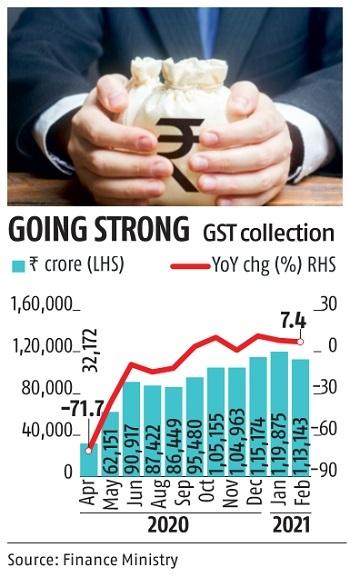

Goods and services tax collection surpassed the Rs 1 trillion-mark for the fifth consecutive month, touching Rs 1.13 trillion in February, according to provisional data released by the government on Monday.

The robust mop-up could partially be attributed to the government’s drive against GST evaders and fake bills, apart from tightened compliance measures and overall improvement in the economy. GST collection grew seven per cent over the corresponding period last year, when it was Rs 1.05 trillion, and was partially lower than the record of Rs 1.19 trillion achieved in January, data released by the Ministry of Finance showed. Collections posted growth for the sixth consecutive month.

These collections mostly account for transactions done in January. Till now, GST revenues have crossed Rs 1.1 trillion five times since its introduction. “The GST revenues crossed Rs 1 trillion-mark fifth time in a row and crossed Rs 1.1 trillion third time in a row post pandemic… This is a clear indication of the economic recovery and the impact of various measures taken by tax administration to improve compliance,” the ministry said.

The government attributed the robust mop-up to closer monitoring against fake billing, deep data analytics using data from multiple sources, including GST, income tax and Customs IT systems, and effective tax administration.

“While the growth of GST collections eased mildly in February, it remained healthy, in line with the consolidation in the momentum of economic activity observed across a variety of lead indicators. Subsequently, a favourable base effect is likely to result in the CGST collections expanding by 18-23 per cent in March,” said Aditi Nayar, principal economist, ICRA Ratings.

In February, revenue from import of goods posted 15 per cent growth, while that from domestic transaction (including import of services) grew by five per cent, compared with the previous year.

In October, the government introduced e-invoicing for firms with a turnover of Rs 500 crore and above. This was extended to entities with turnover of Rs 100 crore from January 1. The government also made registration norms more stringent while tightened rules for tax credits.

Key segments of GST collections yielded marginally less in February than in January. For instance, CGST collections were Rs 21,092 crore, as against Rs 21,923 crore in January. SGST mop-up was Rs 27,273 crore in February, as against Rs 29,014 the previous month. However, compensation cess was higher at Rs 9,525 crore, as against Rs 8,622 crore the previous month.

“In addition to the stabilisation of economic activities, the continuing trend of high GST collections for the past few months is also on account of the data analytics approach adopted by the authorities, which has led to significant detection of evasion,” said M S Mani, senior director, Deloitte India. “With the gradual opening up of the services sectors, economic activity is expected to pickup, leading to improved collections in the next month as well,” added Mani.

In addition to regular settlement of Rs 55,253 crore as integrated GST settlement, the Centre has also settled Rs 48,000 crore as IGST ad-hoc settlement in the ratio of 50:50 between the Centre and states/Union Territories, resulting in Rs 67,490 crore for CGST and Rs 68,807 crore for the SGST.

“The settlement of IGST of Rs 48,000 crore between the Centre and the states, will adversely impact the net CGST+IGST revenues of the Centre in February, resulting in a moderation in the growth of its gross and net tax revenues in that month. This could be a key reason why the FY21 RE implicitly built in a contraction in CGST +IGST of 27 per cent in Q4 FY21,” said Nayar.

Around 10 states and UTs posted reduction in collections in February, including Delhi and Chandigarh, which saw contractions of three per cent and 14 per cent, respectively.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

RECOMMENDED FOR YOU