Bulls continued to be in the driving seat for the third session in a row on March 3 after a steep correction seen in previous week, amid rally in the global peers and stabilised bond yields. The buying in banking & financials, IT, Metals and Pharma stocks and Reliance Industries supported the market.

The S&P BSE Sensex closed above 51,000 mark, rising 1,147.76 points or 2.28 percent to 51,444.65, while the Nifty50 rallied 326.50 points or 2.19 percent to 15,245.60 and formed a strong bullish candle.

"A slight cool off in US bond yields has led to a strong rebound in the global markets this week, and this in turn has underpinned sentiment in India as well, causing volatility to recede," Abhishek Chinchalkar, CMT Charterholder and Head of Education at FYERS told Moneycontrol.

Technically, "the price action suggests that Nifty could soon be poised to surpass its life-time high of 15,431, for a possible extension towards 15,578. On the downside, immediate support now lies at 15,176 followed by 15,027," he said.

The volatility also cooled off for the third consecutive session and supported the bullish bias of the market. India VIX declined 6.4 percent to 22.09. The broader markets also continued to rally with the Nifty Midcap 100 index rising 1.67 percent and Smallcap 100 index up 0.99 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,069.87, followed by 14,894.13. If the index moves up, the key resistance levels to watch out for will be 15,347.27 and 15,448.93.

Nifty Bank

The Nifty Bank index surged 948.40 points or 2.68 percent to 36,368.10 on March 3. The important pivot level, which will act as crucial support for the index, is placed at 35,807.44, followed by 35,246.77. On the upside, key resistance levels are placed at 36,691.94 and 37,015.77 levels.

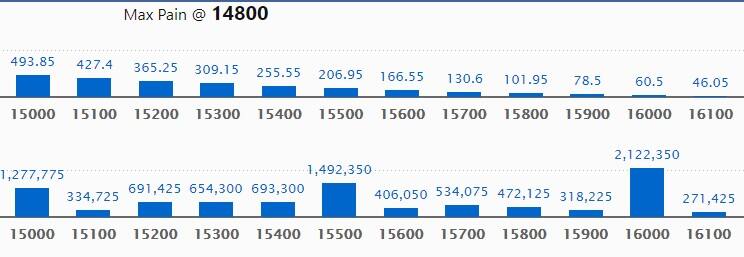

Call option data

Maximum Call open interest of 21.22 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 15,500 strike, which holds 14.92 lakh contracts, and 15,000 strike, which has accumulated 12.77 lakh contracts.

Call writing was seen at 15,300 strike, which added 1.45 lakh contracts, followed by 15,700 strike which added 92,025 contracts and 15,800 strike which added 81,150 contracts.

Call unwinding was seen at 15,000 strike, which shed 3.59 lakh contracts, followed by 14,800 strike which shed 2.12 lakh contracts and 16,000 strike which shed 2.05 lakh contracts.

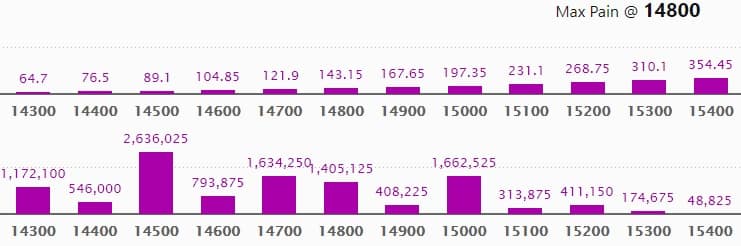

Put option data

Maximum Put open interest of 26.36 lakh contracts was seen at 14,500 strike, which will act as a crucial support level in the March series.

This is followed by 15,000 strike, which holds 16.62 lakh contracts, and 14,700 strike, which has accumulated 16.34 lakh contracts.

Put writing was seen at 15,000 strike, which added 3.25 lakh contracts, followed by 15,200 strike, which added 2.61 lakh contracts and 15,100 strike which added 1.67 lakh contracts.

Put unwinding was seen at 14,300 strike, which shed 71,025 contracts, followed by 14,500 strike which shed 36,375 contracts.

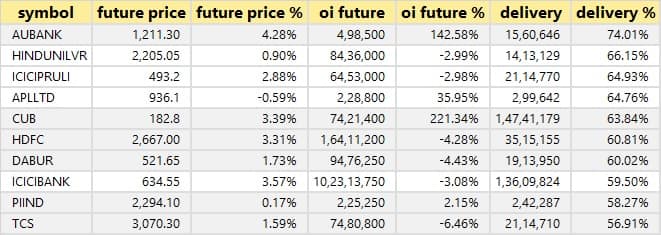

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

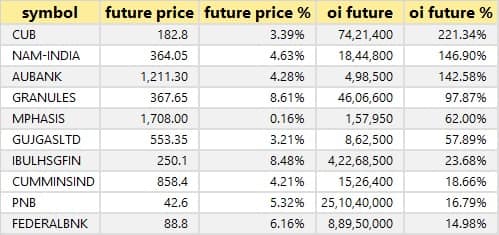

66 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

12 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

18 stocks saw short build-up

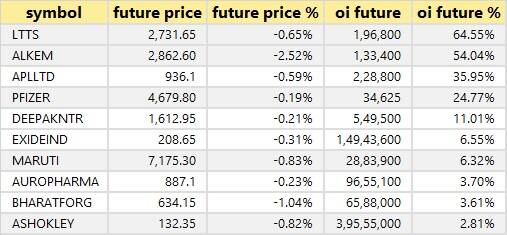

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

63 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

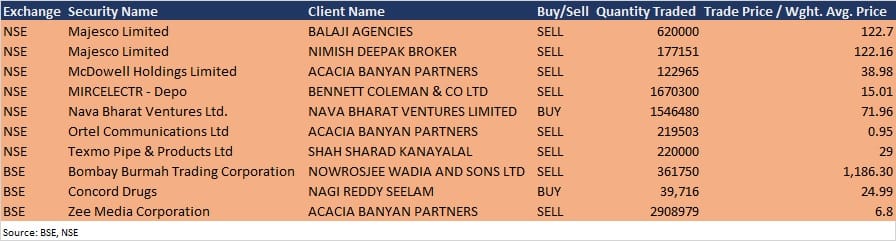

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Cummins India: The company's officials will meet B&K Securities, Goldman Sachs, Kotak Securities and ICICI Prudential Mutual Fund via conference call on March 4.

Hindustan Copper: The company's officials will meet institutional investors on March 4 through video conferencing.

Infibeam Avenues: The company's officials will meet Zaaba Capital via conference call on March 4.

Eicher Motors: The company's officials will meet Ashmore Investment Management on March 4.

Paisalo Digital: The company's officials will meet Tata Capital and Elara Capital on March 5.

Maruti Suzuki: The company's officials will participate in the investor (virtual) meetings on March 5, March 8 and March 9.

Mold-Tek Packaging: The meeting of board of directors of the company will be held on March 8 to consider the declaration of interim dividend for the financial year 2020-21.

Welspun Specialty Solutions: The meeting of the board of directors of the company is scheduled on March 20 to consider variation of rights of cumulative redeemable preference shares of the company.

Stocks in the news

Indian Bank: CRISIL revised bank's Tier 1, Tier 2 and Infrastructure Bonds' ratings to 'stable' from 'negative'.

IRCON International: The government to sell 6% additional stake via offer for sale on March 4. The company bagged letter of award worth Rs 187.80 crore from Railway Ministry.

VST Tillers Tractors: The company will invest $1.5 million in Zimeno Inc.

IRCTC: The company will operate trips through Golden Chariot from March 14.

Union Bank of India: ICRA assigned AA+(HYB)/Negative as credit rating to the bank's proposed Basel III Compliant Tier-II bonds aggregating up to Rs 2,000 crore.

Techno Electric & Engineering Company: SBI MF reduced stake in the company to 6.13% from 7.12% via open market sale.

Bajaj Electricals: The company and Mahindra Logistics signed an agreement for innovative logistics optimisation and outsourcing arrangement.

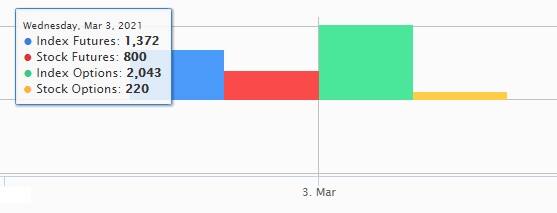

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 2,088.7 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 392.91 crore in the Indian equity market on March 3, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Indiabulls Housing Finance and SAIL - are under the F&O ban for March 4. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: "Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol."