to longer-term, and are targeting an upside of 22 percent by FY23.

Investors who wish to invest in the EM region can consider doing so via quality mutual funds investing in these geographies.

Disclaimer: This article is not to be construed as an offer or solicitation for the subscription, purchase or sale of any mutual fund. No investment decision should be taken without first viewing a mutual fund's scheme information document including statement of additional information. Opinions expressed herein are subject to change without notice.