The market rebounded to close in the positive territory on May 5 with the Nifty scaling above 14,600 levels after the RBI announced liquidity measures for small finance banks, MSMEs and microfinance institutions to support the economy and businesses to tide over COVID-19 crisis.

The BSE Sensex jumped 424.04 points to 48,677.55, while the Nifty50 rose 121.40 points to 14,617.90 and formed Inside Bar kind of pattern on the daily charts, driven by banking & financials, IT, metals and pharma stocks.

"Since the three consecutive sessions, the index continues to face resistance around 14,650-14,700 levels which remains a crucial resistance zone to watch out for. On the daily chart, the Nifty continues to hold its 100-day SMA (14,499) which acts as support on the short term charts," Rajesh Palviya, Head - Technical and Derivative Research at Axis Securities told Moneycontrol.

"Any sustainable move above 14,700 may cause momentum towards 14,800-14,850 levels. On the downside, any violation of an intraday support zone of 14,500 levels may cause profit booking towards 14,400-14,300 levels," Palviya said.

On the broader markets front, the Nifty Midcap 100 index gained 1 percent and Smallcap 100 index rose 0.41 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,536.97, followed by 14,456.13. If the index moves up, the key resistance levels to watch out for are 14,668.27 and 14,718.73.

Nifty Bank

The Nifty Bank index climbed 513.40 points or 1.59 percent to 32,783.70 on May 5. The important pivot level, which will act as crucial support for the index, is placed at 32,280.84, followed by 31,777.97. On the upside, key resistance levels are placed at 33,074.34 and 33,364.97 levels.

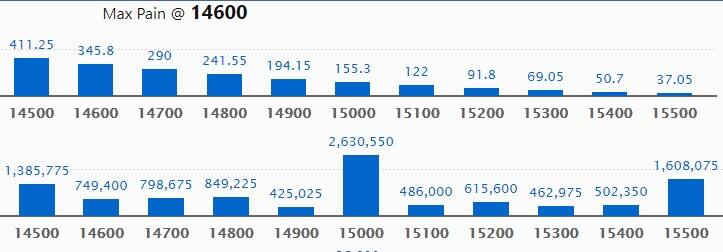

Call option data

Maximum Call open interest of 26.3 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the May series.

This is followed by 15,500 strike, which holds 16.08 lakh contracts, and 14,500 strike, which has accumulated 13.85 lakh contracts.

Call writing was seen at 14,600 strike, which added 1.1 lakh contracts, followed by 15,000 strike which added 74,850 contracts and 15,400 strike which added 42,075 contracts.

Call unwinding was seen at 14,900 strike, which shed 32,025 contracts, followed by 14,800 strike which shed 12,075 contracts and 15,300 strike which shed 10,125 contracts.

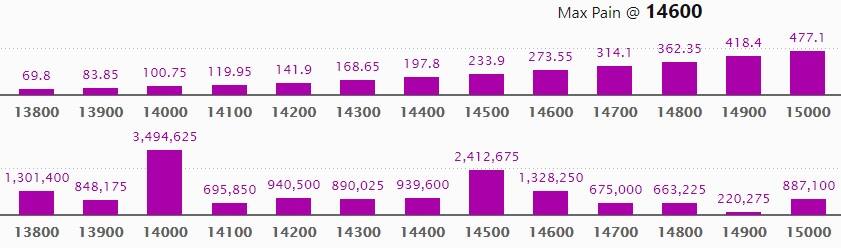

Put option data

Maximum Put open interest of 34.94 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the May series.

This is followed by 14,500 strike, which holds 24.12 lakh contracts, and 14,600 strike, which has accumulated 13.28 lakh contracts.

Put writing was seen at 14,600 strike, which added 2.33 lakh contracts, followed by 14,500 strike which added 1.06 lakh contracts and 14,100 strike which added 78,375 contracts.

Put unwinding was seen at 14,700 strike which shed 98,475 contracts, followed by 13,800 strike, which shed 41,325 contracts, and 14,900 and 15,000 strikes which shed 13,425 contracts.

