The market witnessed a rangebound trade and closed flat with a negative bias on March 22, dented by banking and financial counters. However, the buying in FMCG, IT, metals and pharma stocks capped the downside.

The benchmark indices corrected a percent intraday amid volatility and witnessed recovery in late trade. The S&P BSE Sensex declined 86.95 points to close at 49,771.29, while the Nifty50 fell 7.60 points to 14,736.40 and formed a Doji pattern on the daily charts as closing was near opening levels.

"A small candle was formed with long lower shadow. This pattern indicates a buy-on-dips opportunity in the market with rangebound action. The formation of bullish Piercing Line candlestick pattern of Friday and a smart upside recovery of Monday could signal possibility of more upside in the market," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"A sustainable move above the immediate resistance of 14,800 levels is expected to pull Nifty towards the next hurdle of around 15,050-15,200 levels in the near term. Immediate support is placed at 14,600," he said.

The broader markets closed in the green. The Nifty Midcap 100 index was up 0.82 percent and the Smallcap 100 index gained 0.03 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,634.83, followed by 14,533.27. If the index moves up, the key resistance levels to watch out for are 14,800.93 and 14,865.47.

Nifty Bank

The Nifty Bank index underperformed benchmark indices, falling sharply by 558.15 points or 1.63 percent to close at 33,603.45. The important pivot level, which will act as crucial support for the index, is placed at 33,278.7, followed by 32,954. On the upside, key resistance levels are placed at 34,038.5 and 34,473.6 levels.

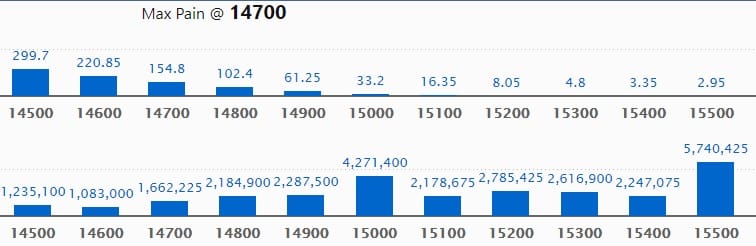

Call option data

Maximum Call open interest of 57.40 lakh contracts was seen at 15,500 strike, which will act as a crucial resistance level in the March series.

This is followed by 15,000 strike, which holds 42.71 lakh contracts, and 15,200 strike, which has accumulated 27.85 lakh contracts.

Call writing was seen at 15,500 strike, which added 18.02 lakh contracts, followed by 15,000 strike which added 9.38 lakh contracts and 14,900 strike which added 5.88 lakh contracts.

Call unwinding was seen at 14,500 strike, which shed 3.53 lakh contracts, followed by 14,400 strike which shed 1.47 lakh contracts and 14,600 strike which shed 1.21 lakh contracts.

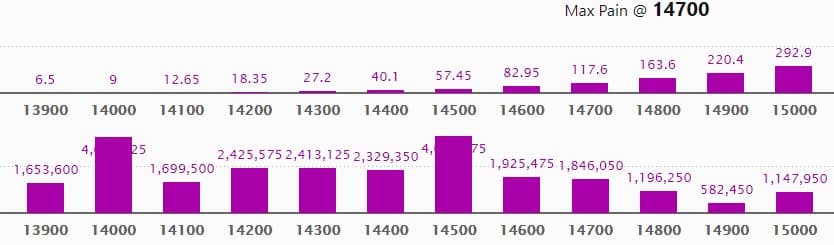

Put option data

Maximum Put open interest of 40.86 lakh contracts was seen at 14,500 strike, which will act as a crucial support level in the March series.

This is followed by 14,000 strike, which holds 40.34 lakh contracts, and 14,200 strike, which has accumulated 24.25 lakh contracts.

Put writing was seen at 14,000 strike, which added 4.82 lakh contracts, followed by 14,700 strike, which added 3.93 lakh contracts and 14,300 strike which added 3.41 lakh contracts.

Put unwinding was seen at 15,000 strike, which shed 96,225 contracts, followed by 14,900 strike which shed 43,125 contracts and 14,500 strike which shed 41,250 contracts.

