Shares of ICICI Prudential Life Insurance Company surged in intra-day trade today after the company posted a 23% year-on-year (YoY) growth in value of new business (VoNB) premiums during the March quarter (Q4FY21), led by steady traction in both the regular and single premium businesses.

VoNB is the present value of expected future earnings from new policies written during a specified period. It reflects the additional value to shareholders expected to be generated through the activity of writing new policies during a specified period.

On an annualised premium equivalent (APE) basis too, the insurer's business grew by 27%, ending the streak of contraction for three consecutive quarters.

APE is the sum of annualised first year premiums on regular premium policies, and 10% of single premiums, written by the company during any period come from new retail and group customers.

This cheered investors with the shares gaining more than 6% in early trade today.

--- Advertisement ---

The company ended FY21 with a 40% YoY growth in assets under management (AUM) at Rs 2.2 trillion and became the market leader among private insurers in new business sum assured with a 13% market share, up from 11.8% a year ago.

The focus on maintaining balance sheet resilience through a robust risk management mechanism and investment policy has helped ensure zero non-performing assets since inception and across market cycles, Chief executive and Managing Director N S Kannan told in a post-earnings call.

He also attributed the numbers to a well-diversified product and distribution mix and expressed hope that the company is well poised to achieve the stated objective of doubling its FY19 VoNB.

Despite reporting a good set of overall numbers, the net profit of ICICI Prudential Life Insurance fell by 65% year-on-year (YoY) to Rs 625 million during the quarter, on account of provisions of Rs 2 billion for the pandemic.

However, Rs 74 billion of investment income, as a result of gains from the market, against a loss of Rs 180 billion in the corresponding period last year, helped it cushion the hit.

The company also had a payout of Rs 2.7 billion, net of reinsurance for 205 claims from the pandemic deaths.

With the additional Rs 2 billion of provisions for this quarter, the total amount of provisions set aside stands at Rs 3 billion, taking the company's solvency ratio to 217% (well above the regulatory requirement of 150%) with zero NPAs, well protecting its embedded value which rose 26% YoY to Rs 211 billion.

The board of directors of the company also approved a final dividend of Rs 2 per equity share for FY21.

We reached out to Tanushree Banerjee, Co-Head of Research at Equitymaster, and Editor of the premium stock recommendation service, StockSelect, for her view on the company.

Here's what she has to say -

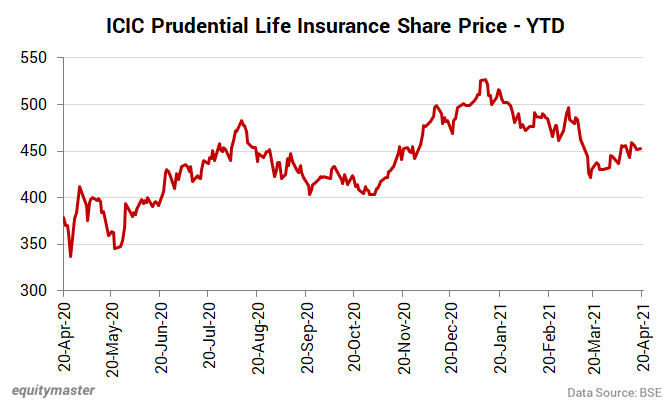

Shares of ICICI Prudential Life Insurance Company opened at Rs 462.3 on the BSE and Rs 465.5 on the NSE and gained 8.8% in early trade today.

The stock closed at Rs 478.3 (up 5.8%) on the BSE and Rs 476.8 (up 5.5%) on the NSE, respectively.

At its current price, it is trading at a P/E of 64.1.

The share also touched its 52-week high of Rs 537.9 on January 8, 2021, and its 52-week low of Rs 329.8 on April 24, 2020.

ICICI Prudential Life Insurance Company is in the business of providing life insurance, pensions and health insurance products to individuals and groups.

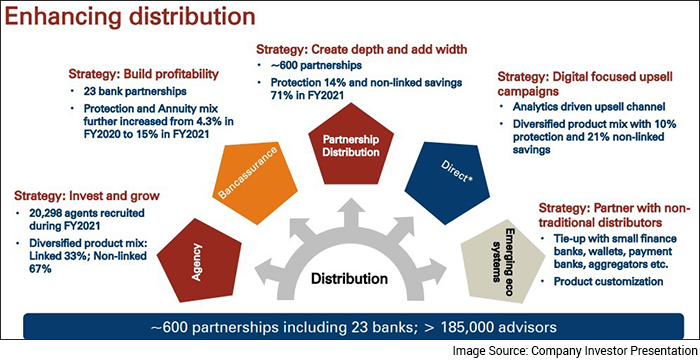

These products are distributed through individual agents, corporate agents, banks, brokers, the company's proprietary sales force and the company website. Riders providing additional benefits are offered under some of these products.

It is also one of the largest private-sector life insurers in the country based on new business premiums, its strong bancassurance channel, robust underwriting performance with an increasing focus on the protection business and comfortable solvency levels.

For more details about the insurance sector, you can check out the insurance sector report on our website.

And to know what's moving the Indian stock markets today, check out the most recent share market updates here.

ICICI PRUDENTIAL LIFE INSURANCE share price is trading up by 10% and its current market price is Rs 501. The BSE 500 is up by 0.9%. The top gainers in the BSE 500 Index are ICICI PRUDENTIAL LIFE INSURANCE (up 10.2%) and SYMPHONY (up 12.4%). The top losers are HDFC BANK and BLUE DART EXPRESS .

GLENMARK PHARMA share price has hit a 52-week high. It is presently trading at Rs 589. BSE 500 Index is up by 1.1% at 19,461. Within the BSE 500, GLENMARK PHARMA (up 0.1%) and ICICI PRUDENTIAL LIFE INSURANCE (up 6.7%) are among the top gainers, while top losers are GE POWER INDIA and OMAXE.

More Views on NewsA look at the various types of primary and secondary markets and the key differences between them.

Ajit Dayal on how India's vaccine strategy will impact the markets.

Apr 15, 2021Narayana Murthy was one of the first unicorn founders to get the backing of this entity...

Apr 16, 2021There is no stopping this 11-bagger stock from significant upside.

In this video, I'll you what I think is the real reason behind yesterday's market crash.

More

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!