The market rebounded sharply after five days of selling pressure and closed with gains of over a percent on March 19, driven by buying in FMCG, metals, pharma and banking & financials. A drop in oil prices also supported the market.

The BSE Sensex gained 641.72 points, or 1.30 percent, to close at 49,858.24, while the Nifty50 rose 186.10 points, or 1.28 percent, to 14,744 and formed a Piercing Line pattern on the daily chart. For the week, the Nifty declined 1.9 percent and formed a Hammer candlestick on the weekly scale.

"A long bull candle was formed on Friday after opening lower and this pattern indicates the formation of bullish 'Piercing Line' candlestick pattern. Normally, this bullish pattern is formed at the lows and is part of short term bottom reversals. Hence, one may expect Friday's low of 14,350 to be a short-term bottom reversal," Nagaraj Shetti, Technical Research Analyst at HDFC Securities said.

“Further upmove from here could confirm reversal pattern and that could open more upside in the coming sessions at 14,900-15,000 levels in the short term. Immediate support is placed at 14,600."

The broader markets also made gains. The Nifty midcap 100 index was up 1.2 percent and the smallcap 100 index gained 0.7 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,466.67, followed by 14,189.33. If the index moves up, the key resistance levels to watch out for are 14,904.77 and 15,065.53.

Nifty Bank

The Nifty Bank index climbed 304.80 points to 34,161.60 on March 19. The important pivot level, which will act as crucial support for the index, is placed at 33,563.27, followed by 32,964.93. On the upside, key resistance levels are placed at 34,557.66 and 34,953.73 levels.

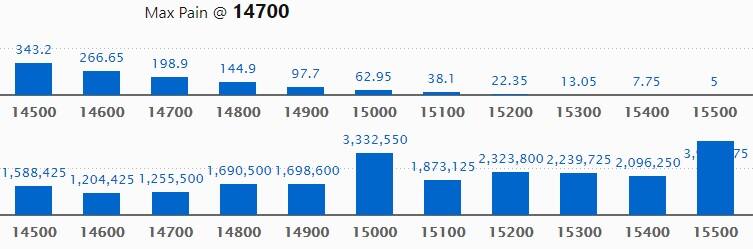

Call option data

Maximum Call open interest of 39.37 lakh contracts was seen at 15,500 strike, which will act as a crucial resistance level in the March series.

This was followed by 15,000 strike, which holds 33.32 lakh contracts, and 15,200 strike, which accumulated 23.23 lakh contracts.

Call writing was seen at 15,500 strike, which added 12.70 lakh contracts, followed by 15,200 strike which added 7.33 lakh contracts and 14,500 strike which added 6.04 lakh contracts.

Call unwinding was seen at 15,000 strike, which shed 5.84 lakh contracts, followed by 14,900 strike which shed 2.17 lakh contracts and 14,800 strike which shed 1.54 lakh contracts.

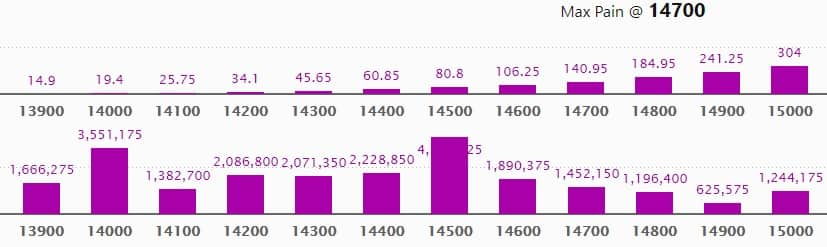

Put option data

Maximum Put open interest of 41.27 lakh contracts was seen at 14,500 strike, which will act as a crucial support level in the March series.

This is followed by 14,000 strike, which holds 35.51 lakh contracts, and 14,400 strike, which has accumulated 22.28 lakh contracts.

Put writing was seen at 14,400 strike, which added 11.06 lakh contracts, followed by 14,500 strike, which added 10.88 lakh contracts and 14,000 strike which added 8.64 lakh contracts.

Put unwinding was seen at 14,900 strike, which shed 3.81 lakh contracts, followed by 15,000 strike, which shed 3.01 lakh contracts and 15,200 strike which shed 34,050 contracts.

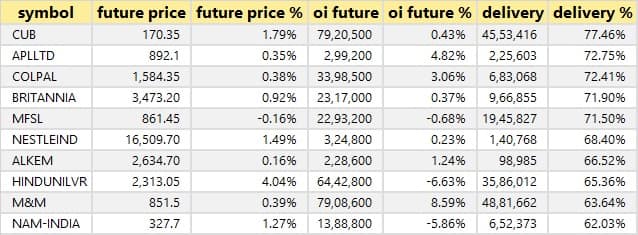

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks:

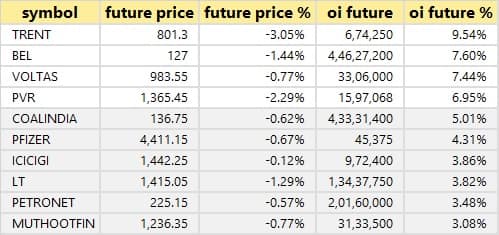

55 stocks see long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

6 stocks see long unwinding

Based on the open interest future percentage, here are the six stocks in which long unwinding was seen.

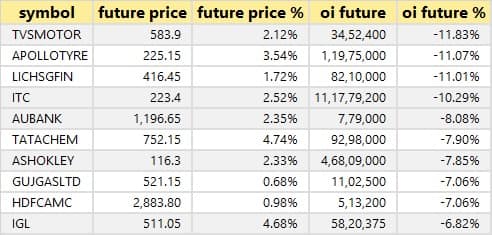

19 stocks see short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are top 10 stocks in which a short build-up was seen.