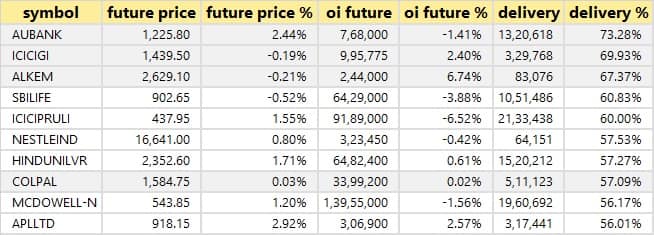

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

46 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

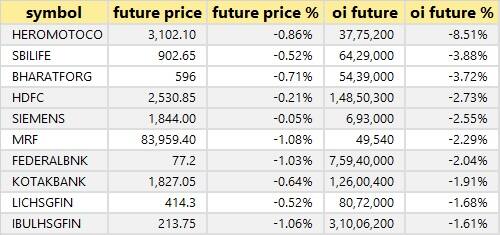

23 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

40 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

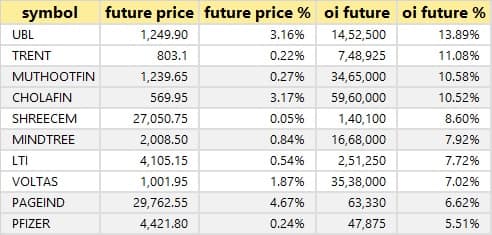

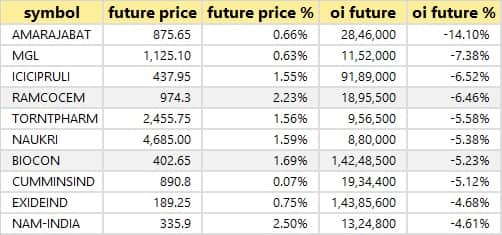

49 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

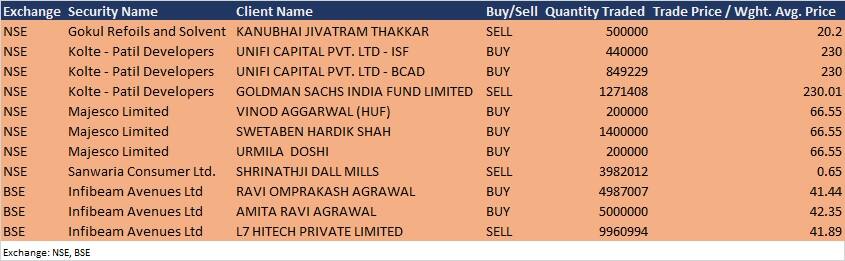

(For more bulk deals, click here)

Analysts/Board Meetings

VIP Industries: The interactions/meetings have been scheduled to be held with analyst/ institutional investors on March 23.

Escorts: The company will be interacting with Macquarie Capital, Segantii Capital Management and IIFL - Institutional Equities on March 24.

Take Solutions: The company's officials will interact with Karma Capital and Profusion Capital on March 24.

Delta Corp: A virtual conference has been scheduled for March 24.

Sterlite Technologies: The company will be participating the shining stars, Small & midcap investor conclave virtual investor call on March 24.

ISGEC Heavy Engineering: The company will attend virtual conference call with institutional investors /analysts organised by Centrum Broking on March 25.

HKG: The meeting of the board of directors of the company is scheduled on March 25 to consider the appointment of Deependra Shukla as an additional and non-executive & non-independent director of the company.

Stocks in the news

Bharat Petroleum Corporation: State-owned oil refinery and marketing company BPCL said board of directors of the company has approved the Scheme of Amalgamation of natural gas firm Bharat Gas Resources with the company.

KEC International: Global infrastructure EPC major KEC International has secured new orders of Rs 1,429 crore across its various businesses.

Madhav Infra Projects: Madhav Infra has received award for solar project from Gujarat State Electricity Corporation (GSECL) for a contract value of Rs 87.27 crore.

Jubilant Ingrevia: Ace investor Rakesh Jhunjhunwala said persons acting in his concert have purchased 3,04,009 equity shares in Jubilant Ingrevia on March 19, resulting in total shareholding in the company to be 99,33,809 equity shares or 6.2367% of total paid up equity of Jubilant Ingrevia.

Varroc Engineering: Varroc Engineering approved that the proposed fund raise by way of a qualified institutions placement of equity shares. The QIP issue opened on March 22.

Maruti Suzuki India: Country's largest car maker Maruti Suzuki India has increased vehicle prices with effect from April 2021, due to increase in various input costs.

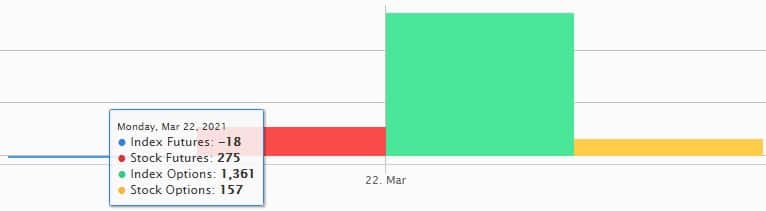

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 786.98 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 542.70 crore in the Indian equity market on March 22, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Vodafone Idea and SAIL - are under the F&O ban for March 23. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.