In a bid to encourage digital payments in India and popularise UPI transactions across all sections of the population, the State Bank of India (SBI) and digital payments National Payments Corporation of India (NPCI) are together launching a campaign. The motive behind this campaign is to encourage more and more YONO users to opt for UPI payments that are easy, safe, and quick.

SBI's banking and lifestyle platform YONO has observed 34 lakh UPI registrations with over 62.5 lakh transactions worth more than Rs. 2,520 crore since 2017. The current daily average of nearly 27,000 transactions has been made in the last 30 days.

Through this initiative, SBI and NPCI will educate YONO users about UPI's benefits so that there are more and more UPI users in the ecosystem.

Praveena Rai, COO, NPCI said, "Customers just need to know their UPI ID and use it so they can enjoy the convenience of making or receiving payment from their YONO app to any other bank or payment app. With this campaign, we aim to witness increasing numbers of UPI users which is a step further towards less-cash economy."

SBI is the largest public sector banking and financial service in the country in terms of assets, deposits, branches, customers, and employees.

The number of customers using internet banking and mobile banking stand at 85 million and 19 million respectively.

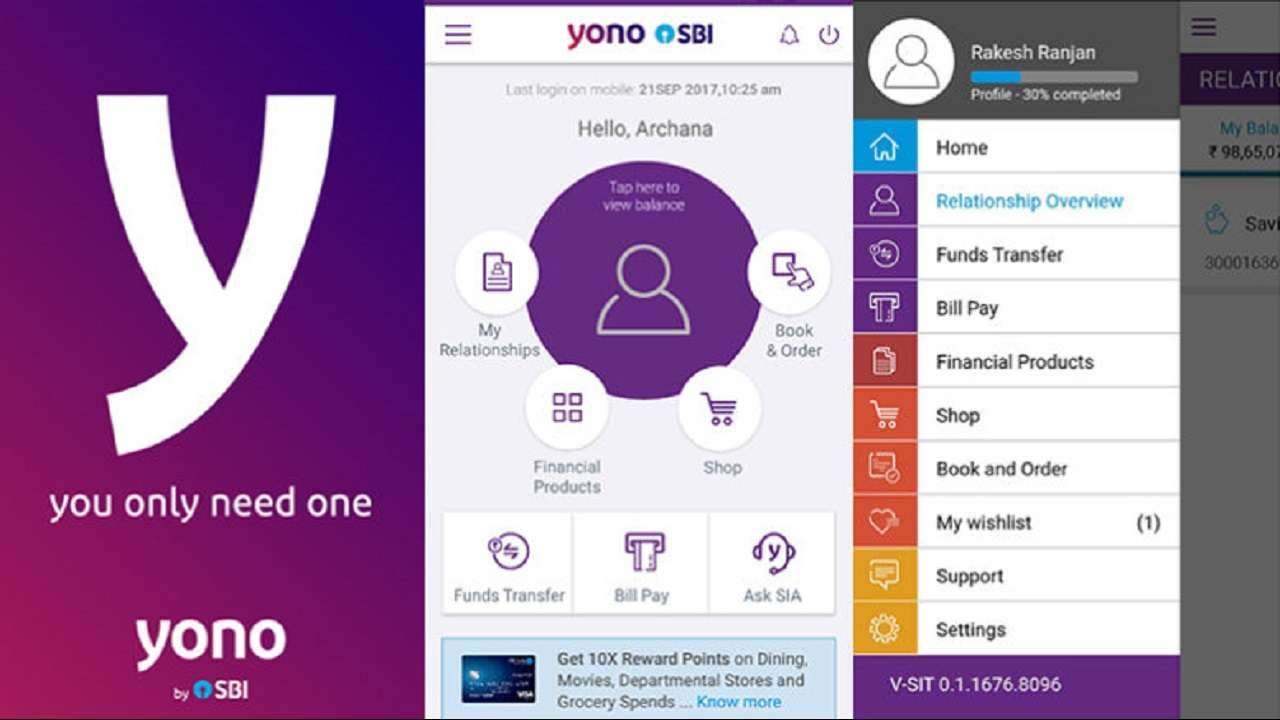

The integrated digital and lifestyle platform by SBI - YONO has crossed the 74 million downloads mark.

YONO which has over 34.5 million registered users, witnesses 9 million logins per day.

UPI is a system that powers multiple bank accounts into a single mobile application, merging several banking features, seamless fund routing & merchant payments into one hood.

It also caters to the 'Peer to Peer' collect request which can be scheduled and paid as per requirement and convenience.

Immediate money transfer through mobile device round the clock 365 days.

Single mobile application for accessing different bank accounts.

Single Click 2 Factor Authentication - Aligned with the Regulatory guidelines, yet provides for a very strong feature of seamless single click payment.

The virtual address of the customer for Pull & Push provides for incremental security with the customer not required to enter the details such as Card no, Account number; IFSC etc.

The best answer to Cash-on-Delivery (COD) hassle, running to an ATM or rendering the exact amount.

Merchant Payment with Single Application or In-App Payments.

Utility Bill Payments, Over the Counter Payments, Barcode (Scan and Pay) based payments.