JPMorgan Chase & Co. CEO Jamie Dimon took the leadership spot at the largest U.S. bank in December 2005. It has been an excellent run for the bank’s investors, as you can see below.

In his latest letter to shareholders April 7, Dimon wrote that over the long term, the performance of JPMorgan Chase’s

JPM,

Those are fine words, backed by outperformance against the S&P 500 Index

SPX,

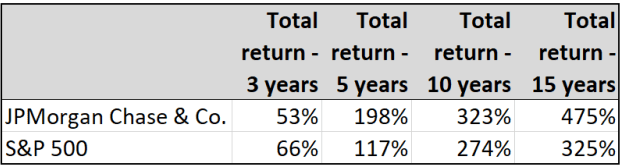

Check out these total returns for JPM and the index (both with dividends reinvested) for longer periods through April 6:

So JPM has soundly beaten the S&P 500’s total return for five, 10 and 15 years. It has trailed for three years, but keep in mind what a remarkable run the index has had, led by rapidly growing tech-oriented companies. It’s also worth noting that bank stocks tend to trade at price-to-earnings ratios of about 60% to 70% of the index’s P/E.

As of the close April 6, the forward P/E ratio for the SPDR S&P 500 ETF Trust

SPY,

Bank earnings in the spotlight

Bank earnings season begins on April 14, when JPM, Wells Fargo & Co.

WFC,

Odeon Capital Group analyst Dick Bove advised clients in a note April 6 “to avoid making investment decisions based on first-quarter results.”

He expects that in the second half of 2021, “the economy will be growing so rapidly that when we reach that period, bank earnings will be soaring.” He has “buy” ratings on all of the big six U.S. banks listed above.

How the big bank stocks have performed

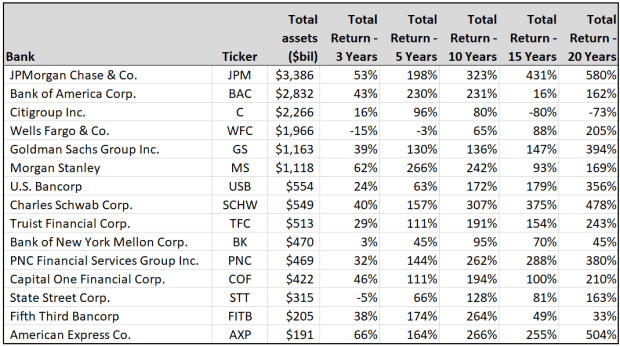

Here’s a ranking of the 15 largest U.S. banks by asset size, with long-term total returns through April 6:

For the definition of “bank,” we have included bank and thrift holding companies. So Charles Schwab Corp.

SCHW,

Looking back at the 20-, 15- and 10-year periods, JPM has had the strongest total returns. For five years, Morgan Stanley has been the clear leader, followed by Bank of America, with JPM ranked third. For three years, American Express Co.

AXP,

Don’t miss: These stocks seem expensive now, but in two years you may wish you’d bought them at these prices