While the oil market has seen some volatility on news of multiparty talks getting underway in Vienna aimed at bringing the U.S. back into the 2015 nuclear treaty with Iran, don’t look for much quick progress.

Here’s a look at what’s at stake:

What’s happening?

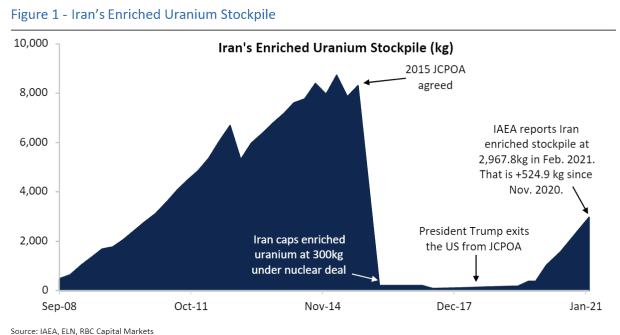

In 2018, then-President Donald Trump pulled the U.S. out of the 2015 Joint Comprehensive Plan for Action, otherwise known as the Iranian nuclear deal, which put limits on the country’s nuclear enrichment efforts. Even though the International Atomic Energy Agency said Iran was largely complying with the deal, Trump reimposed previous sanctions and added new ones in what the administration called a campaign of maximum pressure.

Iran responded by breaching terms of the agreement, boosting its nuclear capabilities. Its stockpile of enriched uranium has grown significantly, according to the International Atomic Energy Agency, but remains well below levels seen before the 2015 deal.

Negotiators from other nations that signed the JCPOA — Russia, China, France and Britain — began meetings Tuesday in Vienna aimed at getting the agreement back on track. U.S. negotiators were present, but not meeting face-to-face with Iranian officials. Instead, European negotiators have served as go-betweens.

See: White House sees ‘long process’ as nuclear talks with Iran resume

How far apart are U.S., Iran?

Both the U.S. and Iran have insisted the other side must move first.

U.S. officials sounded like they were softening their stance somewhat ahead of the talks, said Helima Croft, head of global commodity strategy at RBC Capital Markets, in a Monday note, citing an April 2 television interview with Robert Malley, the U.S. special envoy to Iran.

“Noticeably absent were the emphatic statements that Iran must make the first move and reverse all JCPOA breeches and that there was no urgency to reach an agreement. This potentially leaves the door open for face-saving simultaneous action on the part of Washington and Tehran,” Croft wrote.

Significant movement in the talks would make prospects for the return of large quantities of Iran oil exports in the second half of this year “quite high,” she said. But the position of Iranian Supreme Leader Ali Khamenei remains unclear and remains the biggest uncertainty around the talks.

“If Washington or Tehran (or both) dig in and there is no breakthrough in the next few weeks, we think the chances of reviving the deal and fully restoring Iranian oil exports this year will be greatly diminished,” Croft wrote.

What’s at stake for the oil market?

Oil futures fell sharply Monday, in a move traders attributed in part to expectations the talks could make progress, though analysts said the move, which was also blamed on other factors, was likely overdone. Oil took back some lost ground on Tuesday, with June Brent crude BRN00, the global benchmark, up 57 cents, or 0.9%, at $62.71 a barrel on ICE Futures Europe. May West Texas Intermediate crude CL CLK21, the U.S. benchmark, was up 60 cents, or 1%, at $59.25 a barrel on the New York Mercantile Exchange.

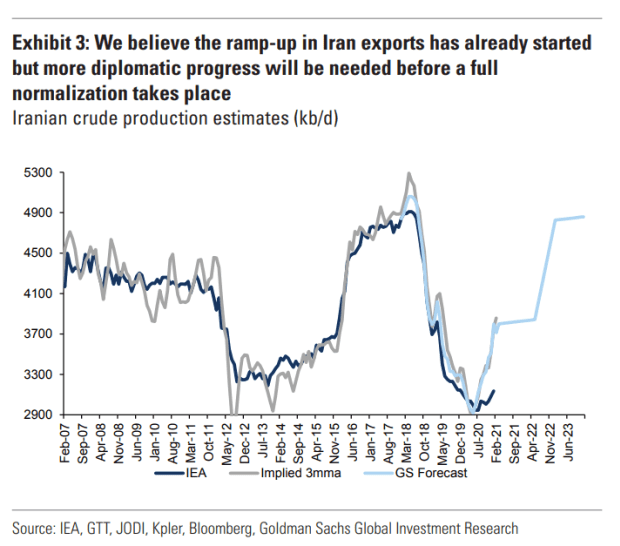

Iran appears to have already boosted oil exports somewhat, according to news reports, with China seen ramping up purchases in March.

Analysts at Goldman Sachs recently raised their estimate of Iranian production to 2.7 million barrels a day based on what the firm said it had identified as a large increase in exports so far this year. They expect production to remain near that level until the second quarter of next year, followed by an increase of 900,000 barrels a day through the end of 2022. They also assume a 20 million barrel discharge of oil from floating storage over the next six month as talks resume (see chart below).

The Goldman analysts said the talks aren’t a threat to their bullish view on oil prices, but could affect the “price path.” Given the Biden administration’s desire to re-enter the agreement, most analysts look for Iranian crude to return to the market at some point, they said. Meanwhile, the Organization of the Petroleum Exporting Countries and its allies would likely move to adjust production to accommodate the rise.

But “shifts” in the timing of a deal could create “asymmetric risk” to Goldman’s forecasts for a year-end price of $75 a barrel for Brent in 2021 and 2022. Normalization before year-end would reduce the forecast by $5 a barrel, while a lack of a deal in 2022 could create more than $10 a barrel in upside risk, they said.