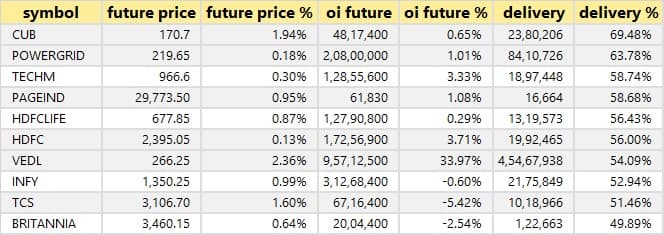

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

80 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

4 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 4 stocks in which long unwinding was seen.

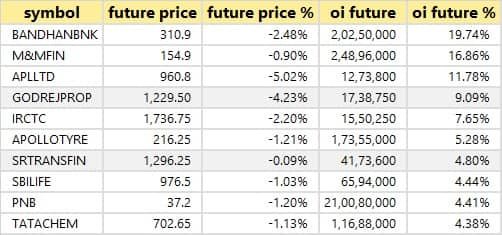

18 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

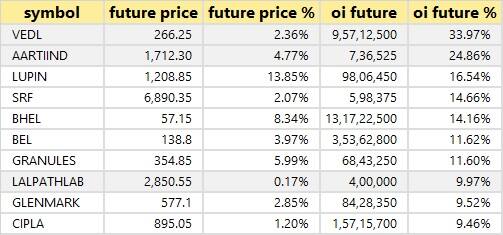

56 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

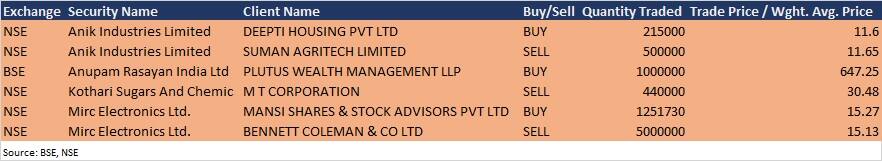

Bulk deals

(For more bulk deals, click here)

Results on May 6

Hero MotoCorp, Adani Power, Adani Transmission, Apcotex Industries, Blue Star, Caplin Point Laboratories, Century Textiles & Industries, Coforge, CreditAccess Grameen, Hindoostan Mills, ICRA, IIFL Finance, Jost's Engineering, Ludlow Jute & Specialities, Procter & Gamble Health, Praj Industries, Raymond, Solara Active Pharma Sciences, Sundram Fasteners, Tata Consumer Products, Five X Tradecom, Foseco India, Hikal, Ashika Credit Capital and Bombay Burmah Trading Corporation will release quarterly earnings on May 6.

Stocks in News

Tata Steel: The company posted consolidated profit of Rs 6,644.1 crore for Q4FY21 against loss of Rs 1,481.3 crore in the year-ago period. Consolidated revenue increased to Rs 49,977.4 crore from Rs 36,009.4 crore in Q4FY20.

Maharashtra Seamless: ONGC has issued the letter of award to Jindal Drilling & Industries for deployment of Jack-up drilling rig 'Jindal Explorer' owned by Maharashtra Seamless on charter hire contract for a period of 3 years.

Praj Industries: HDFC Mutual Fund sold 4,34,583 equity shares (0.24 percent) in Praj Industries via open market transaction on May 3, reducing shareholding to 6.51 percent from 6.75 percent earlier.

IDBI Bank: Cabinet Committee on Economic Affairs has given its in-principle approval for strategic disinvestment along with transfer of management control in IDBI Bank. LIC may reduce its shareholding in IDBI Bank through divesting its stake along with strategic stake sale envisaged by the government, said the bank.

Adani Green Energy: The company reported consolidated profit of Rs 104 crore for Q4FY21 against Rs 56 crore reported in Q4FY20, revenue rose to Rs 986 crore from Rs 696 crore in the year-ago period.

Wipro: The company partnered with Transcell Oncologics to transform vaccine safety assessment using augmented intelligence.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,110.50 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 240.61 crore in the Indian equity market on May 5, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Sun TV Network and Tata Chemicals - are under the F&O ban for May 6. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.