Suryoday Small Finance Bank will open its maiden public offer for subscription on March 17. This is the fourth small finance bank to launch an IPO, after AU Small Finance Bank, Ujjivan Small Finance Bank and Equitas Small Finance Bank.

Equity shares will get listed on the BSE and the National Stock Exchange. Axis Capital, ICICI Securities, IIFL Securities and SBI Capital Markets are the book running lead managers to the issue.

Here are 10 key things to know about the issue and the company:

1) IPO Dates

The public offer will open on March 17 and close on March 19.

Click Here to catch up on all IPO-related news

2) Price Band

The price band for the offer has been fixed at Rs 303-305 per equity share.

3) Public Issue

The IPO comprises a fresh issue of 81.50 lakh equity shares and an offer for sale of 1.09 crore equity shares.

Investors that are offloading stake via the offer for sale route are -- International Finance Corporation to sell 43,87,888 equity shares

- Gaja Capital Fund II will sell 20,21,952 equity shares

- DWM (International) Mauritius 18,89,845 equity shares

- HDFC Holdings 7.5 lakh shares

- IDFC First Bank will sell 15 lakh equity shares

- Americorp Ventures 1 lakh shares

- Kotak Mahindra Life Insurance Company 1,86,966 equity shares, and

- Gaja Capital India AIF Trust 1,06,419 equity shares

The issue includes a reservation of 5 lakh equity shares for employees, who may get those shares at a discount of around 10 percent (Rs 30 per share) to the offer price.

Suryoday Small Finance Bank has already raised Rs 151.94 crore by issuing 52,08,226 equity shares to SBI Life Insurance Company, Axis Flexi Cap Fund, Axis Equity Hybrid Fund and Kiran Vyapar at a price of Rs 291.75 per share, through pre-IPO placement.

Bids can be made for a minimum of 49 equity shares and in multiples of 49 equity shares thereafter, which computes to a minimum application size of Rs 14,945 at the higher end of the price band.

4) Objectives of the Issue

The small finance bank (SFB) will utilise the net proceeds from fresh issue towards augmenting its Tier – 1 capital base to meet future capital requirements.

5) Bank Profile

Suryoday Small Finance Bank is among the leading SFBs in India in terms of net interest margins, return on assets, yields and deposit growth and had the lowest cost-to-income ratio in FY20. It started operations as an SFB in January 2017.

Prior to that, it operated as an NBFC (non-banking finance company) – MFI (micro-finance institution).

Its average 'priority sector' loans, as a percentage of average adjusted net bank credit (ANBC) for FY18, FY19 and FY20 and nine months ended December 2020 was 99.08 percent, 112.10 percent, 103.67 percent and 114.09 percent, respectively. As of December 2020, its customer base was 1.44 million and it operated 554 banking outlets, including 153 unbanked rural centres (URCs).

The bank has set up 661 customer service points (CSPs) as additional service or touch points during April 2020 and January 2021 and intends to continue to expand reach through the CSP model.

Its operations are predominantly in urban and semi-urban locations due to greater income earning capabilities and employment opportunities in such areas compared with rural regions. As of December 2020, 37.13 percent, 27.78 percent and 28.83 percent of gross advances were from metropolitan, urban and semi-urban areas (based on branch locations as classified by the RBI), respectively.

6) Strengths

a) It is a commercial bank focused on serving customers in the unbanked and underbanked segments in India and consider customers to be the most significant stakeholders of operations.

b) The company has diversified asset portfolio with a focus on retail operations. It commenced operations as a microfinance institution in 2009, and following conversion to a SFB, it has been able to diversify into other products which broadly include commercial vehicle loans, affordable home loans, micro business loans, secured and unsecured business loans to MSME/SME and corporates and financial intermediary group loans.

c) It is a fast evolving granular deposit franchise.

d) The bank is leveraging emerging technologies to enhance digital footprint.

e) It has strong credit processes and robust risk management framework.

f) It has a track record of strong financial performance and cost efficient operations.

g) It has multiple distribution and service channels comprising banking outlets, ATMs, phone banking, mobile banking, tablet banking, CSPs and internet banking services.

h) It has an experienced leadership team, professional management and strong corporate governance.

7) Strategies

a) Suryoday Small Finance Bank intends to expand its asset portfolio while focusing on secured lending.

b) We intend to strengthen our liability franchise growing our CASA and retail deposit base in a steady manner.

c) The bank seeks to continue to focus on technology and data analytics to grow operations.

d) It intends to expand geographic presence and penetrate further into existing geographies.

