The market remained in a consolidative phase and corrected for the third consecutive week ended April 23 as traders seem to be worried about economic recovery amid consistent rise in COVID-19 infections and increasing state-wise restrictions along with likely hike in capital gains tax in the US.

The BSE Sensex fell 953.58 points, or 1.95 percent, to close the week at 47,878.45, and the Nifty50 declined 276.50 points, or 1.89 percent, to 14,341.35, while the broader markets outperformed frontliners. The BSE Midcap index was down 1 percent and Smallcap index dipped 0.06 percent.

Experts feel the nervousness among traders may continue.

"Despite the weak market trend, vaccine drive and lockdown are invoking hopes of economic recovery in the near future," Vinod Nair, Head of Research at Geojit Financial Services told Moneycontrol.

"Movement will be stock-specific based on Q4 results and dictated by developments on the COVID spread, like falling infection rate," he said.

Here are 10 key factors that will keep traders busy in the coming week:

1) Earnings

The coming week will be busy as a total of 129 companies will release their March quarter earnings including key ones - Tech Mahindra, Axis Bank, Bajaj Finance, Britannia Industries, Maruti Suzuki India, Bajaj Finserv, Bajaj Auto, Hindustan Unilever, Titan Company, IndusInd Bank, Reliance Industries, SBI Cards and Payment Services, HDFC Life Insurance Company, HDFC Asset Management Company and ABB India.

Among others, Castrol India, Delta Corp, Tata Teleservices (Maharashtra), Gateway Distriparks, Hatsun Agro Product, Hindustan Zinc, Nippon Life India Asset Management, PNB Housing Finance, Symphony, Syngene International, TVS Motor Company, VST Industries, Biocon, KPIT Technologies, Mastek, Sundaram-Clayton, Tata Communications, UTI Asset Management Company, Ambuja Cements, AU Small Finance Bank, Bajaj Holdings & Investment, Equitas Small Finance Bank, Exide Industries, IndiaMART InterMESH, L&T Finance Holdings, Motilal Oswal Financial Services, Persistent Systems, Tata Coffee, Astec Lifesciences, Can Fin Homes, Marico, Yes Bank and Zen Technologies will also announce quarterly earnings in the last week of April.

India continued to add the maximum number of COVID-19 cases globally with facing lot of crisis including increasing state-wise restrictions to control the spread of infections, non-availability of beds and oxygen, and travel bans from India being imposed by several countries.

The nation reported the highest ever daily infections at 3.46 lakh in the world on Friday and in fact the daily cases count was at over 3 lakh for third consecutive day, which experts feel is a major concern for the country and if it goes out of control then that could have major impact on the market as well as economy.

Maharashtra continued to report the highest cases per day, followed by Uttar Pradesh, Kerala, Karnataka, Delhi, Tamil Nadu, Andhra Pradesh, West Bengal, Chhattisgarh, Rajasthan, Madhya Pradesh, Gujarat, Haryana and Bihar. All these states reported daily cases in five digits.

The total confirmed cases, so far, in India stood at 1.66 crore with 1.89 lakh deaths, while the recoveries were at more than 1.38 crore. The active cases count per day increased by more than 1 lakh for eighth straight day on Friday, taking the total active cases count to 25.52 lakh.

The recovery rate remained below 84 percent for second day, at 83.49 percent which has fallen from 83.92 percent in previous day.

On the other side, more than 13.83 crore people have been vaccinated so far in the country including the Friday's vaccination tally at 29 lakh people, while the single-day testing at 17.53 lakh on Friday was the highest-ever.

3) FII Outflow

Given the record COVID-19 infections on daily basis and increasing restrictions by states to control the spread of virus, the outflow by foreign institutional investors/foreign portfolio investors has also been increasing. So far in the month of April, they have been net sellers to the tune of over Rs 7,500 crore, after having a robust buying in previous six months.

It is also one of reasons for caution and volatility in the market for last few weeks. On the other side, domestic institutional investors have been playing a supportive role for the market as they have net bought nearly Rs 8,000 crore in April, continuing buying for second consecutive month (Rs 5,200 crore buying in March) after major selling in previous five consecutive months.

4) FOMC Meet

The Federal Reserve's two-day meeting - April 27-28 - is one of the key factors globally to watch out for in the coming week. The Fed will conclude its two-day meeting on Wednesday. Experts largely expect the Federal Reserve Chair Jerome Powell to keep its interest rates near zero levels and continue with bond purchases plan, though the last month's economic projections summary pointed towards better economic performance in the first quarter of CY21.

"Over the coming week, investors across the globe would keep an eye on the outcome of the FOMC meeting for any change in interest rates and their future guidance on inflation. Any central rate change will have a ripple effect on other rates, including foreign exchange rates and bond prices which may have a sizeable influence across emerging markets," Nirali Shah, Head of Equity Research at Samco Securities said.

