Table of Contents

- How to calculate KMC property tax online

- Key highlights of Unit Area Assessment

- Base Unit Area calculation

- Multiplicative factors

- Property tax calculation formula

- How to pay KMC property tax online

- How to find assessee number online on KMC website

- Commonly used terms/abbreviations in KMC property tax bill

- KMC WhatsApp number for property tax assessment

- KMC property tax waiver scheme

- KMC property tax: Latest news

- KMC helpline and contact details

- FAQs

Owners of residential properties in Kolkata, are liable to pay property tax to the Kolkata Municipal Corporation (KMC) every year. The municipality uses the funds collected as property tax, to provide important civic facilities and services.

On December 15, 2016, the Kolkata Municipal Corporation (Amendment) Bill 2016 was passed, to simplify the assessment and collection of property tax and make the entire process more transparent. It empowered the KMC to limit the increase and decrease in property tax, to a certain extent and also enable self-assessment of one’s property tax.

Here’s how to calculate and pay KMC property tax online:

How to calculate KMC property tax online

In March 2017, the new Unit Area Assessment (UAA) system for property tax calculation, was passed in the KMC. This enabled property owners in the city to calculate their tax themselves, thereby, removing any subjectivity or ambiguity that existed under the earlier Annual Rateable Value system.

Key highlights of Unit Area Assessment

- Under the UAA scheme, the city has been divided into 293 blocks and seven categories – A to G. The division is on the basis of market value of the properties, facilities and infrastructure.

- Each category has been assigned an annual value per sq ft, also known as the Base Unit Area Value (BUAV) where category A has the highest while category G has the lowest BUAV.

- All slum areas in the city are categorised as ‘G’, irrespective of the location, to reduce the tax liability on the economically weaker classes. Similarly, all Refugee Rehabilitation colonies and government schemes for the economically weaker section are categorised as ‘E’, regardless of their geographical location.

- The system covers around six lakh property tax payers in Kolkata. The UAA calculation method is expected to bring parity in the tax system, so that all the properties under the block are taxed uniformly.

Base Unit Area calculation

| Base Unit Area Values for covered space of building or land comprising building or vacant land | |

| Block Category | Base Unit Area Value per sq ft (in Rs) |

| A | 74 |

| B | 56 |

| C | 42 |

| D | 32 |

| E | 24 |

| F | 18 |

| G | 13 |

See also: Property Tax Guide: Importance, Calculation and Online Payment

To simplify property tax assessment even further, ‘bustee’/slum/’thika’-tenanted areas are categorised as ‘G’, irrespective of their geographical location under any block. Additionally, all recognised RR colonies*, including settlements under government-notified EWS and BSUP (Basic Services for Urban Poor) Schemes, are categorised as ‘E’, irrespective of their geographical location under any block, unless they belong to a block that is categorised lower than ‘E’.

(* RR Colonies refer to refugee rehabilitation colonies, including slum settlements that are spread all across the city.)

The property tax calculation also utilises the concept of multiplicative factors (MFs), to account for the many critical differences in houses within the same block. MFs would account for variations in terms of the purpose of use, location of the property within the block, the age of the property, nature of occupancy and type of structure. These factors are clearly notified and used to increase or decrease the BUAV of different properties, as applicable.

Check out price trends in Kolkata

Multiplicative factors

| Location of the property | Multiplicative factor |

| Property abutted by roads having width ≤ 2.5m | 0.6 |

| Property abutted by roads having width >2.5 m but ≤ 3.5 m | 0.8 |

| Property abutted by roads having width >3.5 m but ≤ 12 m | 1 |

| Property abutted by roads having width >12 m | 1.2 |

| Age of building | Multiplicative factor |

| Age of premises 20 years or less | 1 |

| Age of premises more than 20 years but less than 50 years | 0.9 |

| Age of premises more than 50 years | 0.8 |

| Type of property | Tax Rate |

| Un-developed bustee | 6% |

| Developed bustee | 8% |

| Government properties under KMC Act, 1980 | 10% |

| Properties having annual value <Rs 30,000 | 15% |

| Others | 20% |

| Occupancy Status | Multiplicative factor |

| Property (or portion thereof) under occupation of tenant(s) or anybody else other than an owner or his/her “family” as defined in the scheme, where the tenancy ≤ 20 years old and is used for non residential purpose | 4 |

