The Indian market made a smart comeback this week with benchmark indices rising over 2 percent. However, weakness in the last two sessions cut profits and pulled Nifty back below the psychological 15,000 mark. Improving macro numbers and a strong showing from autos in February lifted sentiment, while rising bond yeilds and weak global cues kept bulls in check. Last week, BSE Sensex added 1,305.33 points or 2.6 percent to end at 50,405.32 and Nifty50 rose 408.95 points or 2.8 percent to finish at 14,938.1 levels. The broader markets outperformed with the Nifty Midcap 100 index rising 3.5 percent and the Nifty Smallcap 100 index adding nearly 4 percent.

Experts expected volatility to continue next week. According to them, investors should keep a close eye on the US for triggers and oil prices along with economic data points on the domestic front.

"In the absence of any crucial events in India, market participants would keep a vigilant eye on the US for any major triggers. Any unexpected outcome in the 3/10/30 year US treasury auctions arranged next week could directly influence bond yields and in-turn equity valuation," Nirali Shah, Head of Equity Research at Samco Securities said.

Vinod Nair, Head of Research at Geojit Financial Services feels the market will be mainly focusing on the expectations on whether the Federal Reserve, in its upcoming meeting on March 16-17, will maintain its accommodative stance in a rising bond yield market. "Additionally, Fed's measures to maintain low-interest rate and high liquidity will also provide relief to the market sentiments," he said.

Meanwhile, the market could also react on Monday to Joe Biden's $1.9 trillion coronavirus relief package passed in the Democratic-controlled Senate on March 6.

The market will remain shut on Thursday, March 11 for Mahashivratri.

Here are 10 key factors that will keep traders busy in the coming week:

Bond Yields and Dollar Index

US 10-year bond yields rose to a new 52-week high on increasing expectations of improving economic growth and faster inflation which rattled investors sentiment globally. If it keeps increasing in the coming months, there could be some FII outflow from emerging markets like India and could also impact emerging markets currencies.

In the week gone by, the 10-year bond yields jumped to around 1.6 percent intraday before settling at 1.57 percent against around 1.4 percent in the previous week. Experts are of the view that it could be due to inflation rather than economic recovery. The dollar index, which measures the US dollar's value against the world's six major currencies, jumped to around 92 levels (for the first time since November last year) from around 90 levels in a couple of weeks.

"In the US, CPI rose to 1.4 percent from zero in the last 8 months and is forecasted to reach the Fed target of 2 percent in 2022. Consequently, in the market, US 10-year bond yield has increased to a new one-year high of 1.57 percent and is estimated that it can breach 2 percent by the end of December 2021," Vinod Nair of Geojit Financial Services.

Given the spike in bond yields, the Federal Reserve's decision in the forthcoming meet on March 16-17 would be crucial to watch out for, though Fed has been promising that it would maintain interest rates low till the US economy rebounds to strong growth levels and keep buying treasury notes and mortgage papers to increase liquidity in the system.

FII Flow

The foreign investors remained net buyers for the week gone by, though there was some outflow in the latter part of the week. FIIs bought around Rs 4,400 crore of shares in the first three days of the week on positive economic data points. But there was around Rs 2,200 crore of outflow in the last two days due to a spike in US bond yields and rising dollar index.

Net they bought Rs 2,200 crore of buying in Indian equities in the week ended March 5. Hence, all eyes are on the US developments for the coming weeks.

On the other side, domestic institutional investors remained net sellers to the tune of Rs 2,635 crore worth of shares last week.

Oil Prices

The oil price, which is the key part of India's import bill, increased to the highest level since January 2020 after the Organization of the Petroleum Exporting Countries and its allies decided to extend oil output cut into April, and better US jobs data. International benchmark Brent crude futures jumped to $69.69 a barrel intraday on March 5, before settling at $69.36 a barrel with more than 5 percent gains for the week.

If the oil prices increase further it would be a reason to worry for India as it increases expenditure, resulting in an impact on fiscal deficit, experts feel.

Goldman Sachs raised its Brent crude price forecast by $5 to $75 a barrel in the second quarter and $80 a barrel in the third quarter of this year. UBS raised its Brent forecast to $75 a barrel and WTI to $72 in the second half of 2021, reports Reuters.

Today, the daily rise in new coronavirus infections were recorded above 18,000 for the second consecutive day taking India's total tally of COVID-19 cases to 1,12,10,799, the Union Health Ministry said. The active cases registered an increase for the fifth consecutive day and the COVID-19 active caseload increased to 1,84,523 which now comprises 1.65 percent of the total infections. The recovery rate has dropped further to 96.95 percent, the ministry data stated.It could be a cause of concern in the coming weeks, experts feel.

Economic Data Points

The industrial production data for the month of January and CPI inflation for February will be released on coming Friday, while bank loan and deposit growth for the fortnight ended February 26 as well as foreign exchange reserves for the week ended March 5 will also be released on the same day.

The industrial output for December reported an expansion of 1 percent driven by basic metals, pharmaceutical and petrochemical products, and overall positive growth in the manufacturing sector, against a contraction of 1.9 percent in November last year.

CPI inflation for the month of January dropped to 4.06 percent, which is within the RBI's medium-term target range of 4 percent (+/- 2 percent), on the back of falling food prices. It was at 4.59 percent in December last year.

The primary market will remain in full swing as a lot of IPOs are expected in March. Easy Trip Planners will open its three-day public issue on March 8, at a price band of Rs 186-187 per share. The company targets to raise Rs 510 crore through IPO.

Media reports indicated that Anupam Rasayan India could also launch its initial public offering towards the end of the coming week. The company plans to raise around Rs 760 crore via public issue and received approval from the Sebi for the same earlier this week.

Technical View

The Nifty50 has broken the psychological 15,000 mark this week. It fell nearly a percent on Friday to form Spinning Top pattern on the daily charts, while for the week, it gained 2.8 percent and witnessed Shooting Star kind of formation on the weekly scale.

Overall, the index has been in a broad range of 14,500-15,300 levels, hence the breaking of the same range on either side could be a trend decider, experts feel.

"The Nifty has not broken the medium-term support range of 14,700-14,800. If we break that, we could travel south to levels closer to 14,400-14,500. If we bounce from these levels, we would need to get past the 15,300 level to move to higher targets of 15,500-15,600. Until then the Nifty is going to be rangebound and choppy," Manish Hathiramani, Proprietary Index Trader and Technical Analyst at Deen Dayal Investments told Moneycontrol.

F&O Cues

The option data indicated that the Nifty50 could see a wider trading range of 14,500-15,500 levels, while an immediate trading range could be around 14,700-15,300 levels.

Maximum Call open interest was seen at 15,000 strike followed by 15,500 and 15,200 strikes, while maximum Put open interest was seen at 14,000 strike, followed by 14,500 and 15,000 strikes.

Call writing was seen at 15,500, 15,000 and 14,900 strikes, with unwinding at 14,000 and 14,600 strikes. Put writing was seen at 14,000, 14,500 and 14,800 strikes, with unwinding at 15,000 and 15,100 strikes.

The volatility remained at higher levels which could restrict the upside and keep the market in a consolidation mode, experts feel.

India VIX fell sharply from 28.14 to 25.56 levels on a week-on-week basis. "VIX is turning highly volatile in a broader range of 21.80 to 29.64 from last nine trading sessions. Cool down in VIX below 21-20 zones is required for bullish grip," Chandan Taparia of Motilal Oswal said.

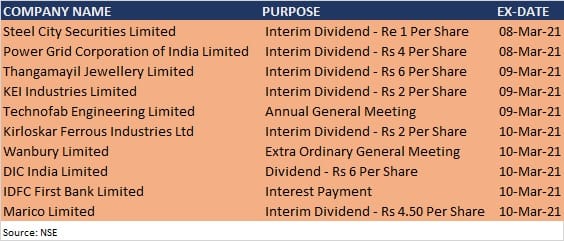

Corporate Action

Here are key corporate actions taking place in the coming week:

Apart from that, Jagran Prakashan will open its Rs 118-crore share buyback offer, with a buyback price of Rs 60 per share, on March 8.

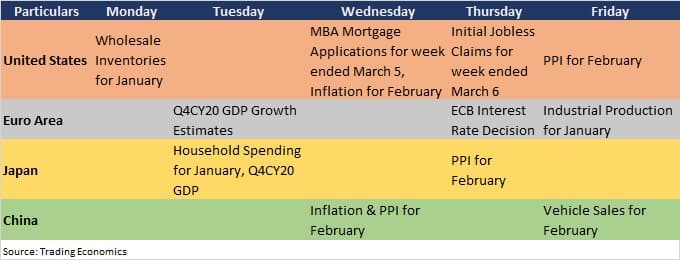

Global Cues

Here are key global data points to watch out for next week: