Shorter India Bonds Rally as Virus Spike Fuels Dovish Rate Bets

(Bloomberg) -- Shorter-maturity Indian sovereign bonds rallied as a record jump in coronavirus infections reinforced the case for policy to remain accommodative. Supply factors also helped.

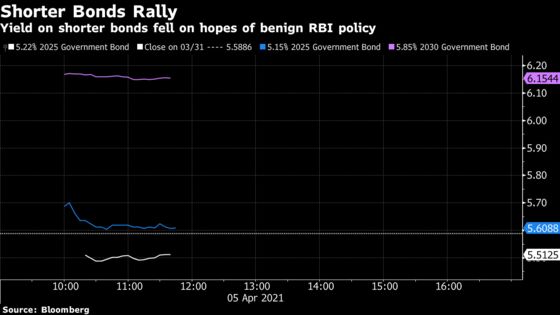

Yields on the 5.22% 2025 bond slumped eight basis points to 5.51%, while that on the 5.15% 2025 debt slid nine basis points to 5.61%. In contrast, the benchmark 10-year yield was down one basis point.

Traders are recalibrating bets for India’s rate outlook after an unprecedented increase in virus infections triggered curbs on movements in the nation’s richest state. Expectations had been building that the central bank could shift to a tightening mode later in the year, with investors awaiting a policy review on Wednesday for clues.

“If the Monetary Policy Committee was thinking of reacting to inflation pressures, Covid might stay their hand and they won’t do anything,” said Harihar Krishnamoorthy, treasurer at FirstRand Bank in Mumbai. “Most people had been expecting that in the second half of the year, we would start to see rate hikes start to begin. Probably that certainty is not there.”

All 27 economists in a Bloomberg survey expect the Reserve Bank of India to keep the benchmark rate on hold on Wednesday.

The bond rally also came on the heels of the fiscal 2022 first-half borrowing calender released last week which shows issuance tilted toward the long end. Debt with maturities of over 30 years accounted for 27.5% of total issuance, compared with 21.5% a year ago, according to a note from Kotak Mahindra Bank Ltd. Securities due in less than five years made up 24.7% of the total, versus 31.4% previously, it estimated.

The pattern of issuance suggests pressure will weigh more heavily on the longer end of the yield curve, said Madhavi Arora, economist at Emkay Global Financial Services Ltd. The RBI will need to conduct 4.5 trillion to 4.8 trillion rupees ($61 billion to $65 billion) of open-market operations this fiscal year, she said.

©2021 Bloomberg L.P.