5) Auto Sales

Auto stocks will also be in focus in the coming week on Friday as the monthly sales data for April will be released by companies - Tata Motors, Hero MotoCorp, Maruti Suzuki, Escorts, Eicher Motors, TVS Motor, Bajaj Auto, Ashok Leyland etc - on Saturday, May 1.

6) IPO

Power Grid Infrastructure Investment Trust, owned by country's largest power transmission company Power Grid Corporation of India, will open its initial public offering for subscription on April 29 and the same will close on May 3, 2021.

The issue comprises a fresh issue of Rs 4,993.48 crore, and an offer for sale. The proceeds of the fresh issue will be utilised towards providing loans to the initial portfolio assets for repayment or pre-payment of debt.

7) Technical View

The Nifty50 lost 1.9 percent during the week and shed half a percent on Friday, witnessing a Doji kind of pattern formation on the daily as well as weekly charts and indicating caution for the days ahead.

Overall the index has managed to hold its crucial support at 14,300-14,150 levels, which experts feel if it breaks then 14,000 mark can be easily breached.

"Markets are completely clueless which way to move in the near term. At higher levels, we are facing some pressure as the battle continues with respect to the pandemic and on the lower side; bulls are clearly not willing to give up. Hence, it has become very difficult to take any kind of directional call on the market," said Angel Broking.

"We have been quite cautious on the market and despite Nifty still holding on to a key support zone of 14,200 – 14,150, we continue to advocate caution till the time some important levels are not surpassed. For Nifty, the immediate resistance zone can be seen around 14,575 – 14,650, where a sustainable move beyond 14,650 would negate the possibility of further correction to resume the upward trajectory," the brokerage added.

On the flip side, "all eyes on 14,200 – 14,150 and the more it gets challenged, the higher it creates the possibility of breaching it. Below this, Nifty opens up the downside zone of 14,000 – 13,700," he said.

8) F&O Cues

Maximum Call open interest was seen at 15,000, 14,800 and 14,500 strikes, while the maximum Put open interest was seen at 14,000, 13,500 and 14,200 strikes.

Call writing was seen at 15,000, 14,800 and 14,600 strikes with Call unwinding at 13,500 and 13,600 strikes, whereas Put writing was seen at 14,000, 14,100 and 14,300 strikes with Put unwinding at 14,500, 14,600 and 14,700 strikes.

The abovementioned option data indicated that the Nifty50 could see a wider trading range of 14,000 to 14,700 levels in coming sessions.

"The Nifty has major Call base at the 14,500 strike for the settlement week while the VWAP (volume weighted average price) levels for the series are placed near 14600. In case of continued recovery, we believe 14,600 should act as immediate hurdle for the index. At the same time, recent lows near 14,200 are likely to provide immediate support to the indices on the lower side, below which declines may extend towards highest Put base of 14,000," said ICICI Direct.

"Current levels of volatility suggest a cautious sign, going ahead, and continued divergence from VWAP may bring further pressure in the market during settlement," the brokerage added. The volatility in the markets inched up to 22.69 levels from 20.40 levels on week-on-week basis.

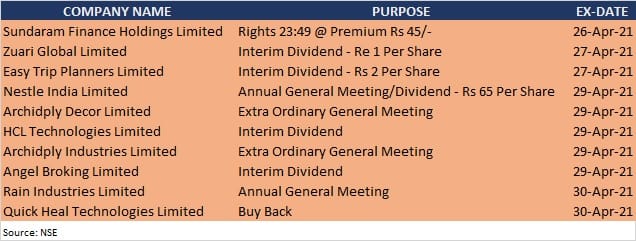

9) Corporate Action

Here are key corporate actions taking place in the coming week:

Infrastructure output for March and foreign exchange reserves for week ended April 23 will be released on Friday.

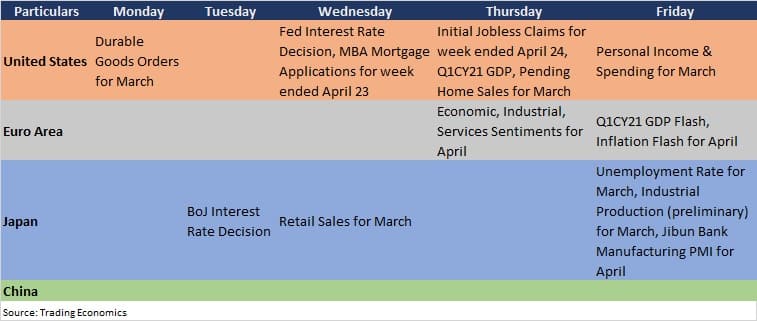

10) Global Cues

Apart from FOMC meet, here are key global data points to watch out for next week: