KEC INTERNATIONAL

KEC International share price jumped over 3 percent at open on March 23 as the company secured new orders worth Rs 1,429 crore across its various businesses.

The EPC major has secured new orders worth Rs 1,429 crore across its various businesses. Its transmission & distribution division has secured orders worth Rs 701 crore, while railways, civil and cables divisions secured orders of Rs 366 crore, Rs 318 crore and Rs 44 crore, respectively, the company said in a filing to exchanges.

The stock was trading at Rs 462.75, up Rs 15.45, or 3.45 percent at 9:24 hours. It has touched an intraday high of Rs 469.00 and an intraday low of Rs 462.70.

The Transmission & Distribution (T&D) business has secured orders of Rs. 701 crore for T&D projects from Power Grid Corporation of India (PGCIL) and other customers in India, East Asia Pacific and the Americas.

The Railways business has secured orders of Rs. 366 crores in the emerging segments in India. The Civil business has secured orders of Rs 318 crores from reputed private players for infra works in the cement, residential and metals & mining segments in India. The Cables business has secured orders of Rs. 44 crores for various types of cables in India and overseas.

Vimal Kejriwal, MD & CEO, KEC International said, the company's current year order inflows have exceeded Rs 11,000 crore with these orders.

KEC International is a global infrastructure Engineering, Procurement and Construction (EPC) major. It has presence in the verticals of power transmission and distribution, railways, civil, solar, smart infrastructure and cables.

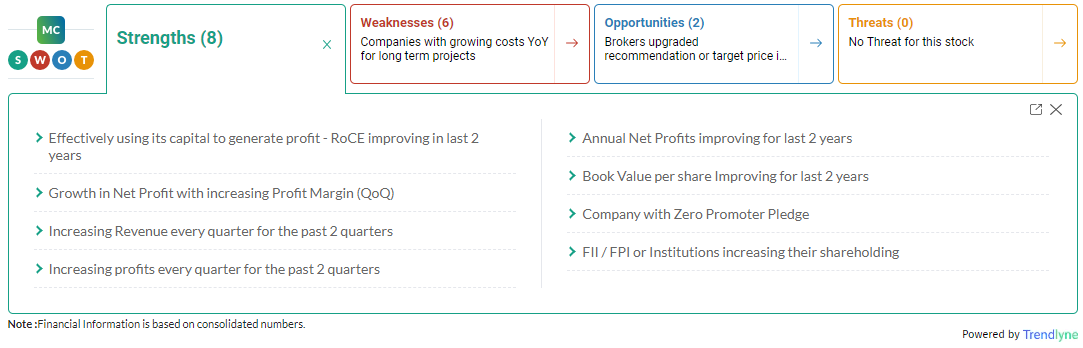

According to Moneycontrol SWOT Analysis powered by Trendlyne, the company has zero promoter pledge with FII / FPI or institutions increasing their shareholding.

Moneycontrol technical rating is bullish with moving averages being bullish and technical indicators being being neutral.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.