(Image: HCL)

HCL Technologies share price gained in the afternoon session on April 19 after the IT major signed a multi-million dollar contract with Japan-based UD Trucks for digital services.

HCL Technologies announced it signed a multi-million dollar digital transformation and hybrid cloud contract with the Japanese commercial vehicle solutions provider. HCL will deliver end-to-end IT transformation spanning across digital platforms, agile digital application development, migration, support and maintenance and digital workplace services, the company said in an exchange filing.

"With this new partnership, HCL will further accelerate UD Trucks’ digital transformation journey. Recent changes in its operational structure have required UD Trucks to build and migrate to its own dedicated IT environment, while at the same time ensuring service continuity. By moving to a new next-generation IT environment, UD Trucks aims at leveraging the power of cloud and IoT while providing its employees globally with an enhanced user experience," it added.

The stock was trading at Rs 1,017.50, up Rs 4.95, or 0.49 percent, at 1254 hours. It has touched an intraday high of Rs 1,018.55 and an intraday low of Rs 984.60.

Brokerage firm Axis Securities said the COVID-19 outbreak would create huge opportunities across geographies and services for HCL Tech to post strong organic growth over different verticals. "We believe HCL Tech has a resilient business structure from a long-term perspective. We recommend buy and assign 16 x P/E multiple to its FY23E earnings of Rs 59.8, which gives a target price of Rs 1,136 per share," it said.

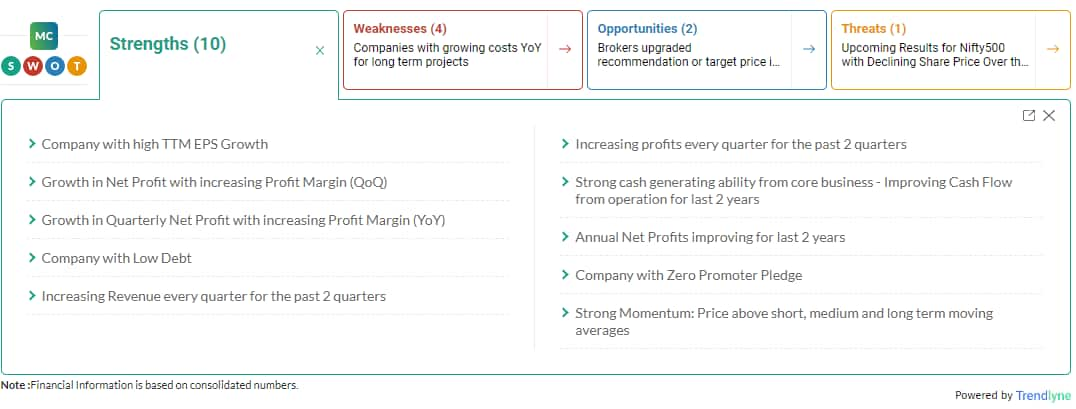

According to Moneycontrol SWOT Analysis powered by Trendlyne, the stock is showing strong momentum—price above short, medium and long term moving averages. It has low debt with strong cash-generating ability from core business, with cash flow from operation improving for the last two years.

Moneycontrol technical rating is very bullish with moving averages and technical indicators being bullish.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.