The states are resorting to measures like stamp duty cuts and higher welfare pensions to provide a targeted impetus to specific sectors in their bid to revive demand and economic growth.

The states are resorting to measures like stamp duty cuts and higher welfare pensions to provide a targeted impetus to specific sectors in their bid to revive demand and economic growth. HIGHER SPENDING for social sectors like health and education, counterbalanced by sharp cuts in capital expenditure. Amid plummeting revenues and a surge in debt levels, this is the common thread across the budgets presented by 13 major states so far.

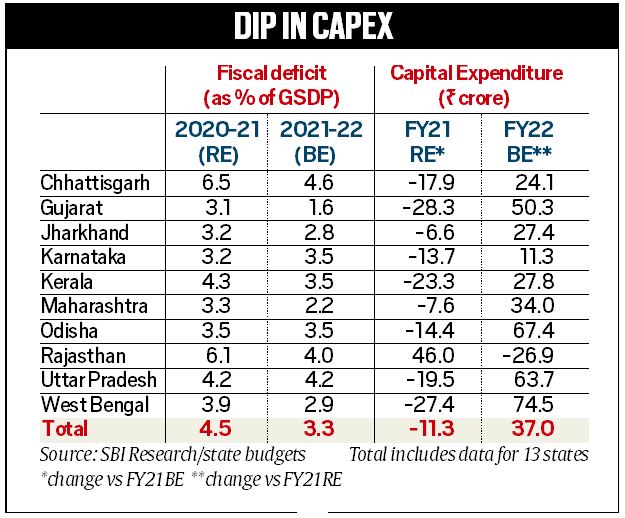

On an average, capital expenditure for the current fiscal has taken a hit of over 11 per cent in these states – Bihar, Chhattisgarh, Gujarat, Jharkhand, Karnataka, Kerala, Madhya Pradesh, Maharashtra, Odisha, Rajasthan, Uttar Pradesh, West Bengal and Uttarakhand.

This could impact the revival process, as expenditure by states is said to have a more immediate trickle-down effect than spending by the Centre. The states are resorting to measures like stamp duty cuts and higher welfare pensions to provide a targeted impetus to specific sectors in their bid to revive demand and economic growth.

There are two overarching trends visible across the budgets. One, the pandemic has changed budget estimates significantly, eroding the gains of consolidation seen in the preceding three years. The average Gross Fiscal Deficit (GFD) for states that presented their budgets pre-Covid was 2.4 per cent of Gross State Domestic Product (GSDP); the average for budgets presented post-lockdown was 4.6 per cent, according to the Reserve Bank of India (RBI) study on state finances. States had budgeted their consolidated GFD at 2.8 per cent of GSDP in 2020-21, but the final figures are considerably higher, and projections for 2021-22 are on the higher side too.

Second, even as their revenue receipts have been badly hit, states have not been able to curtail revenue expenditure to the same extent. Result: capital expenditure has taken a beating.

For instance, Uttar Pradesh will see a revenue deficit after a gap of 14 years as per the revised estimate (RE) of FY21. UP’s revenue account is estimated to have a deficit of Rs 13,161 crore (0.7 per cent of GSDP) in FY21, as against the budget estimate of a surplus of Rs 27,451 crore (1.5 per cent of GSDP). However, as per the FY22 budget, UP’s revenue account is estimated to return to a surplus of Rs 2,321 crore (1.1 per cent of GSDP).

The fiscal account is expected to see a slippage in FY21, with fiscal deficit estimated to increase to 4.2 per cent of GSDP from the budgeted 3 per cent of GSDP and surplus of 0.7 per cent in FY20, according to data analysed by India Ratings.

The revenue deficit of Rajasthan for 2020-21 is estimated at Rs 41,722 crore (4.36 per cent of GSDP), three times more than the budget estimate of 1.09 per cent of GSDP. Fiscal deficit for 2021-22 is targeted at Rs 47,653 crore (3.98 per cent of GSDP), while for FY21, it is estimated to be 6.12 per cent of GSDP, higher than the budget estimate of 2.99 per cent.

A downward revision in the capital expenditure figures for FY21 is visible across states. Maharashtra has revised its capital expenditure estimate to Rs 43,828 crore from Rs 47,417 crore, while projecting it at Rs 58,748 crore for next fiscal. Similarly, Chhattisgarh’s capital outlay for FY21 was revised down 23 per cent from the budget estimate of Rs 10,681 crore, and has now been estimated at Rs 13,839 crore for FY22.

Karnataka noted that the drop in its revenue collection and decrease in tax devolution from the Centre resulted in the revenue deficit. Therefore, part of the borrowings, otherwise used to fund capital expenditure, was used to fund the revenue expenditure. So, the allocation for capital expenditure came down from the budgeted amount of Rs 46,512 crore to Rs 39,125 crore in the revised estimates for 2020-21.

Revenue estimates for states show a sharp fall in CGST and SGST, which have been revised 21.2 per cent lower than the budgeted figures, the State Bank of India (SBI) said in a research report. Also, despite the increase in duties, states are seeing a decline of 14.7 per cent in state VAT and sales tax — mainly imposed on crude oil products — from the budgeted figures, due to lower crude prices and reduced consumption in the initial months of FY21, it said.

Many measures are being taken by states to give a fillip to the distressed sectors and provide more social security.

Maharashtra has announced a 1 per cent cut in stamp duty for women undertaking transfer of house property or registration of sale deed. Karnataka has proposed reduction in stamp duty to 3 per cent for houses valued between Rs 35-45 lakh; last year, it had reduced stamp duty on houses less than Rs 20 lakh to 3 per cent (from 5 per cent) to provide a boost to the real estate sector.

Kerala announced a hike in all welfare pensions, and creation of 4,000 new posts in the health sector. Delhi has allocated about one-fourth of its Budget, or Rs 16,377 crore, for education.

Similarly, Chhattisgarh has allocated 6.1 per cent of its total expenditure on health for 2021-22, while Uttar Pradesh has allocated 6.3 per cent of its total expenditure on health. The average allocation for health by states in their budget estimates was 5.5 per cent, according to PRS India.

Chhattisgarh has allocated 19 per cent of its total expenditure to education, while Uttar Pradesh’s allocation is 13.3 per cent; the average allocation by states for education in the previous fiscal was 15.8 per cent, said PRS India.

Of the 13 states, five — Madhya Pradesh, Maharashtra, Rajasthan, Uttar Pradesh and Uttarakhand — have budgeted over 20 per cent growth in expenditure on health and family welfare for FY22, said the SBI report. The average increase is 6.5 per cent, it said.

However, according to the report, six states — Jharkhand, Madhya Pradesh, Maharashtra, Rajasthan, Uttar Pradesh, Uttarakhand — spent less on health and family welfare in FY21 as compared to their budget estimates. This is partly attributed to lower receipts, including tax transfers from the Centre.