IRCTC | Indian Railway Catering and Tourism Corporation said there has been no major impact of terminations of mobile catering contracts in the financial year 2020-21. "The impact, if any, will be reassessed on resumption of regular train services and subject to outcome of the ongoing litigation," it added. Earlier in the March, IRCTC following directive of Ministry of Railways terminated all existing contracts of mobile catering (currently kept in abeyance) involving scope of work of providing cooked food to passengers prepared from base kitchens. The stock closed 4.28 percent lower at Rs 1,821.60 on March 17. It hit a 52-week high of Rs 2,072.95 on March 9, 2021, and a low of Rs 774.85 on March 26, 2020. The market-cap of the company stands at Rs 29,145.60 crore. In terms of technicals, the current rating by Moneycontrol on the stock is Neutral. The important support levels for the stock are placed at Rs 1,882.80-1,861.55, while resistance is placed at Rs 1,932.50-1,960.95, data from Moneycontrol.com showed.

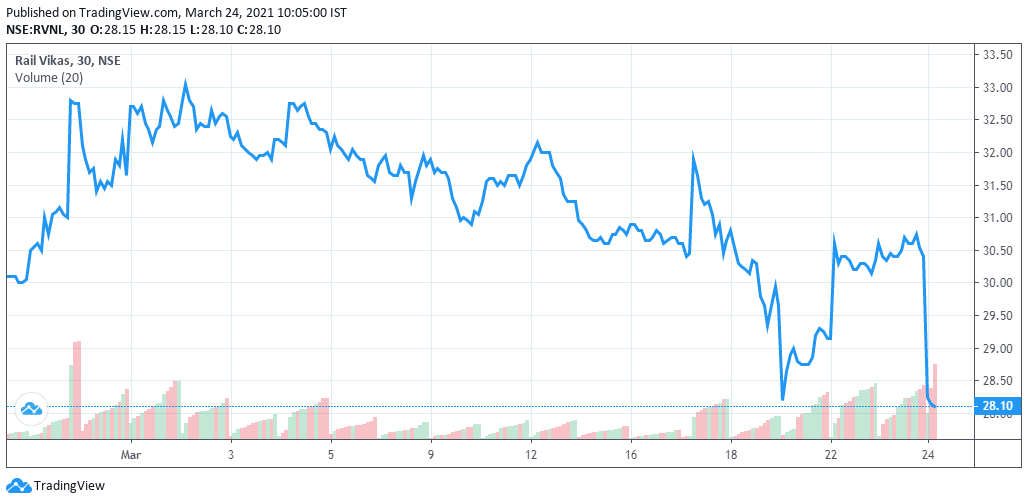

Rail Vikas Nigam Limited (RVNL) share price fell over 8 percent intraday on March 24 as the government said it will sell 20,85,02,010 equity shares (or 10 percent of total paid-up equity) of Rail Vikas Nigam via offer for sale route on March 24-25.

In case of oversubscription, the government will sell additional 10,42,51,005 equity shares (or 5 percent shareholding) in the company. The floor price for the offer has been fixed at Rs 27.50 per share.

Stock movement in last 1 month

Stock movement in last 1 month

The stock was trading at Rs 27.95, down Rs 2.45, or 8.06 percent at 09:53 hours. It has touched an intraday high of Rs 28.40 and an intraday low of Rs 27.90.

"Offer for Sale in RVNL opens on March 24 for Non Retail investors. Retail investors can bid on Thursday. Government would divest 10 percent equity with a 5 percent Green Shoe option," Department of Investment and Public Asset Management (DIPAM) secretary Tuhin Kanta Pandey said in a tweet on March 23.

RVNL was incorporated as a 100 percent owned PSU of the Ministry of Railways on January 2003 with the objectives of raising extra-budgetary resources and implementation of projects relating to creation and augmentation of capacity of rail infrastructure on fast track basis.

For FY21, finance ministry has slashed its disinvestment target to Rs 32,000 crore from Rs 21,0000 crore due to the disruptions caused by the Covid pandemic. DIPAM has so far mopped up Rs 31,006 crore, with its latest exit from Tata Communications, Mint reported.

RVNL last month reported a consolidated net profit of Rs 281 crore for the December quarter, a jump of 171 percent over the same quarter a year ago.

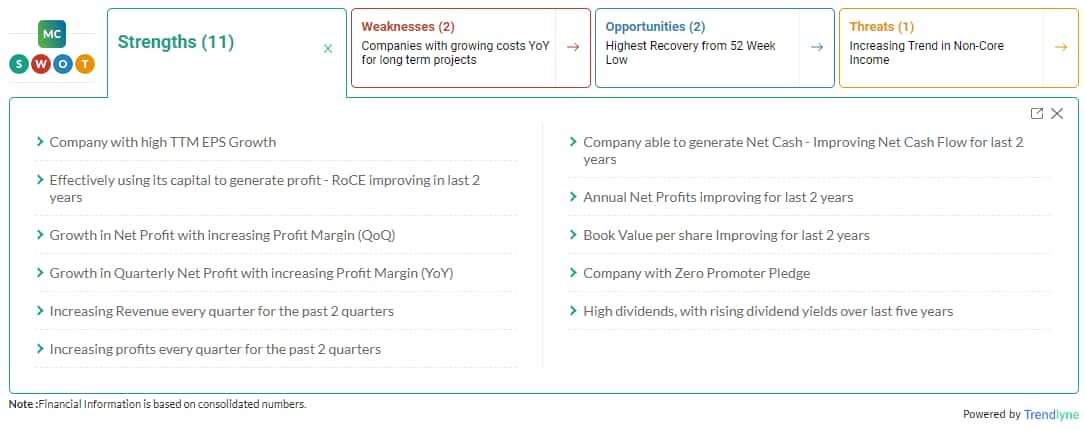

Despite the fall in stock price, the book value per share is improving for last 2 years with increasing revenue every quarter for the past 2 quarters. The company has been able to generate net cash - improving net cash flow for last 2 years, according to Moneycontrol SWOT Analysis powered by Trendlyne.

Moneycontrol technical rating is neutral with moving averages and and technical indicators being bearish and moving averages crossovers being neutral.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.