The road to wealth creation with your investment portfolio entails volatility during various market phases, so it's critical to keep a proper asset allocation in place.

While equities are beneficial for long-term wealth creation, they carry a high level of risk. Debt investments in the portfolio on the other hand complement your equity investment by providing protection against downside risk and generating consistent returns. However, do note that debt investments are not risk-free.

Depending on your risk tolerance and asset allocation pattern, you can build a robust investment portfolio consisting of equity and debt investment to generate better risk-adjusted returns.

If you are interested in diversifying the investment in the debt market, you can consider government and PSU bonds, which are highly liquid and carry lower risk than corporate bonds,

Just like equity funds, passive investing is gaining momentum in the debt segment as well with a number of fund houses launching Debt Index funds that aim to offer low cost fixed-income investment avenue. These funds invest passively to mimic the composition of an underlying benchmark index

--- Advertisement ---

This Stock Could Potentially be the Next Bajaj Finance

It's a small NBFC player.

This company is backed by one of the most experienced and competent people in the sector.

It already derives good business from corporate lending.

But now the company is making a transition from being a corporate lender to a retail lender.

A transition which turned around the fortunes of Bajaj Finance, another NBFC player.

That's why Richa is confident that this small NBFC player which she has uncovered could potentially be the next Bajaj Finance.

Richa calls this small NBFC player the dark horse of the stock market.

At our Smallcap Fortunes Summit, Richa revealed the details of this stock.

Plus, she also revealed the details of two more dark horse stocks like this.

You had signed-up for Richa's summit, but missed it for some reason.

You still have the chance to get the details of these 3 little-known stocks which could potentially hand you multi-digit gains over the long term.

Just click on the link below to watch the special replay of Richa's summit.

Watch the Replay

------------------------------

Looking at the market scenario, IDFC Mutual Fund has launched two funds; IDFC Gilt 2027 Index Fund and IDFC Gilt 2028 Index Fund, both the funds are open-ended target maturity index funds that will invest only in high-quality government securities (which are backed by government and mitigate the risk of any default) and treasury bills that constitute the CRISIL Gilt 2027 Index and CRISIL Gilt 2028 Index respectively.

| Type | An open-ended Target Maturity Index fund investing in constituents of CRISIL Gilt 2027 Index and CRISIL Gilt 2028 Index. | Category | Index Fund | |

|---|---|---|---|---|

| Investment Objective | The investment objective of the scheme is to provide investment returns closely corresponding to the total returns of the securities as represented by the CRISIL Gilt 2027 Index and CRISIL Gilt 2028 Index before expenses, subject to tracking errors. However, there can be no assurance or guarantee that the investment objective of the Scheme will be achieved. | |||

| Min. Investment | Rs 5,000 and in multiples of Re 1/- thereafter. Additional Purchase Rs. 1000/- and any amount thereafter. | Face Value | Rs 10/- per unit | |

| SIP/STP/SWP | Available | |||

| Plans |

|

Options |

|

|

| Entry Load | Not Applicable | Exit Load | Nil | |

| Fund Manager |

|

Benchmark Index | - CRISIL Gilt 2027 Index - CRISIL Gilt 2028 Index |

|

| Issue Opens: | March 12, 2021 | Issue Closes: | March 19, 2021 | |

The scheme is a target maturity index fund, which will employ an investment approach designed to track the performance of CRISIL Gilt 2027 Index and CRISIL Gilt 2028 Index.

Such target maturity funds are a type of mutual fund/index fund/ETFs that have a fixed maturity date, unlike other traditional debt funds. The maturity period for IDFC Gilt 2027 Index Fund is June 30, 2027 and for IDFC Gilt 2028 Index Fund it is April 05, 2028, on maturity the investor will receive the net asset value of these funds.

Both the funds, will invest in government securities and treasury bills that constitute the CRISIL Gilt 2027 Index and CRISIL Gilt 2028 Index respectively. The CRISIL Gilt 2027 Index yield is 6.31% and CRISIL Gilt 2028 Index yield is 6.39% as on March 15, 2021.

This Target Maturity strategy is adopted by the fund house with a view that the 6-9 year segment of government securities yield curve is very steep currently that offers an investment opportunity in this space through which both the funds may benefit.

The open-ended index fund will replicate the index and the funds' performance will be exhibited accordingly. In addition to optimize the portfolio performance the schemes involves a barbell strategy, where investments are into 6-7 years Government securities with high yields as currently due to the steep yield curve and then it is combined with T-bills which are rebalanced every three months. Here, if in future the interest rates rise the portfolio consisting new T-bills every three months with better coupon rate will maintain the performance.

Learn: How to Potentially Accumulate Rs 7 Crore in Wealth Over the Long-term

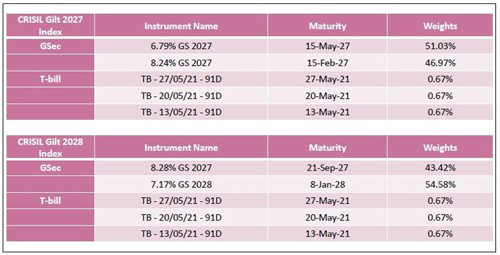

CRISIL Gilt 2027 Index seeks to measure the performance of portfolio of Government Securities (GSecs) and Treasury Bills (T-bills) such that the index will terminate on June 30, 2027.

CRISIL Gilt 2028 Index seeks to measure the performance of portfolio of Government Securities (GSecs) and Treasury Bills (T-bills) such that the index will terminate on April 05, 2028.

