The market remained rangebound with a positive bias and ended off day's high on April 8. The rally in metals and IT stocks supported the market, whereas the selling pressure in banks limited upside.

The BSE Sensex gained 84.45 points at 49,746.21, while the Nifty50 rose 54.80 points to 14,873.80 and formed a Doji kind of pattern on the daily charts as the closing was near its opening levels.

"The daily price action has formed a 'Doji' Candlestick pattern representing indecision at current levels. The Nifty50 has marked an intraday high above its two weeks multiple resistance zone of 14,900 levels; however, it failed to surpass the same on a closing basis. Hence, any sustainable close above 14,900 levels will confirm 'consolidation range' (14,900-14,400) breakout," Rajesh Palviya, Head - Technical and Derivative Research at Axis Securities told Moneycontrol.

"Since the past couple of sessions, Nifty is sustaining above its 20 DMA and 50 DMA which support bullish sentiments ahead. The next higher levels to be watched are around 14,980-15,080 levels," he added.

The broader markets outpaced frontliners as the Nifty Midcap 100 index was up 0.53 percent and Smallcap 100 index gained 1.24 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,801.87, followed by 14,729.93. If the index moves up, the key resistance levels to watch out for are 14,964.97 and 15,056.13.

Nifty Bank

The Nifty Bank index fell 208.35 points to 32,782.85 on April 8. The important pivot level, which will act as crucial support for the index, is placed at 32,556.2, followed by 32,329.5. On the upside, key resistance levels are placed at 33,158.2 and 33,533.5 levels.

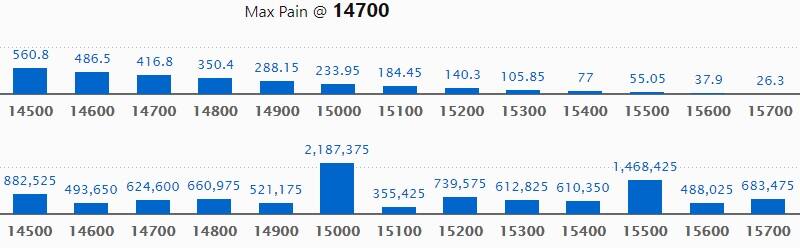

Call option data

Maximum Call open interest of 21.87 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 15,500 strike, which holds 14.68 lakh contracts, and 14,500 strike, which has accumulated 8.82 lakh contracts.

Call writing was seen at 15,200 strike, which added 1.06 lakh contracts, followed by 15,400 and 15,000 strikes which added 1.05 lakh contracts.

Call unwinding was seen at 15,800 strike, which shed 1.24 lakh contracts, followed by 14,500 strike which shed 75,150 contracts and 14,700 strike which shed 74,325 contracts.

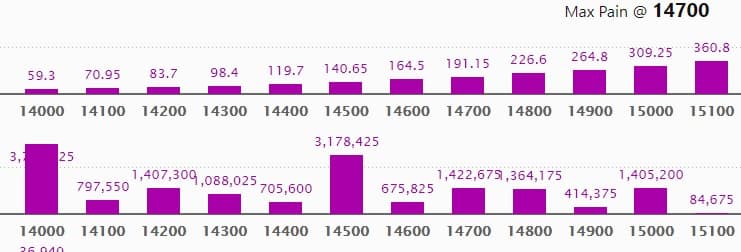

Put option data

Maximum Put open interest of 37.13 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the April series.

This is followed by 14,500 strike, which holds 31.78 lakh contracts, and 14,700 strike, which has accumulated 14.22 lakh contracts.

Put writing was seen at 15,000 strike, which added 2.08 lakh contracts, followed by 14,900 strike which added 1.6 lakh contracts and 14,500 strike which added 69,000 contracts.

Put unwinding was seen at 14,000 strike, which shed 1.17 lakh contracts, followed by 14,700 strike which shed 1.1 lakh contracts.

