On October 6, 2017, SEBI came out with the re-categorisation circular wherein they created about 36 categories. It has been almost three and a half years since that circular came out but I'm more confused than before. Has that re-categorisation really worked or there should be some changes in that? What do you think?

- Anonymous

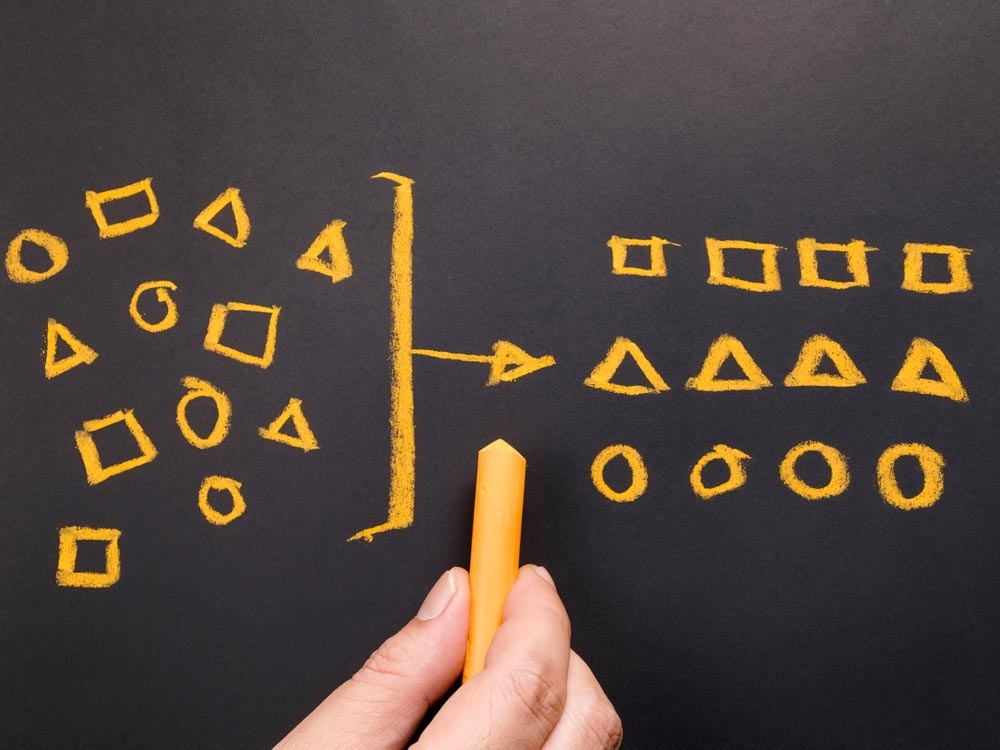

The re-categorisation has brought at least some kind of homogeneity within different categories. Prior to that, any fund or any category didn't have any definition. At that time, Value Research used to classify funds based on their portfolios. However then, the fund could very well change its colour and complexion and get compared to a different peer set. So then, there could be a large-cap fund that could become a flexi-cap fund and on other occasions, could become a small-cap fund. So, the re-categorisation has definitely brought about a degree of style purity. Now you know what you are getting into. This is true even for debt funds.

Now I think another additional thing has happened, which is the risk-o-meter has been enhanced further. If you see the categories in conjunction with the risk-o-meter, I think it has become quite a useful tool in terms of decoding what the associated risks are.

Beyond that, if you want to unclutter your mind as to what will fulfil your needs, then I think you should focus on your specific requirements. There will be hundreds of things available to you. This is true for any product that you want to buy. For instance, if you go to a supermarket, you will have shelves of different products of different varieties giving you lots of options. But you just buy a couple of things you need and getaway.