The Australian property market is skyrocketing. However consultants concern there’s one issue that’s masking the actual fact.

Because the pandemic arrived on our shores somewhat over a 12 months in the past, the Australian property market has been on fairly the rollercoaster of highs and lows.

This time final 12 months, sellers had been usually accepting 10 per cent beneath their asking value and predictions of costs falling nearly a 3rd had been coming from among the massive 4 banks.

However with record-low rates of interest and authorities stimulus beginning to move into housing, the broader market bottomed out and commenced its climb to present heights.

Relatively than crashing, property costs are at the moment rising on the quickest fee for the reason that late 1980s.

However there’s one other facet to this story, with out which the present housing increase could also be far much less sturdy — or maybe not even occurring in any respect.

The Financial institution of Mum and Dad.

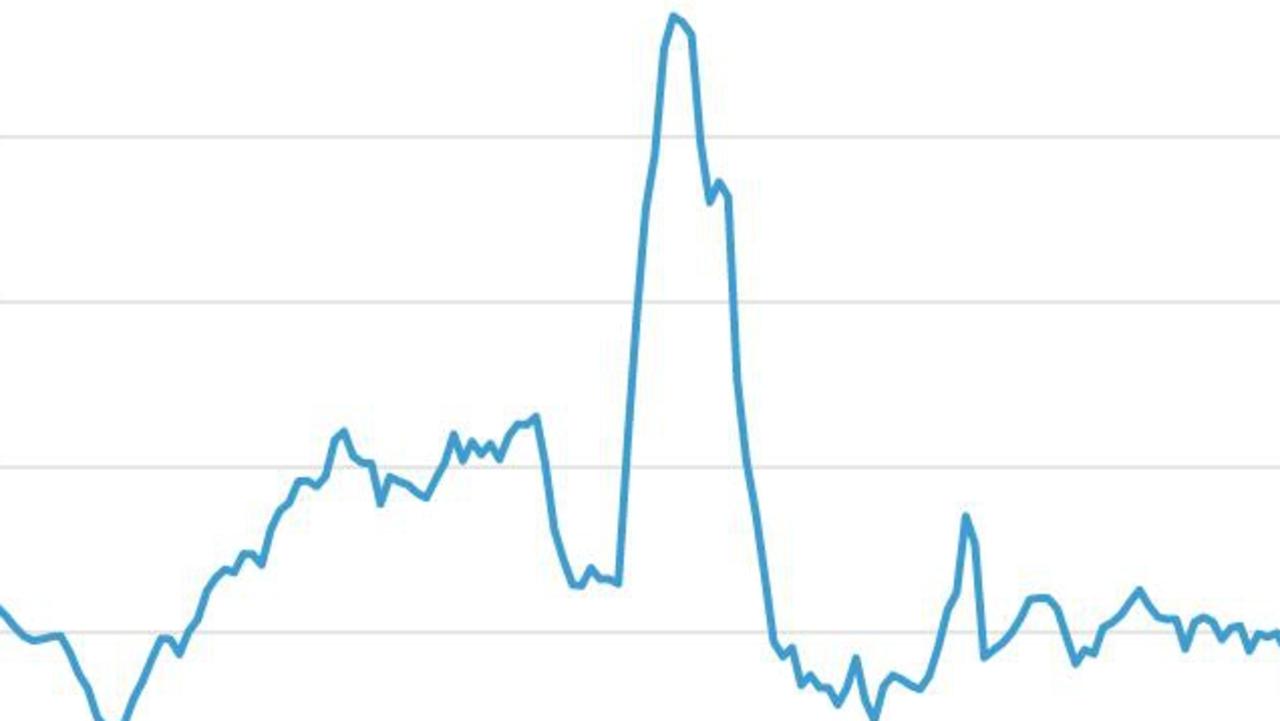

Based on Digital Finance Analytics (DFA) information, in March final 12 months, simply eight per cent of first homebuyers had been receiving help from their dad and mom.

