The market extended losses for the second consecutive session as the rising US bond yields and oil prices in the international markets dented sentiment on March 5. Banks, IT, Metals and Pharma stocks witnessed selling pressure.

The BSE Sensex was down 440.76 points at 50,405.32, while the Nifty50 fell 142.70 points to 14,938.10 and formed a small bearish candle that resembles a Spinning Top kind of pattern on the daily charts. On the weekly basis, however, the index gained 2.81 percent and saw a Shooting Star kind of formation on the weekly scale.

"The dollar index has formed a series of higher high and higher low that could be the cause of concern as it controls or curtails inflows for emerging markets. In the short term until the market is not breaking 15,280 levels, our bias should be on the downside," Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities told Moneycontrol.

In the coming week, "we could see Nifty touching minimum 14,750 or 14,550 levels. On the higher side, 15,150 and 15,280 would be major hurdles," he said.

The broader markets have also seen more correction than benchmarks on Friday as the Nifty Midcap 100 index dipped 2.15 percent and Smallcap 100 index dropped 1.55 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,836.03, followed by 14,733.97. If the index moves up, the key resistance levels to watch out for are 15,066.23 and 15,194.37.

Nifty Bank

The Nifty Bank index declined 574.35 points or 1.6 percent to 35,228.15 on March 5. The important pivot level, which will act as crucial support for the index, is placed at 34,875.5, followed by 34,522.9. On the upside, key resistance levels are placed at 35,598.4 and 35,968.7 levels.

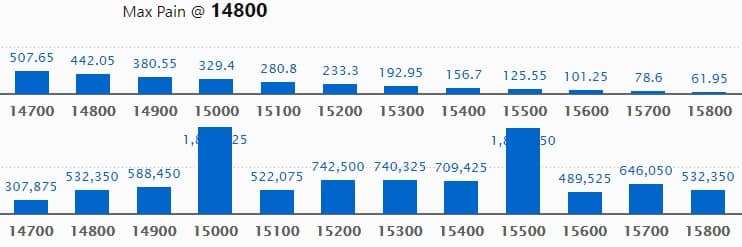

Call option data

Maximum Call open interest of 18.44 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 15,500 strike, which holds 18.22 lakh contracts, and 15,200 strike, which has accumulated 7.42 lakh contracts.

Call writing was seen at 15,500 strike, which added 2.96 lakh contracts, followed by 15,000 strike which added 1.96 lakh contracts and 14,900 strike which added 1.3 lakh contracts.

Call unwinding was seen at 14,000 strike, which shed 2,250 contracts, followed by 14,600 strike which shed 1,050 contracts.

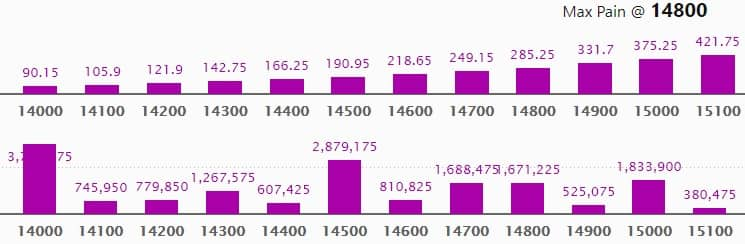

Put option data

Maximum Put open interest of 37.37 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the March series.

This is followed by 14,500 strike, which holds 28.79 lakh contracts, and 15,000 strike, which has accumulated 18.33 lakh contracts.

Put writing was seen at 14,000 strike, which added 4.93 lakh contracts, followed by 14,500 strike, which added 4.26 lakh contracts and 14,800 strike which added 1.27 lakh contracts.

Put unwinding was seen at 15,000 strike, which shed 1.39 lakh contracts, followed by 15,100 strike which shed 56,025 contracts.

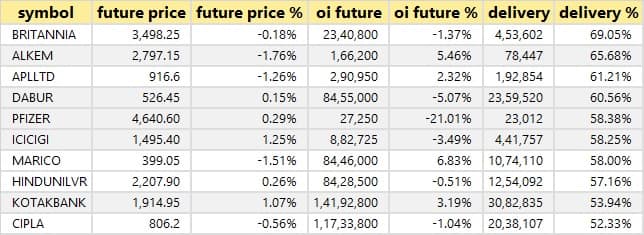

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

Six stocks saw long build-up

Based on the open interest future percentage, here are the six stocks in which a long build-up was seen.

78 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

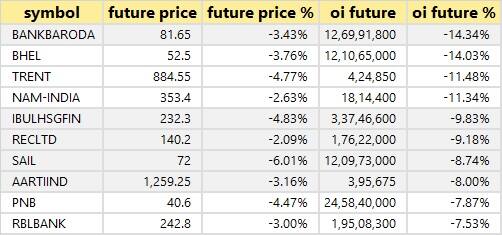

64 stocks saw short build-up

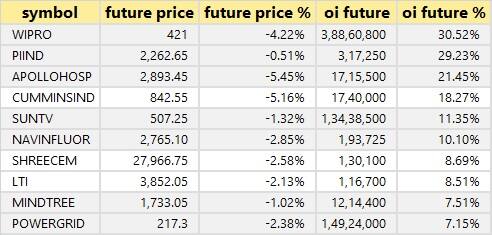

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

11 stocks witnessed short-covering

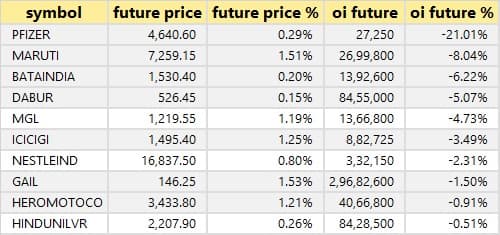

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

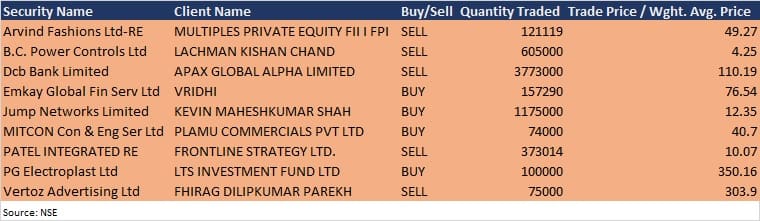

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Indostar Capital Finance: Sundaram Asset Management Company, and Dalal & Broacha will meet the company's officials on March 8 and 9 respectively, to discuss the performance of the company for the quarter and nine months ended December 2020.

Mahindra & Mahindra: The company's officials will interact with RBC Global Asset Management on March 8, and Avendus Capital and Limiar Capital on March 9.

United Spirits: Analysts'/institutional investors' meetings to be held on March 8 and 9.

Hindustan Copper: The company's officials will meet Bajaj Allianz on March 8 through video conferencing.

Thyrocare Technologies: The representatives of First State Sentier would be having a Con-call with Thyrocare Technologies on March 8.

Blue Star: The company's officials will meet Ambit Capital on March 15, Dolat Capital Market on March 18, and DSP Mutual Fund, Cooper Investors & Enam Asset Management Company on March 19.

Rallis India: The company's officials will meet Mirae Asset Global Investments (India) on March 11.

EIH: Kallol Kundu, CFO of EIH will be having a call with SKP Institutional Equities on March 16.

Stocks in the news

Sayaji Hotels: Subsidiary Sayaji Hotels Management (SHML) has signed and entered into 7 management agreement for the expansion of SHML by having new properties in Andhra Pradesh, Gujrat, Uttarakhand, Rajasthan and Maharashtra.

Aarti Drugs: Subsidiary Aarti Speciality Chemicals stands out to be one of the beneficiaries of the Government of India's recently approved Production Linked Incentive scheme for the pharmaceutical sector.

NMDC: The company has fixed prices of iron ore - lump ore (65.5 percent, 6-40mm) at Rs 5,100 per tonne and fines (64 percent, -10mm) at Rs 4,210 per tonne - w.e.f. March 6.

PNC Infratech: CARE revised the company's PNC Delhi Industrialinfra's credit rating on long-term bank facilities to A- from BBB+, with stable outlook.

Tata Chemicals: ICICI Prudential Mutual Fund lowered its shareholding in the company to 3.05 percent from 3.37 percent via open market transactions.

India Grid Trust: The company signed a share purchase agreement to acquire NER-II Transmission, from Sterlite Power as part of the Framework Agreement. The indicative value of the acquisition is around Rs 4,625 crore and would boost IndiGrid's AUM by 34 percent to over around Rs 20,000 crore ($2.8 billion).

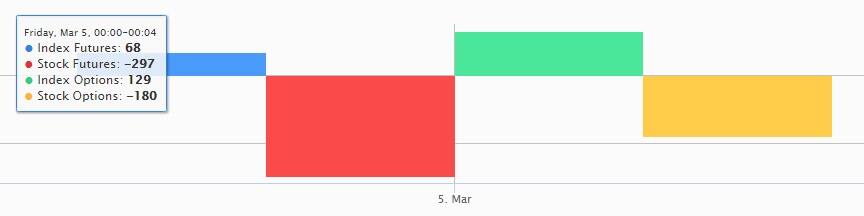

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 2,014.16 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 1,191.19 crore in the Indian equity market on March 5, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Five stocks - Bank of Baroda, BHEL, Punjab National Bank, SAIL and Sun TV Network - are under the F&O ban for March 8. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.