- Treasury officials on Thursday briefed members of Parliament on the recently tabled budget review.

- Finance Minister Tito Mboweni said criticisms that Treasury has adopted "austerity" are unfounded given the substantial social spending.

- The minister will on Friday gazette draft amendments on Regulation 28 of the Pension Funds Act, for public comment.

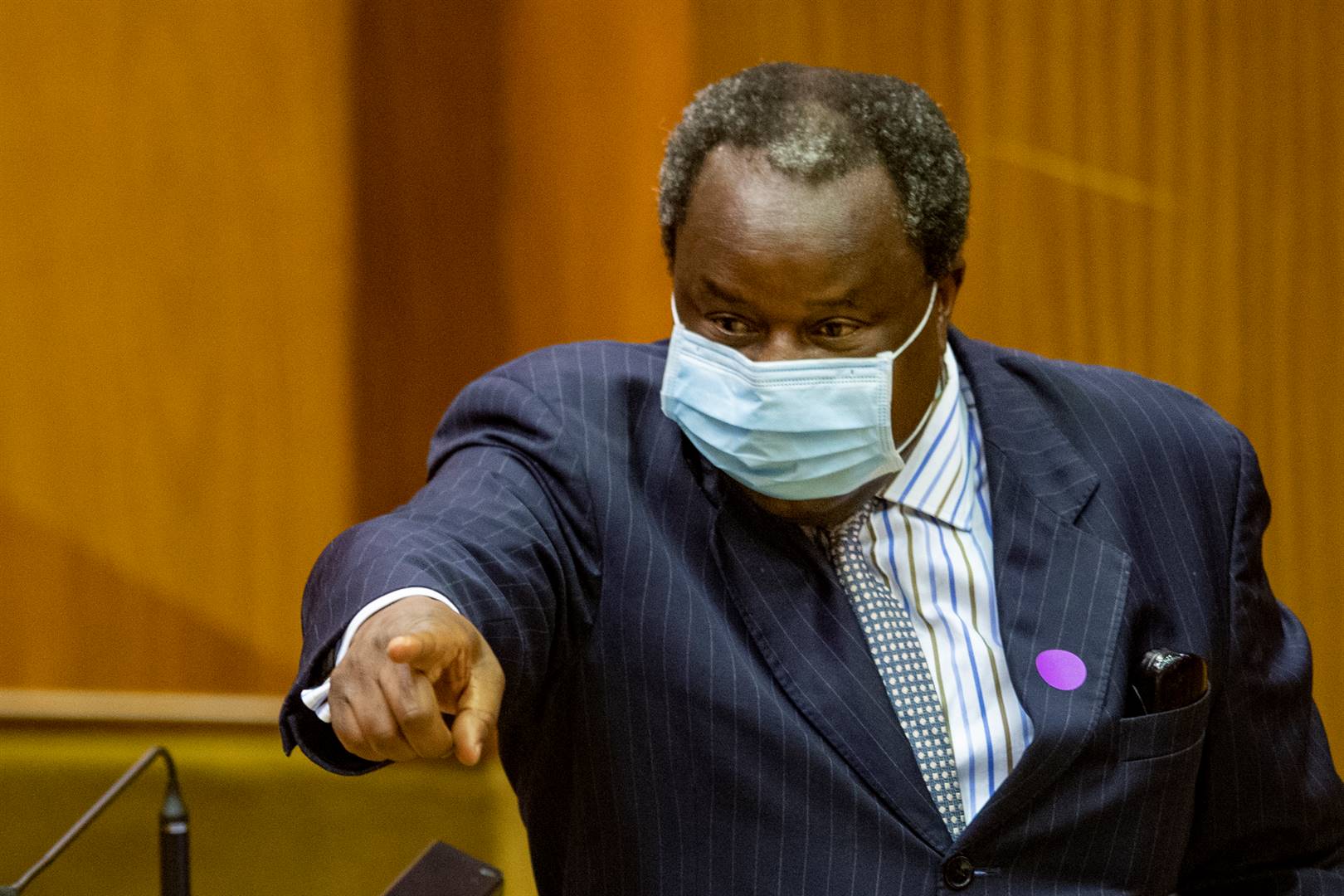

Finance Minister Tito Mboweni has said criticisms again Treasury that it has adopted "austerity" measures are unfounded, especially in light of the substantial spending directed towards social spending.

The minister and Treasury officials on Thursday briefed a joint sitting of the standing committee on finance and the standing committee on appropriations - as well as their counterparts from the National Council of Provinces - on the national budget tabled on Wednesday.

Members of Parliament sought answers on decision made to provide below-inflation increases on social grants. The budget review had indicated social grants had been reduced by R5.8 billion in the 2021/22 financial year and by R10.7 billion and R19.5 billion in the two subsequent years, Fin24 previously reported.

Mboweni, however, highlighted that social services account for more than half (56%) of the R2.02 trillion expenditure for the 2021/22 year.

"When people talk austerity, austerity ... I do not know what they are talking about if, for example, 56% of the budget is social services," said Mboweni.

Treasury indicated that 56.8% of allocations are going to learning and culture, health and social development.

Leeway for the future

Mampho Modise, Treasury's deputy director general of public finance, said that efforts had been made to protect social grants since 2012 when government had to cut back on it expenditure growth. However, the need to arrest debt growth and achieve fiscal consolidation to deal with the budget deficit made it difficult to "fully protect" social grants this time round.

"We hope by doing good now, consolidating now, will give us leeway into the future," said Modise. She added that social grants would be the first in line to receive increases once the fiscus is on a much more stable footing. Modise said it was essentially about balancing the need to protect the poor and the need for fiscal consolidation.

Currently debt servicing costs account for 13.4% of government expenditure.

https://t.co/tgR9Z5oB3U | We are not made of money, Mboweni warns MPs on debt https://t.co/BiwdJBGWRM

— Fin24 (@Fin24) February 24, 2021

Acting head of the budget office Edgar Sishi said that for the past year, the country's expenditure exceeded revenue, which has resulted in a deficit that has become structural. Tough measures must be taken to reduce the deficit as it implies increasing debt levels and associated interest – which must be paid. "Interest is more than R230 billion in one year," he said. Debt-servicing costs were essentially crowding out expenditure in other areas such as like social services, he explained.

By Treasury's estimates, it would take four years to the country's economic growth to return to pre-pandemic levels - and it will equally be the case for revenues. In light of the revenue situation, it would be "irresponsible" to raise the level of spending, said Sishi. He explained that reducing the interest bill requires closing the deficit so that further spending reductions in other programmes of government, such a social grants, can be avoided.

Vaccines good for future economy

Sishi said that pouring funds into vaccines in the short term would be positive in the long run – the economy. This is why the contingency reserve was also expanded by R12 billion to cover unforeseen costs arising in the procurement of vaccines and the Covid-19 response, as well as other emergencies such as natural disasters.

Deputy director general of tax and financial sector policy Ismail Momoniat also confirmed to members of Parliament that Treasury would on Friday gazette draft amendments to regulation 28 of the Pension Funds Act.

The regulation provides guidance to pension funds and similar institutions on their investments. In his address on Wednesday, Mboweni said that the draft amendments would make it easier for retirement funds to increase investment in infrastructure.

Momoniat stressed it would not force pension funds to invest in infrastructure assets. It would simply broaden the scope allowing trustees to do so, if they wish.

The ANC's economic transformation committee last year had included a proposal in its draft document on economic recovery post Covid-19 for the amendments to be made to regulation 28 to include infrastructure and capital projects, Fin24 previously reported.

Countries like Canada, Portugal, Latin American countries and Australia have also implemented such measures.

During the briefing, Mboweni also indicated that that a memoranda on the establishment of a state bank "is on the way" to Cabinet, now that a feasibility study had been concluded. During his speech last year, Mboweni indicated that work on a state bank project is under way with deputy finance minister David Masondo leading it.