| Property (or portion thereof) under occupation of tenant(s) or anybody else other than an owner or his/her “family” as defined in the scheme, where the tenancy ≤ 20 years old and is used for residential purpose | 1.5 |

| Fee/ Commercial Car Parking Space/ garage | 4 |

| Property (or portion thereof) under occupation of tenant(s) or anybody else other than an owner or his/her “family” as defined in the scheme, where (a)the tenancy > 20 years old but ≤ 50 years old and, (b) the tenant is not protected under West Bengal Premises | 1.2 |

| Property (or portion thereof) under occupation of tenant(s) or anybody else other than an owner or his/her “family” as defined in the scheme, where (a) the tenancy > 20 years old but ≤ 50 years old and, (b) the tenant is protected under West Bengal Premises Tenancy Act 1997 | 1 |

| Property (or portion thereof) under occupation of tenant(s) or anybody else other than an owner or his/her “family” as defined in the scheme, where the tenancy > 50 years old | 1 |

| Property (or portion thereof) under occupation of owner or his/her “family” as defined in the scheme | 1 |

| Structure of Building | Multiplicative factor |

| Residential Building (not being an apartment) on a plot size > 10 cottah | 1.5 |

| Apartments belonging to such “Special Projects” as earmarked by IG Registration (excluding apartments identified/ notified as MIG / LIG by any Government/ statutory body) or, Apartments having “covered space (excluding car parking space)” > 2000 sq. ft. | 1.5 |

| All Pucca properties and such other properties not falling under any of the other categories | 1 |

| All Car Parking Spaces (open and covered) and Garage | 0.8 |

| Semi-Pucca | 0.6 |

| Proportionate Common Area | 0.5 |

| Kuchcha | 0.5 |

| Usage Types | Multiplicative factor |

| Water Body | 0.5 |

| Residential Use | 1 |

| Industrial/manufacturing, Shop<250 Sq.Ft., Restaurant | 2 |

| Health, Edu – Inst, Single Screen Cinema, Hotel < 3 star, Bar | 3 |

| Hotels 3 star and 4 star, Ceremonial House | 4 |

| Office, bank, Hotel 5 star or more | 5 |

| Commercial shops(not in U3) , mall, Multiplex | 6 |

| Offsite ATM, Tower, Hoarding, Night Club | 7 |

| Vacant Land upto 5 cottah not falling under above categories | 2 |

| Vacant Land more than 5 cottah | 8 |

Property tax calculation formula

The annual property tax under the UAA system is calculated, using the following formula:

Annual tax = BUAV x Covered space/Land area x Location MF value x Usage MF value x Age MF value x Structure MF value x Occupancy MF value x Rate of tax (including HB tax)

(Note: HB tax refers to Howrah Bridge tax, which is applicable on properties lying in specific wards.)

Ensure that your record in the system is updated and no outstanding amounts are shown against your account. If there are any errors, have them corrected immediately.

How to pay KMC property tax online

The Kolkata Municipal Corporation allows taxpayers to pay property tax online without any hassles. However, you taxpayers should know their assessee number and registered mobile number with them, to make use of this service. You can find your assessee number through your ward number and street name here.

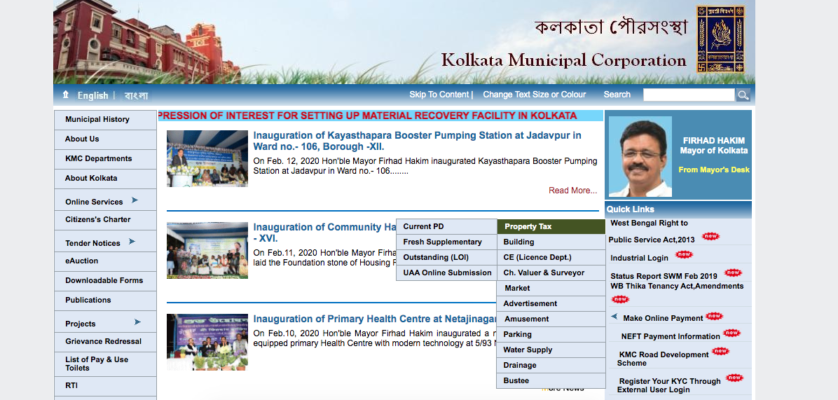

Step 1 > Visit official website of Kolkata Municipal Corporation

Step 2> On the right-hand side, find ‘Online Payment’ option. Select ‘Property Tax’ from the menu and choose the desired option.

