Michael Jackson's image and likeness estimated at $4 mn, says US court ruling

This court ruling will reduce the estate tax bill incurred by Michael Jackson’s beneficiaries, including his mother and children.

Late singer Michael Jackson’s estate was worth just $4 million on the day he died in 2009. Yesterday, on 3 May, a US Tax Court judge ruled the case far below the $161 million valuation sought by the Internal Revenue Service (IRS). This court ruling will reduce the estate tax bill incurred by Jackson’s beneficiaries, including his mother and children.

As per the ruling, US Tax Court Judge Mark Holmes found that the singer’s name and likeness were worth $4 million when he passed away at the age of 50. As the case proceeded, the IRS pointed out the value of other Jackson assets, but will receive far less than the hundreds of millions of dollars in taxes and penalties, according to Wall Street Journal.

Court House News writes that the singer's lifestyle and "repellant behaviour" had not only hindered his reputation in the music business, but also prevented him from earning much of an income from the same.

During the hearing, the government and the estate settled on few issues, after which the case came down to the question of how to value three main assets were Jackson's name, likeness (image) and two entities tied to the music business.

The estate originally started with some lower values, but by Monday’s decision in the court, it had confirmed those three assets were worth $5.3 million combined. The government had also started with higher values but ultimately concluded those three assets were worth $481.9 million combined.

In his ruling, Judge Holmes said they were worth $111.5 million in Jackson’s name. Meanwhile, the estate’s actual tax bill will be looked into later. “The value we put [on] them as of the day he died is, we acknowledge, much less than their value much later under the Estate’s management. Even a rational and undistressed hypothetical seller would have been hardpressed to avoid fire-sale prices,” Judge Holmes wrote.

By the end of the ruling, Holmes concluded on a $107 million value for that third asset, just $7 million below what the IRS had wanted and more than $100 million above what the estate said. However, Holmes denied the government’s request to collect penalties from the estate for significant understatement of its assets, writes Billboard.

So far, Jackson’s estate was represented by a team of California tax lawyers. Meanwhile, the estate’s income and assets go into a trust and Jackson’s mother, Katherine. The assets will finally go to Jackson’s three children and to charity.

also read

Kevin Spacey sexual abuse accuser cannot proceed anonymously in court, US judge rules

The judge said the accuser's privacy interest does not outweigh the presumption of open judicial proceedings and the prejudice to Spacey’s defense that would occur if he were to proceed anonymously.

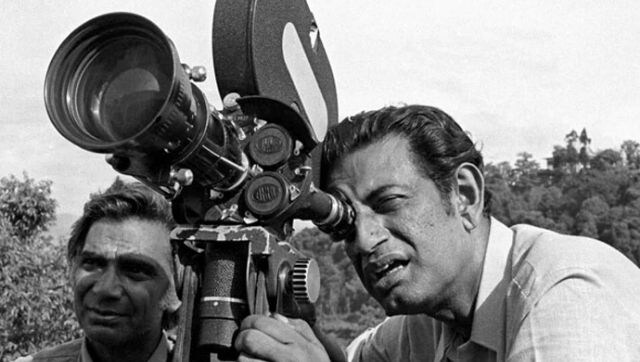

Satyajit Ray's birth centenary celebrations stalled due to second wave of COVID-19

Satyajit Ray's son Sandip, along with other family members had planned year-long celebrations which have now been postponed.

Disney+ Hotstar unveils lineup of short-form titles; Shreyas Talpade, Mandira Bedi, Vidya Malvade part of cast

The shows will begin streaming from 7 May, and episodes will be debuted every day.