Increased Demand for Options Indicate Bitcoin Heading Even Higher

Increased demand for options suggests Bitcoin may soon be headed for a new high, and perhaps a bull market.

"As #BTC (Bitcoin) is flirting with new highs, options are starting to react with call demand," Genesis Volatility, a Chicago-based cryptocurrency analytics website, tweeted.

A call option gives the investor the right, but not the obligation, to buy an asset at a predetermined price on or before a specified date. A put option gives the investor the right to sell.

In mid-day trading Thursday, Bitcoin changed hands at $58,818.96, or 4.45% below the record high of $61,556.59.

Nevertheless, the cryptocurrency is up 102.64% for the year, CoinDesk reported.

Genesis Volatility said the options skew, or the difference between implied volatility from the difference between call and put options, is rising.

Higher prices aren't guaranteed, but Bitcoin is driven by supply and demand. The price can be volatile, but movement isn't irrational or random.

The number of Bitcoins is capped at 21 million and demand is strong, especially as major companies and Wall Street institutions add Bitcoin to their portfolio as a long-term investment and inflation hedge.

Holding coins on the expectation of future price appreciation reduces the number available on the spot market and drives up the price.

If Bitcoin reaches a new high, it might continue to climb until some investors decide to pocket profits. That could lead to a temporary halt in the upward trajectory or even a slight decline similar to the pullback after Bitcoin reached $61,556 on March 13.

The cryptocurrency then fell about 18.12% from its high to about $50,400 before rebounding. A drop of 20% or more is considered a bear market.

The Grayscale Bitcoin Trust is the first digital currency investment registered with the U.S. Securities and Exchange Commission. It allows institutions and accredited individuals to buy and sell the trust's shares over-the-counter.

Market Pulse

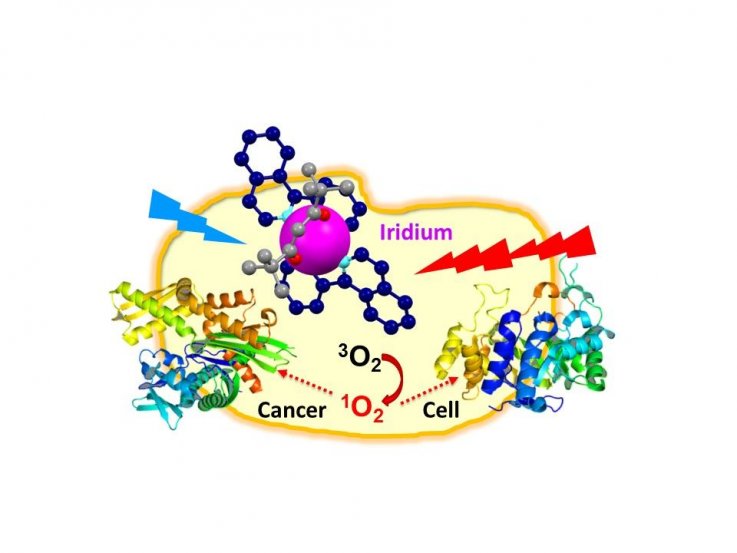

The asteroid that slammed into earth about 65 million years ago and wiped out the dinosaurs is thought to be responsible for the thin layer of iridium-rich clay found throughout the world.

But it took the development of LED screens and backlit displays such as Apple iPads and iPhones to make iridium more valuable than gold. The rare metal recently fetched $6,200 an ounce. Gold traded at $1,714.60 an ounce.

The reason: Gold is about 40 times more common than iridium.

Earlier this year, analysts thought iridium's price might climb to as much as $5,000 in 2021. It broke $1,000 an ounce in 2011.

Heraeus, a technology group headquartered in Hanau, Germany with offices in China, India, Ireland, South Africa, Turkey and the United States, said supply disruptions and increasing demand have driven iridium's price to record highs.

Production cycles are long. Iridium is recovered as a byproduct of copper and nickel mining. There are about 2 parts per billion in the earth's crust.

Therefore, when demand increased and production slowed the only way to increase supply quickly was to boost prices to entice people to sell existing supplies.

Investing in iridium can be almost as difficult producing it because it's not traded on a market and unlike Bitcoin, there are no exchange-traded funds tracking its price.

Retail buyers looking to place their bets are limited to buying ingots from a few dealers willing to deal in small lots. Major users and investors typically deal directly with the producers.

In 1803, British chemist Smithson Tennant found trace amounts of iridium in platinum ores. He called the new element iridium after Iris, who in Greek mythology personified the rainbow. Iridium salts are multicolored.

In 1961, German chemist Rudolf Ludwig Mossbauer won the Nobel Prize in physics after he used iridium to better understand nuclear structure through the absorption and re-emission of gamma rays. The phenomenon is known as the Mossbauer effect.

Iridium resists corrosion better than any other metal. It also has a high melting point – 4,435 degrees Fahrenheit – and trace amounts are used in spark plugs for general aviation aircraft.

The rare element is also combined with osmium to make fountain pen nibs, pivot bearings and specialized scientific equipment.

April Fool's Day - A Brief History

To trace the origin of April Fools Day, turn to John 22 in the New Testament. If you don't find the answer there, others have plenty of theories.

Scholars speculate April Fools Day dates to 1582 when France adopted the Julian calendar and ditched the Gregorian version to comply with the Council of Trent's decision in 1563.

Some people, especially those in rural areas, failed to realize that the New Year began January 1 on the new calendar, and continued to celebrate the old dates during the last week of March through April 1.

Pranksters, the theory goes, attached paper fish to the backs of those who hadn't adopted the new calendar and called them "April fish" because they were gullible and easily hooked.

In 18th Century England and Scotland, April Fool's became a two-day event.

The unsuspecting were sent on a gowk hunt—phony errands such as getting the Navy's cannon report or to assist with washing of the Royal lion near Buckingham Palace. The earnest searchers apparently forgot that "gowk" is a cuckoo bird, a polite way of saying fool. And cats don't like water.

The second day of festivities often involved practical jokes such as pinning fake tails or "kick me" signs on the backsides of the unsuspecting.

In the early 20th Century, a German newspaper reported an April Fool's story that thieves had tunneled into the U.S. Treasury and stolen all the gold and silver. The story was picked up by other newspapers, pre-dating the current rash of "fake news."

Then there was the Swiss spaghetti harvest, not to be confused with the Nebraska lobster fest.

In 1992, National Public Radio ran a clip of Richard Nixon saying he planned to run again for president. "I never did anything wrong, and I won't do it again," the Watergate hero intoned in the clip. Nixon died two years later.

In 1996, Taco Bell said it had purchased the Liberty Bell in Philadelphia. Some people went nuts, but it was a good marketing trick.

Google built on the marketing ploy.

In 2014, the Internet search giant offered a Pokemon game and said players could use Google maps to track down Pikachus and Bulbasaurs. The prize: a job at Google with the grandiloquent title of "Pokemon Master."

For the unimaginative, the Internet is filled with stories about the 15 or 48 best pranks to pull on April 1. There are even stories about harmless pranks suitable for kids.

And in case you've forgotten, there are 21 chapters in the Gospel According to John.