How to link PAN card with Aadhaar

The government of India is making PAN-Aadhaar linking mandatory from March 31, 2021. Failing to do so will not only result in a penalty of Rs 10,000 under Section 272B of Income Tax Act, but also make the PAN null and void.

Wondering how to link a PAN card with Aadhaar? Well, all you need to do is follow these steps:

Things you should keep in handy before starting with the process

Wondering how to link a PAN card with Aadhaar? Well, all you need to do is follow these steps:

Things you should keep in handy before starting with the process

- Keep your PAN and Aadhaar card ready to enter details

- Try to follow these steps on a PC browser and not on smartphone

1.

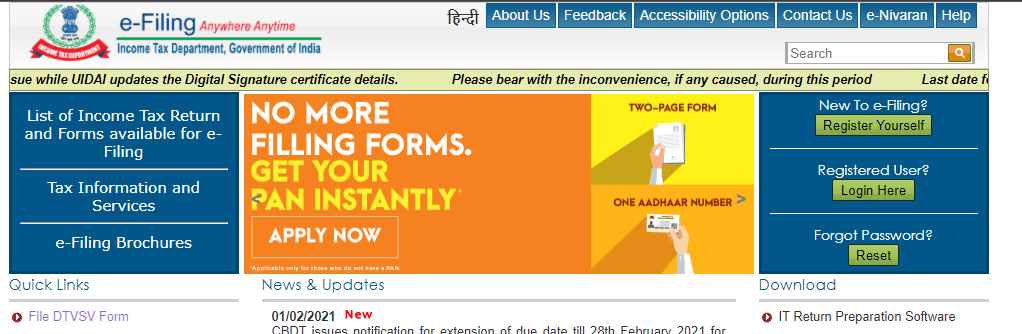

Open e-filing portal of the Income Tax Department at https://www.incometaxindiaefiling.gov.in/home

2.

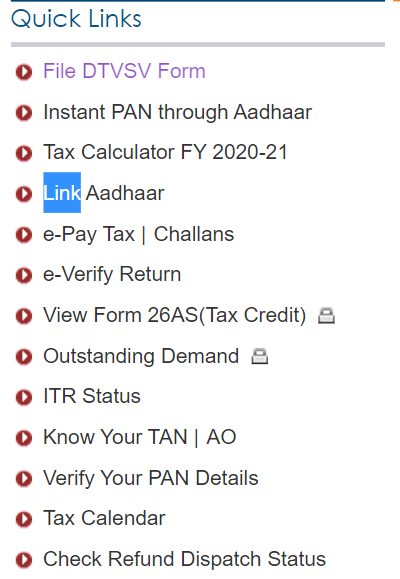

Click on the option Link Aadhaar from the left side of the webpage.

3.

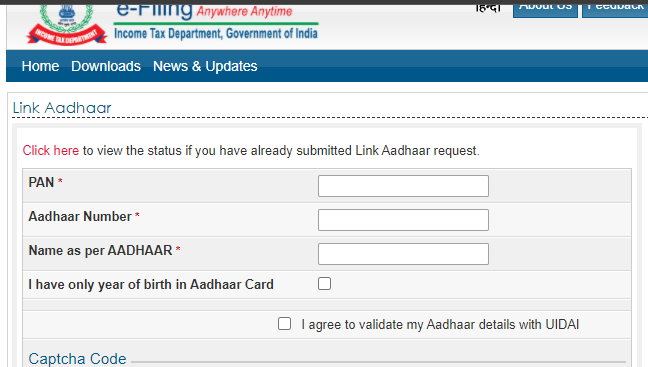

It will then redirect you to another webpage with a form.

Enter all the necessary information such PAN number, Aadhaar details, name, etc.

4.

Once done, you’ll need to make a few choices

If you only have birth year mentioned on the Aadhaar, check the respective box

5.

Also, check the box that says 'I agree to validate my Aadhar details with UIDAI’

6.

Enter the captcha code

7.

All Comments (0)+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE