The market looks to be more worried about the likely impact of the fast-rising COVID-19 infections on the economic and earnings growth. The benchmark Nifty50 has corrected 6.6 percent and the BSE Sensex 8.4 percent from their record highs in February 2021.

India has been reporting more than 2 lakh confirmed COVID-19 cases per day since April 14, 2021, and has now touched the 3-lakh-mark a day.

Several states have announced strict restrictions, and reports suggest many states are likely to introduce more restrictions and could announce lockdowns in the coming days.

"Investor sentiments were hurt with rising COVID cases and the possible disruption being caused by the second wave hammered indices to lower levels. Growing concerns over the negative repercussions on the economy have played out and the weak global cues did not help matters either," Gaurav Garg, Head of Research, CapitalVia Global Research, told Moneycontrol.

Lockdowns in a few states and night curfews have served as a catalyst for the downfall, he said.

Experts feel there could be some impact of COVID-19 on the economic and earnings growth at least in the first quarter of FY22. This would ultimately hit the full-year growth to some extent, but there could be faster recovery, post the second wave.

“There surely will be a negative impact on corporate earnings of Q1FY22 due to the fresh uncertainties arising out of the second wave of the pandemic. To some extent, it will also hamper the recovery that was taking place in the Indian economy,” said Shailendra Kumar, CIO, Narnolia Financial Advisors.

Siddharth Sedani, Vice President, Equity Advisory, Anand Rathi Shares and Stock Brokers, feels that from a short-term perspective, the second wave of COVID-19 and lockdown will keep the market nervous, but the approval of the Sputnik vaccine in India will boost vaccination drive. This will bolster the medium to long term perspective of the markets, say experts.

"However, the risk of lockdown will also bring in a lot of opportunity. The government's capital expenditure and RBI’s accommodative monetary stance are expected to keep the equity market positive, with a long-term perspective," he said.

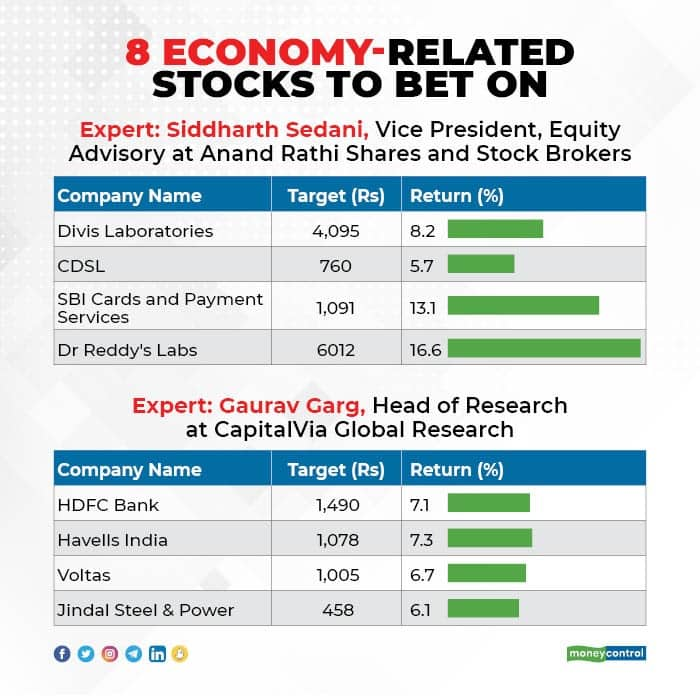

Here are the top eight economy-related stocks experts recommend amid the current market correction and volatility.

Expert: Siddharth Sedani, Vice President, Equity Advisory at Anand Rathi Shares and Stock Brokers

Divis Laboratories: Buy | Target: Rs 4,095

Divis Laboratories is one of the leading manufacturers of active pharmaceutical ingredients (API) in the world. Its growth prospects look decent with favourable traits in the API industry, due to supply-chain readjustments/diversification from China into other countries, including India, amid COVID-19.

As global players look to reduce the dependency on China and prefer India, companies like Divis remain well-placed to capitalise on such opportunities. Also, in custom synthesis, the company is connected with several pharma giants and looks to benefit as India may tap opportunities in terms of the consumption of custom synthesis.

As part of its capex programme, Divis has completed debottlenecking/backward integration for intermediates to reduce the dependence on China for raw materials, and has completed several expansion projects.

On December 1, 2020, the company announced the commencement of the construction of Divis Unit-III Facility (the project) at Kona Forest, Ontimamidi Village, Thondangi Mandal, near Kakinada, East Godavari District, Andhra Pradesh. The company will be investing about Rs 1,500 crore, out of internal accruals, in a phased manner on this facility. The management expects the first phase of the project to commence operations in 12-18 months.

CDSL: Buy | Target: Rs 760

Commencing operations in 1999, the Central Depository Services (CDSL) facilitates holding and transaction of securities in electronic format and settlement of the trades executed on stock exchanges.

These securities include equities, debentures, bonds, ETFs, units of mutual funds, units of alternate investment funds, government securities, etc. The Depository Participants (DPs) act as agents of the company and offer depository services to the beneficial owners of the securities.

Among other services, CDSL offers services to corporates, KYC services in respect of investors to capital market intermediaries, holds insurance policies in electronic format for policyholders and online services such as e-voting, e-Locker, etc. CDSL enjoys a strong market position as India's largest securities depository.

In terms of cumulative market share of active demat accounts, CDSL has witnessed a solid growth in market share from 40 per cent in FY14 to 51 per cent in FY20. As of January 31, 2021, the company had 588 DPs. Its revenue remains well diversified with the annual issuer charges accounting for about 34 per cent of FY20 revenues, followed by transaction charges (19 per cent), online data charges (16 per cent), IPO / corporate action charges (10 per cent) and others (17 per cent).

Notably, CDSL has a high stability of revenues from the fixed annual charges collected from issuer companies and transaction-based fees from DPs.

During Q3FY21, the number of new active beneficial owners’ accounts with CDSL increased by 2.8 million, taking the total number to 28.9 million. As on January 31, 2021, the company reported 30.4 million accounts -- an increase of 1.5 million accounts in January 2021.

Within financial assets, allocation for equities has been rising as retail investors have usually been underinvested in equities. CDSL stands to benefit as capital markets grow. Also, the increasing thrust on digital account opening and online initiatives create further optimism. We initiate coverage on CDSL, with a ‘buy’ rating and a target price of Rs 760 per share.

SBI Cards and Payment Services: Buy | Target: Rs 1,091

SBI Cards and Payment Services has written off loans and improved recoveries, as part of its steps to improve asset quality. Though higher operational costs and lower yields have cut into profitability, they are expected to be relevant only for this quarter.

Credit-card spends rose due to the festival season and even had a comparatively better market share. Asset quality improved markedly. Proforma gross NPA slid around 300bps in Q3 (4.5 per cent versus 7.5 per cent) on loans of Rs 65 crore written off and recoveries of around Rs 400 crore. The move to write off bad loans in Q3 FY21 and the intention to further do so in future is viewed as 'positive'.

The RBI RE book totalled Rs 2,340 crore in Q3 FY21 versus Rs 2,100 crore in the previous quarter. About 33 per cent of the RE book (Rs 780 crore) was over 30 days due and less than 90 days. About 65.5 per cent provisions are for these although they are not classified as NPAs. The standstill book was around Rs 750 crore.

There could be stress over the next couple of quarters as the Supreme Court order comes in this regard.

Operating costs rose 7 percent YoY on account of the festival season's cash-backs and more outlay on collection efforts. However, since the company has written off loans, collection costs would return to normal from the next quarter.

Credit costs were at a high 11.4 per cent, although less than the 15.7 per cent in Q2FY21. We have factored in credit-cost estimates of 9 per cent and 8.5 per cent for FY22 and FY23, respectively. Net Interest Income (NII) fell 3 per cent YoY, owing to yield contraction as the RBI RE book has lower interest rates. However, yields are expected to rise. Fee income rose 2 per cent YoY on an increase in credit-card spends (Rs 37,800 crore versus Rs 35,300 crore).

Dr Reddy's Laboratories: Buy | Target: Rs 6,012

The company reported revenues of Rs 4,930 crore in Q3FY21, up by 12 per cent YoY, driven by growth in all divisions. EBITDA margins remained steady at 24 per cent, thanks to better operating leverage. However, profits were hit due to trigger- based impairment charges on a few acquired products, including Nuvaring.

Revenue from the global generic segment was Rs 4,080 crore -- a growth of 13 per cent YoY. It was primarily driven by product launches and integration of the acquired portfolio from Wockhardt in India. However, volume growth in the base business was largely offset by price erosion. Revenue from pharmaceutical services and active ingredients stood at Rs 700 crore -- a growth of 1 per cent, driven by new products and favourable forex rate, offset by lower volumes for some products. Overall, the results are below our expectations.

Expert: Gaurav Garg, Head of Research at CapitalVia Global Research

HDFC Bank: Buy | Target: Rs 1,490

The bank has come out with good Q4 numbers, with a net interest margin (NIM) of 4.2 per cent, and 46.1 per cent CASA ratio on a YoY basis as against 42 per cent. The bank’s deposits are up 16.3 per cent YoY, suggesting strong fundamentals.

Havells India: Buy | Target: Rs 1,078

The company showed good quarter-on-quarter growth in Q3FY21, with its operating profit up 22.83 per cent, revenue (up 29.10 per cent), gross profit (up 22.35 per cent), net income (up 7.29 per cent), and a reduction in interest expense (down 12.10 per cent). Another factor, which is a positive for this stock, is the approaching summer season.

Voltas: Buy | Target: Rs 1,005

Voltas reported quarter-on-quarter growth in Q3FY21, with its operating profit up 53.44 per cent, revenue (up 22.19 per cent), gross profit (up 11.03 per cent), net income (up 63.25 per cent) and a reduction in interest expenses (down 44.92 per cent). For this stock also, the approaching summer season is a positive.

Jindal Steel & Power: Buy | Target: Rs 458

The company reported quarter-on-quarter growth in Q3FY21, with its operating profit up 84.92 per cent, revenue (up 17.23 per cent), gross profit (up 31.28 per cent), net income (up 391.90 per cent) and a reduction in interest expenses (8.75 per cent). The growing rural demand, increased capex as outlaid in the Union budget, and the pick-up in demand in the infra sector have made this stock lucrative.

Disclaimer: The views and tips by investment experts on Moneycontrol.com are their own, and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking investment decisions.