Bitcoin Hits New High as Crypto Acceptance Goes Global

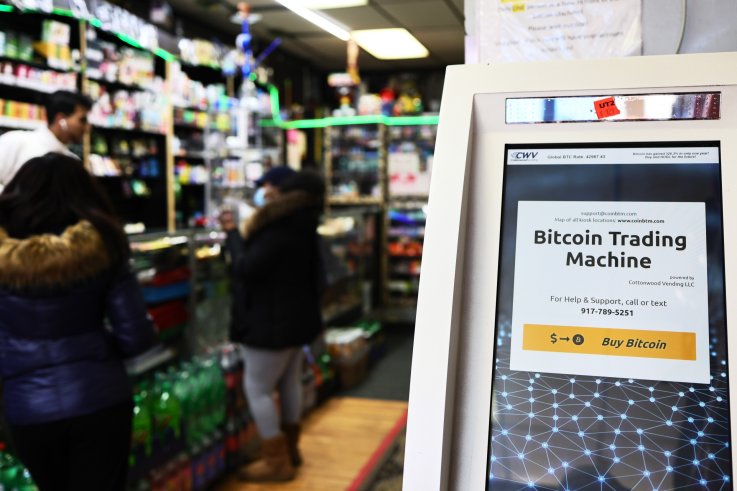

Bitcoin surged to a new high Tuesday as investors bet on its growing strength as a long-term investment and increasing acceptance in commerce.

Many institutional investors are buying and holding the cryptocurrency in anticipation of future price gains. This tactic reduces the number of coins available, driving up the price for new investors or those seeking to expand their holdings.

"Most new price discovery is momentum driven, but the bigger question is always what's driving that momentum and just how far will it go," Jason Deane, Bitcoin analyst at Quantum Economics in London, told Newsweek.

"The narrative about Bitcoin is currently incredibly bullish, from announcements of specific Microstrategy employees either being paid or wanting to be paid with it, ongoing technical developments to the underlying blockchain due to come on line this year and aggressive expansion of the big payment platforms—Ebay, Visa, Mastercard—into the world of cryptocurrencies," Deane said. "Each of these factors drives Bitcoin's credibility, usability and accessibility ever upwards, creating a new round of investors and developers."

Despite growing acceptance, Deane said Bitcoin has barely reached the "early adopter" stage on a global scale.

"It seems feasible that there is room for considerable growth ahead," he said.

Bitcoin also got a boost from Coinbase's plans to launch an IPO Wednesday on Nasdaq through a direct listing. Coinbase is a cryptocurrency trading platform.

"The Coinbase IPO validates digital assets and also demonstrates the paradigm shift towards digitalization is happening faster than most expected," Kevin Kang, co-founder of BKCoin Capital, a Miami-based asset management firm, said in a statement.

"Coinbase's expected valuation of $100 billion is bigger than any of the incumbents —Nasdaq ($25 billion), London Stock Exchange ($35 billion), Intercontinental Exchange ($65 billion), and CME Group ($74 billion)."

Bitcoin has climbed about 45% since Coinbase filed its IPO registration statement with the U.S. Securities and Exchange Commission. The price appreciation isn't solely due to Coinbase's IPO, but the deal underscores the cryptocurrency's emergence as an asset class.

The IPO is likely to establish Coinbase as the largest trading platform, and could heighten interest in other companies active in cryptocurrencies such as MicroStrategy and Square.

Elon Musk boosted Bitcoin's profile earlier this year after his electric car company invested $1.5 billion in the cryptocurrency and garnered a hefty return. Newsweek reported that its growing acceptance in established financial markets has prompted some analysts to ask, "Is Bitcoin Too Big to Fail?"

"To put this in perspective, Tesla is on a trajectory to make more from its Bitcoin investments than profits from selling its EV cars in all of 2020," Daniel Ives, an analyst at Wedbush Securities in Los Angeles, said in a research note.

"While the Bitcoin investment is a sideshow for Tesla, it's clearly been a good initial investment and a trend we expect could have a ripple impact for other public companies over the next 12 to 18 months," Ives said.

But no investment progresses in a straight line.

"Markets tend to overreact both upwards and downwards when big moves happen, especially in a young and relatively new asset class like Bitcoin," Quantum's Deane said.

"However, in our view, there is enough supporting data to show strong fundamentals as a justification for current price activity," he said. "Ultimately, of course, it should be remembered that markets dictate fair price for any asset and the market will let us know in due course what that price is rather than the other way around."

In midday trading Tuesday, Bitcoin changed hands at $63,299.90 after climbing to $63,707.34. The previous high was $61,712. Bitcoin is 116.88% for the year. The cryptocurrency's market cap is now $1.18 trillion, CoinDesk reported.

Market Pulse

Producer prices increased 1% in March, or twice the consensus estimate by economists. Demand is surging as the economy reopens, thanks to fat savings accounts, government stimulus checks and a pent-up desire to spend.

Part of the jump in prices reflects a rebound from last year's sour economy due to the COVID-19 pandemic and recent limits on production, including kinks in the supply chain epitomized by last month's blockage of the Suez Canal.

The consumer price index, a measure of everyday items such as groceries, clothing and vehicles, increased 2.6% for the year ended in March and rose a seasonably adjusted 0.6% in March compared with February, the Labor Department said.

Yield on the 10-year U.S. Treasury bond—the benchmark for interest rates, including mortgages—has risen, suggesting inflation ahead.

But the Federal Reserve, the nation's central bank, said the uptick in inflation will be "transitory" and will recede later this year as supply increases.

Analysts at S&P Global in New York share that view.

"We don't see runaway inflation as an imminent risk—actual inflation is nowhere near what markets are pricing in, and even with a near-term price lift, it won't be enough to signal runaway inflation," Beth Ann Bovino, S&P Global's chief U.S. economist, said in a research report.

"In fact, it barely eked higher in February, as rising gasoline prices lifted overall (Consumer Price Index) just 0.4%, and core CPI—excluding food and energy— rose just 0.1%. On an annual basis, core CPI rose 1.3% and core (Personal Consumption Expenditures) rose 1.4%—well below the Fed's 2% target."

This doesn't signal the runaway inflation some feared from massive government spending as part of the effort to support the economy during the coronavirus pandemic and the Federal Reserve's expansion of the money supply.

"It's especially striking that core inflation in the U.S. has remained within a two-percentage-point band of 0.9% - 2.9% in the past quarter-century or so, considering the political and economic events during that time," Bovino said.

The U.S. labor market is recovering. The unemployment rate peaked at 14.7% in April 2020 and dropped to 6% last month.

The number of people not in the labor force who want to work remained steady at about 6.9 million in March, but up 1.8 million since February 2020. However, these individuals weren't counted as unemployed because they hadn't looked for a job in the last four weeks or were unavailable to work, the U.S. Bureau of Labor Statistics reported.

S&P Global doesn't expect the labor market to fully recover until mid-2023, easing the short-term price spike caused by reopening the economy.

"After the transitory factors, such as the base effect and reopening spending spree, we expect the long-term trends that have held prices down for decades to resurface," the S&P analyst said.

"One of these is globalization. With advances in technology, things can be made anywhere around the world, making it difficult to raise wages or prices," Bovino said. "If a business does raise wage costs or prices, buyers can find a cheaper place in the world to purchase a product or (nowadays) service. In addition, the 'gig' economy often means less bargaining power for workers, resulting in lower wages."