If we want an investor to be interested in our project or company, we will have to make use of a pitch deck , a sales technique - usually presented in Power Point, Google Slides or Keynote - that will summarize in a brief visual presentation the mission of your company , your business plan and its growth vision, that is, the way in which you will sell your company to potential clients.

Try to put yourself in the shoes of an investor who reviews many startup proposals a year. What you really need is to find in each one of them real and measurable information that allows you to detect the potential of the companies seeking your investment. The questions for which you will seek answers are usually of this type: How much money do they generate per month? What is their capital so far? How much have they grown?

Perhaps, without even thinking about it, an investor makes use of something known as "Financial Theory", which some consider the best method to know the acceptability or ordering of investment projects. It consists of finding out the net present value (NPV) of the cash flows, that is, disbursements and reimbursements, associated with the project.

So, for a pitch deck to be truly good and functional, both for the person presenting the proposal and for the investor, it must contain at least the following 12 points:

- Introduction: Who are you and why are you here?

- Team: Who is behind the idea and what is their role?

- Problem: What problem will you solve? Is it really a problem?

- Advantages: Why is your solution special? What makes it different from the others?

- Solution: How do you plan to solve the problem?

- Product: How does your product or service work? Show some examples.

- Traction: Traction means you have customers who show potential.

- Market: Know, or at least try to predict, the size of the market you will impact.

- Competition: What are the alternative solutions to the problem you pose?

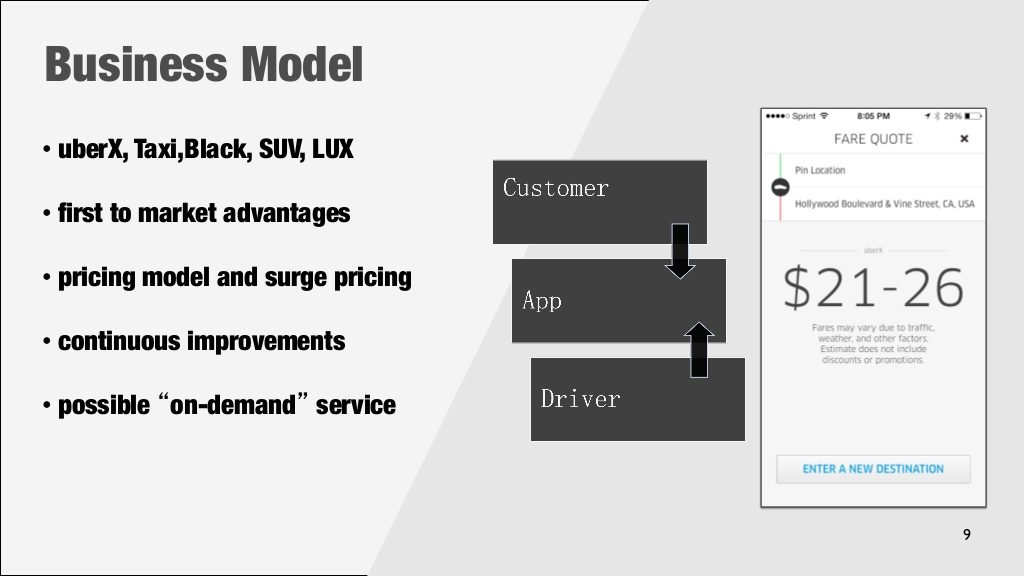

- Business model: How will you make money? Present a calendar showing when you expect to get a return on your investment.

- Investment: What is your budget and how much do you expect to earn?

- Contact: Leave your details to the client and let people know how they can contact you.

The most difficult thing will be to maintain the interest of an investor who has reviewed hundreds of proposals, convince him that yours is the best and achieve the "yes".

Here are the dos's and don'ts that you should keep in mind when making your pitch deck :

The dos

- Tell a story and create an emotional bond with the investor

- Limit a slide to a single idea, don't bore your audience

- Make a great first impression

- Show the people behind the idea

- Be consistent in format

- Know your metrics better than anyone

The don’t’s

- Don't use too many bullets

- That your presentation is not so long

- Don't read everything, interact with your audience

- Do not include too much text in the presentation, your audience will not be able to read and hear you at the same time

- Do not arrive without preparing

- Don't use small fonts

Uber, for example, has one of the best pitch decks that exist in the market, since it summarizes in a very punctual way its business model, where it wants to go, who is part of the project, what is its budget, its profit forecast , etc.

In this slide they present with just 2 bullets the company's objective and where they will operate.

Here, for example, it details who is part of the team and what their roles are.

Finally, in this slide we can see that it is presented in a very clear and punctual way what its business model is and how customers will interact with the application and, in turn, with the drivers.

A pitch deck can make the difference between a “yes” and a “no” from investors, we just have to think about the success and presence that companies like Uber, AirBnB or Linkedin have today.

Raising the necessary capital to fund a company is a complicated task, both for entrepreneurs and businessmen. However, complicated does not mean impossible. Having a clear knowledge of all the finances, sales and valuation of your startup will generate confidence among investors.