How to find assessee number online on KMC website

Property owners can find the assessee number on the KMC official website.

Step 1: Visit the official website of the Kolkata Municipal Corporation

Step 2: Click ‘Online Services’ from the left menu and select ‘Assessment-Collection’.

Step 3: You will be redirected to a new page where you can find the ‘Assessee Information Search’ option.

Step 4: Select the ward number and street, you will be able to find your name and the assessee number.

Commonly used terms/abbreviations in KMC property tax bill

PD Bill: Periodic Demand bills are issued annually, on the basis of the last decided valuation of the property.

F/S Bill: Fresh/Supplementary bills are issued immediately after a hearing to reflect any modification to the earlier issued bills. Additionally, fresh bills are also issued after the first assessment of a property.

LOI: Letter of Intimation is issued against outstanding tax bills and may contain the following tax bills:

- All unpaid fresh and supplementary bills, which attract penalty.

- All unpaid periodic demand bills which were issued prior to the current financial year.

KMC WhatsApp number for property tax assessment

In a move to fast-track property tax assessment for Kolkata property owners, the Kolkata Municipal Corporation is planning to announce a WhatsApp number, where tax payers can apply for the assessment of their property. The KMC WhatsApp number will be 8335988888 and will be monitored by the municipal commissioner, to assess the requests received. If the number of requests received from a particular locality is more, the municipal corporation will set up a camp, to expedite the process.

KMC property tax waiver scheme

The KMC, in October 2020, finally implemented a tax waiver scheme, to compensate for the loss of revenue from property tax, due to the prolonged Coronavirus lockdown period. The tax waiver scheme is applicable to only those tax payers who have received the KMC property tax bill for the financial year 2019-20 by March 31, 2020.

According to the scheme, if a tax payer clears the dues by February 28, 2021, then, the interest and penalty applicable against the due amount will be waived-off by 100%. If a tax payer clears his dues between March and May 2021, a waiver of 60% on the interest and 99% on penalties will be offered.

However, to avail of the scheme, the applicant has to apply by January 31 2020. The applications will be accepted in all the tax collection centres of the KMC, in its headquarters and through the online mode. As soon as a taxpayer submits their application, they will be handed over the amended bill.

Check out properties for sale in Kolkata

KMC property tax: Latest news

The waiver scheme launched by the KMC has now ended. According to officials, the property tax department received around 7,000 applications in January 2021, for availing of the waiver scheme, after it was extended till January 31, 2021. The waiver scheme that was initiated from October 3, 2020, was supposed to end on December 31, 2020. However, it was extended, as the civic body received fewer applications than it expected, for availing of the benefits of the scheme.

Meanwhile, after mopping-up Rs 90 crores from 28,000 property tax defaulters, who have applied for 100% interest waiver on the outstanding amount, the Kolkata Municipal Corporation is now targeting major tax defaulters. The KMC’s Revenue Department has resorted to sending reminder letters to the major defaulters to pay up, or risk having their properties attached. A team has been formed to go through the waiver applications and track down the major defaulters who owe over Rs 1 crore and are yet to apply for the interest waiver scheme.

Earlier, various media reports stated that the waiver scheme of the Kolkata Municipal Corporation had become a big hit among property tax payers, as the civic body mopped up Rs 40 crores in less than 45 days. Around 5,000 people have already paid their taxes and availed of the waiver facility. Under the scheme, a defaulter will have to pay just the principal amount and not the interest and penalty. According to officials, there are 5 lakh-odd tax payers among which 400 are major defaulters, who owed around Rs 1,500 crores to the civic body, prior to the introduction of the waiver.

KMC helpline and contact details

Complaints and queries can be registered on the following given contact number, on working days, between 10 AM and 6 PM and on Saturdays between 10 AM and 5 PM: 033-2286 1305.

FAQs

How to pay KMC property tax bill online?

Property owners can pay property tax online through the official website of the Kolkata Municipal Corporation.

How to get registered on KMC website?

You can get registered on the KMC website by selecting the UAA Online Submission option from the home page. Follow the procedures mentioned above to get registered.

How do I get a duplicate property tax bill?

You can view the pending property tax online, on the KMC official website after logging in, using your User ID.

(With inputs from Surbhi Gupta)

Comments