This was earlier than the speed cuts and the pandemic started to considerably affect the housing market.

This was the bottom proportion of first homebuyers receiving help from dad and mom since 2011.

Simply six months later greater than half of all first homebuyers had been counting on assist from the Financial institution of Mum and Dad as a way to obtain their dream of residence possession.

Based on DFA’s newest figures, greater than 60 per cent of first homebuyers are actually receiving assist from their dad and mom to place down a deposit on a property.

As dad and mom more and more come to the help of their grownup youngsters, the variety of first homebuyers buying properties has risen by 93.eight per cent, in response to figures from the Australian Bureau of Statistics.

Solely throughout the top of the property mania pushed by the Rudd authorities’s first home-owner grants was the variety of first homebuyers higher than it’s now.

Mother and father typically aren’t precisely simply chipping in somewhat bit of additional money to high up a deposit both.

As of March, the typical quantity of help dad and mom had been offering their first homebuyer youngsters for his or her deposits was nearly $90,000.

Based mostly on the typical first homebuyer deposit quantity of $106,743, the Financial institution of Mum and Dad is offering a mean of 84 per cent of the full required deposit for the extra 60 per cent of first homebuyers which are receiving parental help.

The averages are little doubt skewed by some dad and mom offering their youngsters with very giant sums of cash for deposits on dearer houses, significantly in Sydney and Melbourne.

Total the info presents an image of a primary homebuyer cohort more and more supported by the Financial institution of Mum and Dad to get into the market, regardless of the very fact rates of interest are at report lows.

The info additionally suggests they had been seemingly doing OK with out them somewhat over a 12 months in the past.

In actual fact, funds for a primary residence from the Financial institution of Mum and Dad has turn into the nation’s ninth largest lender, with Aussie mums and dads collectively loaning or gifting greater than $33.6 billion to their youngsters for residence deposits.

For a primary homebuyer receiving the typical quantity of help from their dad and mom and getting the typical mortgage, they might solely have to provide you with somewhat over $17,000 – a far cry from the greater than $106,000 they would wish to provide you with in the event that they had been on their very own.

Just some years of saving, or a number of cheeky rounds of superannuation withdrawals (as many did), and hey presto, with the assistance of the Financial institution of Mum and Dad you’ve received your self a newly minted home-owner.

For larger earnings incomes potential first homebuyers, the help of dad and mom can have even higher impacts on home costs.

With a typical mortgage requiring a 20 per cent deposit, each $1 a father or mother supplies in help is one other $four a potential first homebuyer can borrow, offered they earn sufficient to fulfill their lender.

Arguably no less than partially on account of the elevated help by dad and mom, the typical mortgage measurement of first homebuyers has risen by round 20 per cent.

Based on DFA principal Martin North, the Financial institution of Mum and Dad has offered an enormous enhance to the housing market.

“Round 60 per cent of first homebuyers at the moment moving into the market are doing so with the assistance of the Financial institution of Mum and Dad,” Mr North stated.

“With out this issue the property market wouldn’t be almost as sturdy.”

However it’s not all excellent news for the primary homebuyers who use parental help to leapfrog their rivals.

“There’s a 3 times higher chance of a Financial institution of Mum and Dad-enabled purchaser defaulting on their mortgage inside 5 years in contrast with a extra regular first homebuyer,” Mr North stated.

“It’s as a result of some haven’t had the long-term expertise of saving.”

With the excessive proportion of first homebuyers receiving parental help enabling close to report numbers of purchasers to get into the market, it’s clear this demographic is a serious driving drive of the present value increase.

With out the tens of 1000’s of mums and dads who performed financial institution supervisor for his or her grownup youngsters, the present property increase would doubtless be considerably weaker – or maybe not even a increase in any respect.

However this raises an essential query for first homebuyers and the broader property market going ahead.

What number of extra dad and mom are going to be prepared and capable of present every of their youngsters with a mean of round $90,000 to purchase a house?

Tarric Brooker is a contract journalist and social commentator | @AvidCommentator