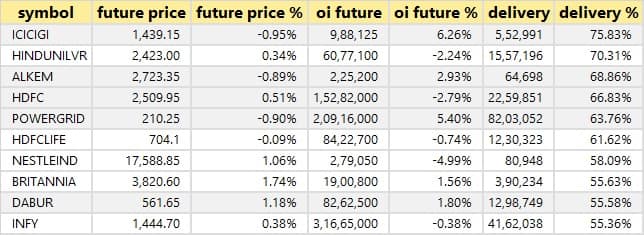

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

52 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

26 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

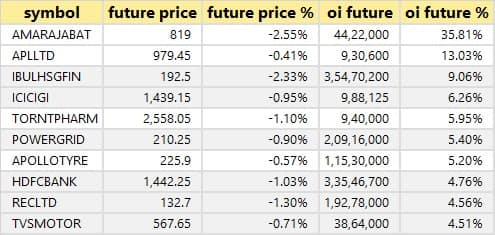

29 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

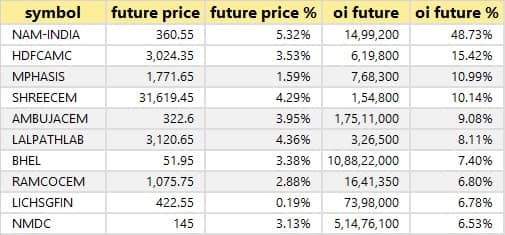

50 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

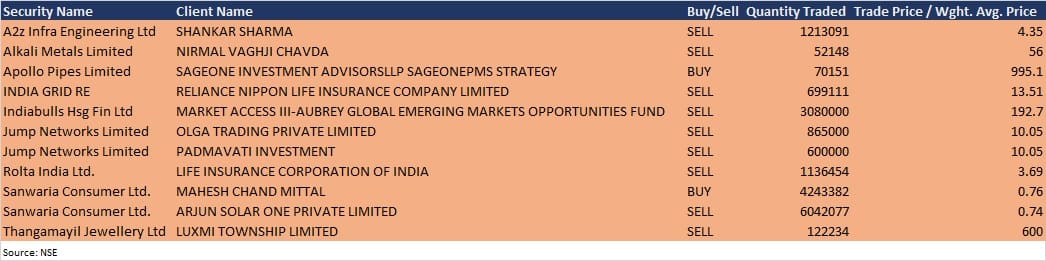

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Punjab National Bank: The representatives of the bank will have a virtual meeting with investors and analysts on April 9.

Prince Pipes and Fittings: The company's officials will interact with InCred Research Services on April 9.

5paisa Capital: A meeting of the board of directors of the company is proposed to be held on April 13 to consider raising funds by issuing equity shares and warrants of the company on a preferential basis.

Tejas Networks: The meeting of the board of directors of the company is scheduled on April 21 to consider the audited financial results.

Everest Industries: The meeting of the board of directors of the company is scheduled on May 7 to consider the audited financial results for the year ended March 31, 2021, and recommendation of dividend, if any, for the financial year FY21.

Stocks in the news

Srei Infrastructure Finance: In a BSE filing, subsidiary Srei Equipment Finance said it had received an expression of interest for up to $250 million capital infusion in the company from international PE funds. The international private equity funds are US-based Arena Investors LP and Singapore's Makara Capital Partners.

CEAT: CEAT in its BSE filing said it had entered into a Third Addendum Agreement to the existing Share Subscription and Shareholders' Agreement with Tyresnmore Online Private Limited, an associate of the company and other parties, for making a future investment of up to Rs 2.4 crore in Tyresnmore, to acquire additional 3.47 percent of the post issue total share capital of Tyresnmore. Upon completion of the investment, the total holding of CEAT in Tyresnmore would be 44.17 percent.

Zensar Technologies: Zensar Technologies has entered into a global strategic partnership with US-based Claimatic. This new, innovative partnership leverages the respective strengths of Claimatic and Zensar to create compelling value for both companies and their mutual clients, the company in its BSE filing said.

Ashok Leyland: Ashok Leyland's unit Switch Mobility Automotive and Siemens have entered into a Memorandum of Understanding to build a co-operative technological partnership in the electric commercial mobility segment and execute eMobility projects in India. "Siemens' charging infrastructure management software solution would enhance the energy-efficient operations of the chargers," the company in its BSE filing said.

Thyrocare Technologies: Arindam Haldar resigned from his current post - Chief Executive Officer - of Thyrocare Technologies, for personal reasons. He had joined Thyrocare Technologies in September 2020.

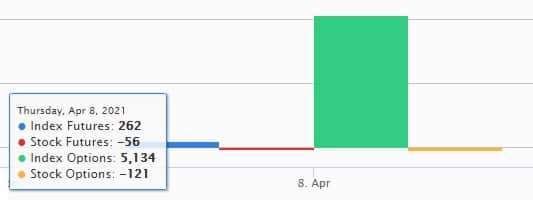

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 110.85 crore, while domestic institutional investors (DIIs) net acquired shares worth Rs 552.78 crore in the Indian equity market on April 8, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - SAIL - is under the F&O ban for April 9. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.