Strong Earnings Season Fails to Lift China’s Range-Bound Market

(Bloomberg) -- For China’s equity investors, a bullish outlook for corporate earnings hasn’t been enough to boost sentiment in a market still weighed by liquidity concerns.

The CSI 300 Index has been stuck in a narrow range for weeks, and investors have stayed cautious heading into the Labor Day break that runs through May 5. A measure of turnover is near its lowest in nearly six months.

It’s a far cry from the scorching rally that drove the CSI 300 Index to its highest level since 2007 ahead of the previous national holiday in February. The benchmark gauge is down 12% since then, having notched up its worst performance against global peers since 2016 in March.

Valuations are still relatively expensive. Optimism about China’s economic recovery from the pandemic was priced in long ago and has been replaced by concerns over monetary tightening and a government campaign to cut leverage. Investors have been rattled by moves to regulate the nation’s internet giants, a record wave of corporate bond defaults and persistent worries over the financial health of firms such as China Huarong Asset Management Co.

“No one knew the sentiment would turn so drastically after the Lunar New Year holiday. Into this long weekend, I’m cautious partly because of the policy uncertainties,” said Jackson Wong, an asset management director at Amber Hill Capital Ltd. “The market is going to be stuck in a narrow range until there is strong signal to sell or to buy.”

Here’s a snapshot of what investors are focused on as they look ahead into May:

Earnings Season

Analysts have largely upheld bullish profit forecasts on the biggest Chinese companies with most firms having reported first-quarter results. Average earnings per share expectations for CSI 300 Index firms are at a record high, according to data compiled by Bloomberg.

The CSI 300 Index members’ earnings grew by 27% from a year in the first quarter, the fastest first-quarter pace since 2010, according to data compiled by Bloomberg. Yet shares have not moved dramatically, while investors rushed to sell stocks that that missed analyst expectations. Kweichow Moutai Co., the biggest mainland-traded stock, has lost 4.2% since releasing quarterly earnings on Tuesday.

Technical Indicators

The CSI 300 Index remains stuck in a narrow trading band between its 100-day and 200-day moving averages. Meanwhile the Shanghai Composite Index has been capped by its resistance at 3,500 points, forming an ascending triangle which could be indicative of future bullish breakthrough.

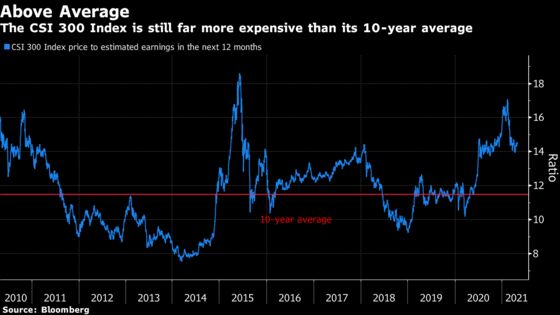

Still pricey

The CSI 300 Index is trading at about 14 times its estimated earnings for the next 12 months, far above its 10-year historical average at about 11.4, data compiled by Bloomberg show. Many heavyweight stocks are still trading at high valuations. To be sure, the CSI 300 Index is still cheaper than S&P 500 Index, where valuations look stretched.

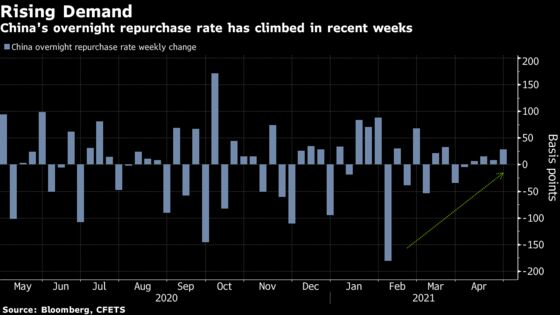

Tighter Liquidity

Equity traders have struggled to come to terms with plans by Chinese policy makers to gradually wind-back pandemic-fueled stimulus. The government has revived a campaign to cut leverage that was shelved amid the trade war with the U.S., and has moved to limit the impact of “hot money.”

China’s top leaders see the current economic recovery as “unstable” and have pledged to keep macro policies consistent to boost a recovery in manufacturing and private investment, the state-run Xinhua News Agency reported, citing a meeting of the Communist Party’s Politburo chaired by President Xi Jinping.

Yet expectations are that liquidity will tighten in May, which would further dampen stock trading sentiment.

©2021 Bloomberg L.P.