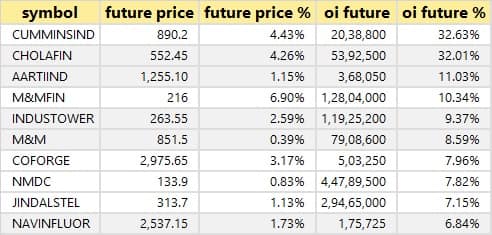

79 stocks witness short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen

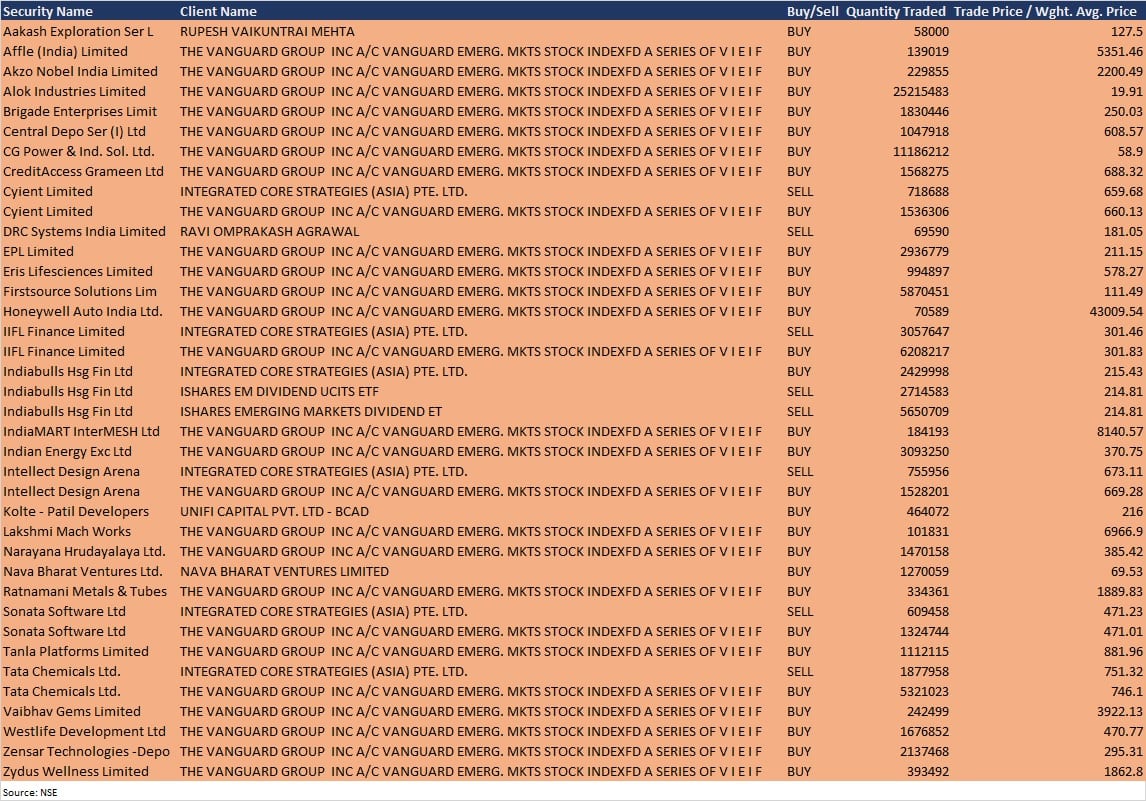

Bulk deals

(For more bulk deals, click here)

Analysts, board meetings

Marico: The company's officials will meet analysts and investors in a virtual conference on March 22.

Indostar Capital Finance: The company would be attending Nakshatra, The Shining Star Mid & Small-Cap virtual conference organised by Centrum Broking on March 23.

City Union Bank: The bank will participate in a banking and financial services conference organised by Axis Capital on March 22.

Mindtree: The company's officials will participate in Motilal Oswal's investors' conference on March 22.

Star Cement: The company's officials will attend investors and analyst meetings on March 22 and 23 through video conferencing.

Prataap Snacks: The company officials will attend one-to-one and group web meetings organised by Centrum Broking at Nakshatra -The Shining Star Mid & Smallcap conference on March 23.

Godawari Power & Ispat: Director Dinesh Gandhi will participate in Nakshatra- The Shining Star-Mid & Smallcap conference on March 24 through virtual mode.

Prince Pipes and Fittings: The company is participating in 4th Ideation Conference being organised by Motilal Oswal on March 23.

Balrampur Chini Mills: The company's representative(s) would be attending the Motilal Oswal 4th Ideation Conference on March 25.

Stocks in the news

Bharti Airtel: Bharti Airtel on March 19 entered into an agreement for the acquisition of 17,43,560 (representing 7.48 percent of paid up equity) equity shares in Sandhya Hydro Power Project Balargha Private Limited, a special purpose vehicle (SPV).

Adani Green Energy: Adani Green Energy, one of the largest renewables companies in India, signed a share purchase agreement for acquiring a 100 percent stake in an SPV holding 50 MW operating solar project of the Toronto-headquartered SkyPower Global.

JSW Energy: JSW Energy said its subsidiary JSW Future Energy, earlier known as JSW Solar, received orders for a total wind capacity of 450 MW from Solar Energy Corporation of India (SECI).

Bharat Dynamics: State-owned defence company Bharat Dynamics has signed a contract for the production and supply of Milan-2T Anti-Tank Guided Missiles. The contract value is Rs 1,188.12 crore.

Infibeam Avenues: Promoter entity O3 Developers sold 0.39 percent equity stake in Infibeam Avenues via open market transaction on March 17. Non-promoter Varini Patel offloaded 32.50 lakh equity shares in the company on March 17.

PNC Infratech: CARE Ratings has assigned credit rating on the bank facilities of the company's subsidiary, PNC Gomti Highways, as 'A'. The rating agency assigned 'stable' outlook on the bank facilities of Rs 559.30 crore.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,418.43 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 559.62 crore in the Indian equity market on March 19, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Vodafone Idea and SAIL are under the F&O ban for March 22. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.