8) Financials

Its gross loan portfolio has grown at a CAGR of 46.98 percent from Rs 1,717.78 crore as of March 2018 to Rs 3,710.84 crore as of March 2020 and was Rs 3,908.23 crore as of December 2020. Deposits have grown at a CAGR of 94.95 percent from Rs 749.52 crore as of March 2018 to Rs 2,848.71 crore as of March 2020 and was Rs 3,343.84 crore as of December 2020

Its net interest income grew by 44.2 percent YoY in FY20 to Rs 490.9 crore and rose by 105.3 percent to Rs 340.37 crore in FY19 compared to previous year, while the profit increased by 23 percent YoY in FY20 to Rs 111.2 crore and rose by 686.6 percent to Rs 90.4 in FY19.

Net interest income in the nine-month period ended December 2020 declined to Rs 353.28 crore from Rs 361.13 crore and profit fell to Rs 54.86 crore from Rs 126.68 crore in the corresponding period last year.

The small finance bank's cost-to-income ratio has reduced from 64.44 percent in FY18 to 47.05 percent in FY20 and was 55.39 percent in the nine months ended December 2020.

Its gross NPA ratio as on December 2020 would have been 9.28 percent, on a proforma basis, of this 8.49 percent pertains to new proforma GNPA (i.e., excluding the pre-COVID GNPA). After considering, the specific NPA provisions and floating provisions, net NPAs would have been 5.38 percent, on a proforma basis.

9) Promoters, Investors and Shareholding

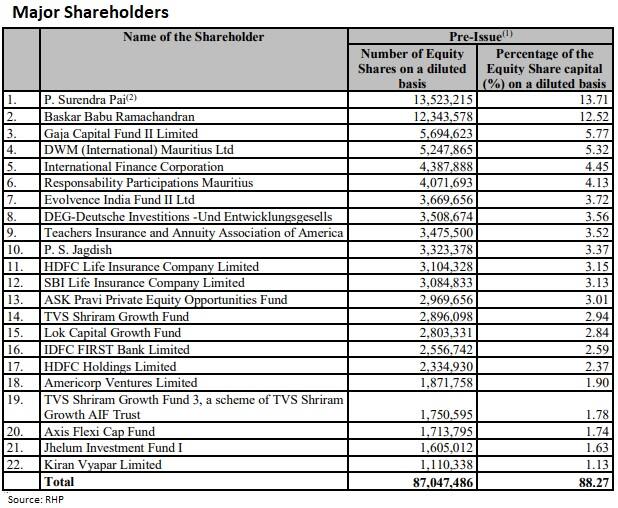

Promoters - Baskar Babu Ramachandran, P Surendra Pai, P S Jagdish, and G V Alankara - hold 2,97,34,732 equity shares in the bank, representing 30.35 percent of the paid-up equity share capital of the bank.

Ramachandran Rajaraman is the Part-time Chairperson and Independent Director of the bank. He has over 38 years of experience in commercial banking and finance. He has served as a part time non-official director of Deposit Insurance and Credit Guarantee Corporation and a member of the Advisory Board on Banks, Commercial and Financial Frauds of Central Vigilance Commission. Previously, he was associated with Small Industries Development Bank of India, Andhra Bank, Syndicate Bank and Indian Bank.

Baskar Babu Ramachandran is the Managing Director and Chief Executive Officer of the bank. He has several years of experience in the banking and finance sector. Prior to co-founding Suryoday Micro Finance, he was associated with various companies including GE Capital Transportation Financial Services and HDFC Bank.

Mrutunjay Sahoo, Jyotin Kantilal Mehta, Meena Hemchandra and John Arunkumar Diaz are Independent Directors on the board. Venkatesh Natarajan, Ranjit Shah and Aleem Remtula are Investor Directors.

Bhavin Damania is the Chief Financial Officer of the bank. He has over 14 years of experience in the banking and financial services sector. Prior to joining the bank, he was associated with Credit Suisse Services (India), ICICI Bank and BSR & Co. LLP, Chartered Accountants.

The bank has been backed by institutional investors which include a mix of development finance institutions such as IFC and DEG, private equity investors such as Gaja Capital India AIF Trust, Gaja Capital Fund II, TVS Entities, ASK Pravi Private Equity Opportunities Fund and Lok Capital Growth Fund, and institutional investors including HDFC Holdings, HDFC Life Insurance Company, IDFC FIRST Bank and Kotak Mahindra Life Insurance Company.

10) Allotment, Refunds and Listing Dates

The small finance bank will finalise the IPO share allotment as well as initiate refunds (if any to anchor investors) and unblock funds from ASBA account around March 24.

Equity shares will be credited to the eligible investors' demat accounts on March 25 and finally the trading in equity shares will commence from around March 30, as per the schedule available in the prospectus.