The selection of government securities in the index is done on the basis of minimum amount outstanding Rs 25,000/- crore, the securities having maturity date within the eligible period (December 01, 2026 to June 30, 2027) for IDFC Gilt 2027 Index Fund and (September 06, 2027 to April 05, 2028) for IDFC Gilt 2028 Index Fund. The index will be reviewed and rebalanced every 6 months.

The selection for Treasury Bills in the Index will be such as; three 91-day T-bills will be selected by rebalancing on a bi-monthly basis.

The Index constituents and the weights assigned to them are as below:

Apart from investment up to 95% of its total asset in securities comprising of CRISIL Gilt 2027 Index and CRISIL Gilt 2028 Index, the respective scheme will also invest up to 5% of its assets in government securities maturing on or before maturity date of the Scheme, Cash, and Money Market Instruments.

Watch Now: Get Details of Richa's 3 Dark Horse Stocks

Under normal circumstances, the asset allocation will be as under:

| Instruments | Indicative Allocations (% of Net Assets) |

Risk Profile High/Medium/Low |

|

|---|---|---|---|

| Minimum | Maximum | ||

| Securities comprising of CRISIL Gilt 2027 Index | 95 | 100 | Low to Medium |

| Government Securities maturing on or before maturity date of the Scheme, Cash, Money Market Instruments | 0 | 5 | Low to Medium |

| Instruments | Indicative Allocations (% of Net Assets) |

Risk Profile High/Medium/Low |

|

|---|---|---|---|

| Minimum | Maximum | ||

| Securities comprising of CRISIL Gilt 2028 Index | 95 | 100 | Low to Medium |

| Government Securities maturing on or before maturity date of the Scheme, Cash, Money Market Instrument | 0 | 5 | Low to Medium |

Mr Anurag Mittal will be the dedicated fund manager for IDFC Gilt 2027 Index Fund and IDFC Gilt 2028 Index Fund.

Mr Anurag Mittal is a Senior Fund Manager at IDFC Asset Management Co. Pvt. Ltd. and he has over 13 years of experience in mutual fund and banking. Prior to joining IDFC AMC, he was associate with Axis Asset Management Company Ltd. as a Fund Manager - Investments (Dealing and Research), ICICI Prudential Life Insurance as Manager of Investments (Dealing and Research) and Bank of America as an Analyst for Corporate Debt products and research.

Mr Mittal's qualification includes, B.com (Hons), CA, M.Sc. (Accounting & Finance with specialisation in Finance) from London School of Economics &Political Science. Currently schemes under his management are; IDFC Hybrid Equity Fund, IDFC Regular Savings Fund, IDFC Cash Fund, IDFC Low Duration Fund, IDFC Money Manager Fund, IDFC Banking & PSU Debt Fund, IDFC Corporate Bond Fund, IDFC Fixed Term Plans.

IDFC Gilt 2027 Index Fund and IDFC Gilt 2028 Index Fund are both open-ended target maturity index funds that allow unitholders to buy and sell securities on a daily basis, evading liquidity issues.

The fund aims to offer high quality investments, high liquidity and a low cost debt investment avenue, the scheme intents to benefit with the target maturity approach and position to benefit from the current steep yield curve.

This scheme invests in sovereign rated government securities, which eliminates the credit risk. Although the target maturity strategy decreases the maturity of investments over the holding period mitigating duration risk and possibility of changing interest rates, if interest rates rise all of a sudden, as they are expected to do in this increasing interest rate environment, then the price of existing bonds will decline affecting the NAV of the fund holding such bonds. Remember that long duration funds are prone to higher interest fluctuations.

Being an Index fund, this scheme offers less flexibility to the fund managers as investments are confined to the constituents of the underlying index and the fund's performance is replicated as the performance of the underlying benchmark index with minimum tracking errors.

This scheme is suitable for investors seeking high quality investments and hold a moderate risk tolerance to stand the intermittent volatility with consistent returns. These target maturity funds launched by IDFC have maturity of 6-7 years and it is a good opportunity for investors with similar investment horizon.

PS: If you wish to select worthy mutual fund schemes, I recommend that you subscribe to PersonalFN's unbiased premium research service, FundSelect.

Additionally, as a bonus, you get access to PersonalFN's popular debt mutual fund service, DebtSelect.

PersonalFN recommendations go through our stringent process that assesses both quantitative and qualitative parameters, providing you with Buy, Hold, and Sell recommendations on equity and debt mutual fund schemes. Read here for details...

If you are serious about investing in a rewarding mutual fund scheme, Subscribe now!

Author: Mitali Dhoke

This article first appeared on PersonalFN here.

PersonalFN is a Mumbai based personal finance firm offering Financial Planning and Mutual Fund Research services.

The views mentioned above are of the author only. Data and charts, if used, in the article have been sourced from available information and have not been authenticated by any statutory authority. The author and Equitymaster do not claim it to be accurate nor accept any responsibility for the same. The views constitute only the opinions and do not constitute any guidelines or recommendation on any course of action to be followed by the reader. Please read the detailed Terms of Use of the web site.

In this video, I'll breakdown our most profitable trade of the year.

Smallcaps are at an inflection point. This could be the return of the 2003 era of investing in smallcaps.

Rahul Shah on whether investing in Kalyan Jewellers IPO makes sense from a long term perspective

This is why I think the price of bitcoin can go to US$ 100,00.

Rounaq Neroy in this edition of the Daily Wealth Letter explains the risk factors in play in the Indian equity markets and what investors should do to safeguard their investment portfolio.

More Views on NewsThis could be the biggest wealth creator of the decade.

What you should watch out for in the search of Hindustan Zinc like next 100 bagger.

In this video, I'll tell you if there is huge money to be made in metals or if there is more to the super cycle story.

The last time India witnessed this devastating tax in 2007.

More

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!